Huntington Bank Beneficiary Form: A Comprehensive Guide

As a customer of Huntington Bank, it's essential to understand the importance of having a beneficiary form in place. This document ensures that your assets are distributed according to your wishes in the event of your passing. In this article, we'll delve into the world of Huntington Bank beneficiary forms, exploring five crucial things you need to know.

In today's fast-paced world, it's easy to overlook the importance of estate planning. However, having a clear plan in place can bring peace of mind and ensure that your loved ones are taken care of. A beneficiary form is a vital component of this plan, allowing you to designate who will receive your assets in the event of your passing.

What is a Beneficiary Form?

A beneficiary form is a document that allows you to name individuals or organizations to receive your assets in the event of your passing. This form is typically used for bank accounts, retirement accounts, and life insurance policies. By completing a beneficiary form, you can ensure that your assets are distributed according to your wishes, rather than being subject to the laws of intestacy in your state.

Why is a Beneficiary Form Important?

A beneficiary form is crucial for several reasons:

- Ensures Asset Distribution: A beneficiary form ensures that your assets are distributed according to your wishes, rather than being subject to the laws of intestacy in your state.

- Avoids Probate: By naming beneficiaries, you can avoid probate, a lengthy and costly process that can tie up your assets for months or even years.

- Provides Peace of Mind: Completing a beneficiary form can bring peace of mind, knowing that your loved ones will be taken care of in the event of your passing.

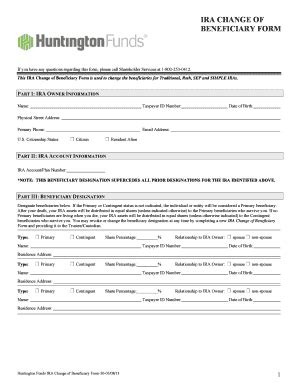

How to Complete a Huntington Bank Beneficiary Form

Completing a Huntington Bank beneficiary form is a straightforward process. Here are the steps to follow:

- Obtain the Form: You can obtain a beneficiary form from Huntington Bank's website or by visiting a local branch.

- Fill Out the Form: Complete the form by providing the required information, including your name, address, and social security number.

- Name Beneficiaries: Name the individuals or organizations you wish to receive your assets in the event of your passing.

- Sign and Date the Form: Sign and date the form, and have it witnessed by two individuals.

What Information is Required on the Form?

When completing a Huntington Bank beneficiary form, you'll need to provide the following information:

- Your Information: Your name, address, and social security number.

- Beneficiary Information: The names, addresses, and social security numbers of your beneficiaries.

- Asset Information: The account numbers and types of assets you're designating beneficiaries for.

Can I Change My Beneficiaries?

Yes, you can change your beneficiaries at any time. To do so, simply complete a new beneficiary form and submit it to Huntington Bank. It's essential to review and update your beneficiary designations periodically to ensure that they reflect your current wishes.

What Happens if I Don't Have a Beneficiary Form?

If you don't have a beneficiary form, your assets will be distributed according to the laws of intestacy in your state. This can lead to a lengthy and costly probate process, which can tie up your assets for months or even years.

In conclusion, a Huntington Bank beneficiary form is a vital component of your estate plan. By completing this form, you can ensure that your assets are distributed according to your wishes, avoiding probate and providing peace of mind. Take the time to review and update your beneficiary designations periodically to ensure that they reflect your current wishes.

We hope this article has provided you with a comprehensive understanding of Huntington Bank beneficiary forms. If you have any further questions or concerns, please don't hesitate to reach out.

What is the purpose of a beneficiary form?

+The purpose of a beneficiary form is to designate who will receive your assets in the event of your passing.

Can I change my beneficiaries?

+Yes, you can change your beneficiaries at any time by completing a new beneficiary form and submitting it to Huntington Bank.

What happens if I don't have a beneficiary form?

+If you don't have a beneficiary form, your assets will be distributed according to the laws of intestacy in your state.