The Wisconsin Form 4H, also known as the "Application for Homestead Credit" is a crucial document for Wisconsin residents who wish to claim a homestead credit on their property taxes. Completing this form accurately and on time is essential to ensure you receive the credit you're eligible for. In this article, we'll guide you through the 5 steps to complete Wisconsin Form 4H, helping you navigate the process with ease.

Understanding the Importance of Homestead Credit

Before we dive into the steps, let's quickly understand the significance of the homestead credit. The homestead credit is a tax credit designed to help low-income families and individuals pay their property taxes. The credit is calculated based on the property taxes paid and the applicant's household income. Eligible individuals can receive a refund or a reduction in their property taxes.

Step 1: Determine Your Eligibility

To begin, you need to determine if you're eligible for the homestead credit. To qualify, you must:

- Be a Wisconsin resident

- Own and occupy a primary residence in Wisconsin

- Meet the income guidelines set by the Wisconsin Department of Revenue

You can check the income guidelines on the Wisconsin Department of Revenue website or consult with a tax professional to ensure you meet the eligibility criteria.

Step 2: Gather Required Documents

Once you've determined your eligibility, gather the necessary documents to complete Form 4H. You'll need:

- Your property tax bill or a copy of your property tax payment receipt

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Proof of income, such as:

- W-2 forms

- 1099 forms

- Social Security benefits statement

- Pension or retirement account statements

- Proof of Wisconsin residency, such as:

- Driver's license

- State ID

- Utility bills

Make sure you have all the required documents before proceeding to the next step.

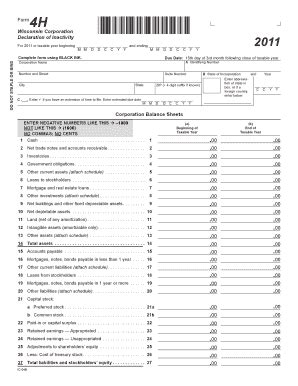

Step 3: Complete Form 4H

With your documents in hand, you're ready to complete Form 4H. The form is available on the Wisconsin Department of Revenue website or through a tax professional. Fill out the form accurately and completely, making sure to:

- Enter your name, Social Security number, and address correctly

- Report your household income accurately

- List your property taxes paid and the credit you're claiming

- Sign and date the form

If you're unsure about any section of the form, consider consulting a tax professional for guidance.

Step 4: Submit Form 4H

Once you've completed Form 4H, submit it to the Wisconsin Department of Revenue by the deadline. You can:

- Mail the form to the address listed on the form

- File electronically through the Wisconsin Department of Revenue website

- Submit the form through a tax professional

Make sure to keep a copy of the form and supporting documents for your records.

Step 5: Follow Up on Your Application

After submitting Form 4H, follow up on your application to ensure it's being processed. You can:

- Check the status of your application on the Wisconsin Department of Revenue website

- Contact the Wisconsin Department of Revenue customer service for assistance

- Receive a refund or a credit on your property taxes if your application is approved

By following these 5 steps, you'll be able to complete Wisconsin Form 4H accurately and on time, ensuring you receive the homestead credit you're eligible for.

By following these steps and staying informed, you'll be able to navigate the process with ease and ensure you receive the homestead credit you deserve.

What is the deadline to submit Form 4H?

+The deadline to submit Form 4H is typically April 15th of each year, but it's best to check the Wisconsin Department of Revenue website for the most up-to-date information.

Can I file Form 4H electronically?

+Yes, you can file Form 4H electronically through the Wisconsin Department of Revenue website.

What if I have questions or need help with Form 4H?

+You can contact the Wisconsin Department of Revenue customer service for assistance or consult with a tax professional.