As tax season approaches, millions of Americans are preparing to file their tax returns, and for many, this process involves receiving and interpreting various tax forms, including the Consolidated Form 1099 from Fidelity. If you're among the countless individuals who receive investments or other income, understanding the details of this form is crucial for accurate tax reporting. In this comprehensive guide, we'll delve into the world of Consolidated Form 1099 from Fidelity, exploring its significance, how to read it, and what actions to take based on the information it provides.

Understanding the Consolidated Form 1099 from Fidelity

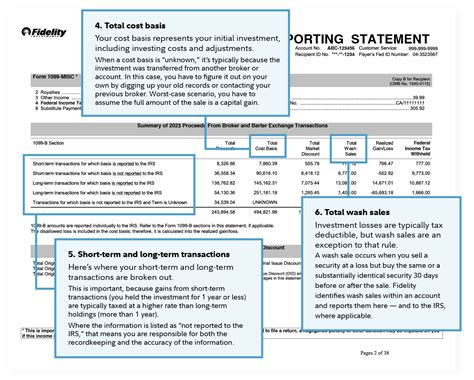

The Consolidated Form 1099 is a tax document issued by Fidelity, a leading financial services company, to report various types of income and transactions related to your investments. Unlike the standard Form 1099, which is issued for specific types of income (such as interest, dividends, or capital gains distributions), the Consolidated Form 1099 combines multiple types of investment income and transactions into a single document. This form is designed to simplify tax reporting by providing a comprehensive overview of your investment activities with Fidelity.

Why is the Consolidated Form 1099 Important?

The Consolidated Form 1099 is essential for several reasons:

- Tax Reporting: It provides the necessary information for you to accurately report your investment income on your tax return.

- Record Keeping: It serves as a detailed record of your investment transactions, helping you keep track of your portfolio's performance.

- Investment Decisions: By analyzing the information on the form, you can make more informed decisions about your investments, ensuring they align with your financial goals.

How to Read the Consolidated Form 1099

Reading the Consolidated Form 1099 can seem daunting due to the vast amount of information it contains. However, by breaking it down into its main sections, you can better understand the data it provides.

- Recipient and Payer Information: The top portion of the form includes your name, address, and taxpayer identification number (TIN), along with Fidelity's name, address, and TIN as the payer.

- Account Number: Your Fidelity account number(s) associated with the transactions listed on the form.

- Boxes 1-15: These boxes report different types of income and transactions, such as interest income, ordinary dividends, capital gains distributions, and proceeds from brokerage and barter exchange transactions.

- Additional Information: This section may include information on state and local taxes withheld, backup withholding, and any federal income tax withheld.

Understanding the Boxes on the Consolidated Form 1099

Each box on the form represents a specific type of income or transaction. Here's a brief overview of what you might find in each box:

- Box 1: Interest Income

- Box 2: Ordinary Dividends

- Box 3: Capital Gains Distributions

- Boxes 4-15: Various types of income and transactions, including proceeds from real estate transactions, royalties, and income from a notional principal contract.

Actions to Take After Receiving the Consolidated Form 1099

After receiving your Consolidated Form 1099 from Fidelity, several steps are crucial to ensure accurate tax reporting and compliance:

- Review for Accuracy: Verify the information on the form, ensuring all details, including your name, address, and taxpayer identification number, are correct.

- Report on Your Tax Return: Use the information from the form to accurately report your investment income on your tax return (Form 1040).

- Keep Records: Retain the form and related documentation for at least three years in case of an audit.

Common Mistakes to Avoid

When dealing with the Consolidated Form 1099, it's essential to avoid common mistakes that could lead to delays in processing your tax return or even trigger an audit:

- Misreporting Income: Ensure you accurately report all income types as listed on the form.

- Missing Documentation: Keep all supporting documentation, including receipts for investment purchases and sales.

- Ignoring State and Local Taxes: Be aware of any state and local taxes withheld, as these may impact your state and local tax returns.

Utilizing the Consolidated Form 1099 for Tax Planning

Beyond tax reporting, the Consolidated Form 1099 can be a valuable tool for tax planning and optimizing your investment strategy. By analyzing the income and transactions reported on the form, you can:

- Identify Tax-Efficient Investments: Opt for investments that generate tax-deferred or tax-free income.

- Consider Tax-Loss Harvesting: Offset capital gains by selling investments that have declined in value.

- Review Investment Diversification: Ensure your portfolio is diversified to minimize risk and maximize returns.

Seeking Professional Advice

While this guide provides a comprehensive overview of the Consolidated Form 1099 from Fidelity, it's always beneficial to consult with a tax professional or financial advisor. They can offer personalized advice on how to best utilize the information from the form for tax planning and investment decisions.

By understanding the Consolidated Form 1099 and taking the necessary actions, you can ensure compliance with tax regulations and make informed decisions about your investments. Don't hesitate to reach out to a professional if you have any questions or concerns about the form or your investment strategy.

Now that you've delved into the world of the Consolidated Form 1099 from Fidelity, share your experiences or questions in the comments below. Your input can help others navigate this complex but crucial aspect of tax season.

What is the Consolidated Form 1099 from Fidelity?

+The Consolidated Form 1099 from Fidelity is a tax document that reports various types of investment income and transactions related to your investments with Fidelity.

Why is the Consolidated Form 1099 important?

+The Consolidated Form 1099 is essential for accurate tax reporting, record keeping, and making informed investment decisions.

What should I do if I find an error on my Consolidated Form 1099?

+If you find an error, contact Fidelity immediately to correct the information. This ensures accurate tax reporting and compliance.