Wisconsin Form 1NPR is a tax form used by nonresident individuals who earn income from Wisconsin sources, but are not residents of the state. This form is used to report and pay taxes on income earned from Wisconsin sources, such as rental income, interest, dividends, and capital gains. In this article, we will provide a comprehensive guide to understanding Wisconsin Form 1NPR, including who needs to file, what income is reportable, and how to complete the form.

Who Needs to File Wisconsin Form 1NPR?

Not all nonresidents who earn income from Wisconsin sources need to file Form 1NPR. To determine if you need to file, you must meet one of the following conditions:

- You are a nonresident individual who earns income from Wisconsin sources, such as rental income, interest, dividends, or capital gains.

- You are a nonresident individual who has a Wisconsin tax liability.

- You are a nonresident individual who wants to claim a refund of Wisconsin taxes withheld.

What Income is Reportable on Wisconsin Form 1NPR?

The following types of income are reportable on Wisconsin Form 1NPR:

- Rental income from Wisconsin properties

- Interest and dividends from Wisconsin sources

- Capital gains from the sale of Wisconsin property or assets

- Business income from a Wisconsin trade or business

- Farm income from a Wisconsin farm

How to Complete Wisconsin Form 1NPR

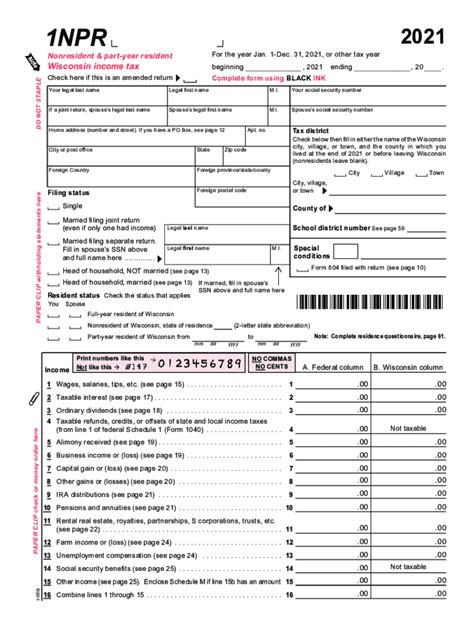

To complete Wisconsin Form 1NPR, you will need to provide the following information:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Wisconsin tax account number (if you have one)

- A list of all Wisconsin sources of income, including the type and amount of income

- A calculation of your Wisconsin tax liability

- A claim for any credits or deductions you are eligible for

Line-by-Line Instructions for Wisconsin Form 1NPR

Here are line-by-line instructions for completing Wisconsin Form 1NPR:

- Lines 1-5: Enter your name, address, Social Security number or ITIN, and Wisconsin tax account number (if you have one).

- Lines 6-15: List all Wisconsin sources of income, including the type and amount of income.

- Lines 16-20: Calculate your Wisconsin tax liability using the tax rates and tables provided in the instructions.

- Lines 21-25: Claim any credits or deductions you are eligible for, such as the Wisconsin earned income tax credit or the standard deduction.

Wisconsin Form 1NPR Schedules and Attachments

You may need to attach additional schedules or forms to your Wisconsin Form 1NPR, depending on your specific tax situation. These may include:

- Schedule 1: Wisconsin income from sources such as rental income, interest, and dividends.

- Schedule 2: Wisconsin capital gains and losses from the sale of Wisconsin property or assets.

- Schedule 3: Wisconsin business income from a Wisconsin trade or business.

- Form 1NPR-B: Wisconsin tax credits and deductions.

Wisconsin Form 1NPR Filing Status and Dependents

Your filing status and number of dependents may affect your Wisconsin tax liability. You can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). You can also claim dependents, such as children or elderly relatives, who live with you.

Wisconsin Form 1NPR Payment and Refund Options

If you owe taxes, you can pay by check or money order, or online through the Wisconsin Department of Revenue's website. If you are due a refund, you can choose to receive it by direct deposit or check.

Wisconsin Form 1NPR Due Dates and Penalties

The due date for Wisconsin Form 1NPR is April 15th of each year. If you fail to file or pay your taxes on time, you may be subject to penalties and interest. You can avoid penalties by filing for an extension of time to file, but you will still need to pay any taxes due by the original due date.

Wisconsin Form 1NPR Amended Returns

If you need to make changes to your original return, you can file an amended return using Form 1NPR-X. You will need to provide a complete copy of your original return, as well as any changes or corrections.

Wisconsin Form 1NPR and the Affordable Care Act

The Affordable Care Act (ACA) requires individuals to have minimum essential coverage or pay a penalty. If you are a nonresident who earns income from Wisconsin sources, you may need to file Form 1NPR and report your ACA coverage or pay the penalty.

Wisconsin Form 1NPR and Tax Law Changes

Tax laws and regulations can change frequently, so it's essential to stay up-to-date on any changes that may affect your Wisconsin tax liability. You can find information on tax law changes on the Wisconsin Department of Revenue's website.

Wisconsin Form 1NPR and Tax Credits

Wisconsin offers several tax credits that you may be eligible for, such as the earned income tax credit or the standard deduction. You can claim these credits on Form 1NPR and reduce your Wisconsin tax liability.

Wisconsin Form 1NPR and Audit Procedures

If you are selected for an audit, you will need to provide documentation to support your income and expenses. You can find information on audit procedures on the Wisconsin Department of Revenue's website.

Conclusion

Wisconsin Form 1NPR is a complex tax form that requires careful attention to detail. By following the instructions and guidelines outlined in this article, you can ensure that you accurately report your Wisconsin income and claim any credits or deductions you are eligible for. If you have any questions or need further assistance, you can contact the Wisconsin Department of Revenue or consult with a tax professional.

Who needs to file Wisconsin Form 1NPR?

+Nonresident individuals who earn income from Wisconsin sources, such as rental income, interest, dividends, or capital gains, need to file Form 1NPR.

What income is reportable on Wisconsin Form 1NPR?

+Rental income, interest, dividends, capital gains, business income, and farm income from Wisconsin sources are reportable on Form 1NPR.

How do I file Wisconsin Form 1NPR?

+You can file Form 1NPR online through the Wisconsin Department of Revenue's website or by mail using the address listed in the instructions.