The DD Form 1351-2, also known as the "State Tax Exemption Certificate for DoD Contractors," is a crucial document for Department of Defense (DoD) contractors who are required to provide their state tax exemption information. In this article, we will guide you through the process of filling out the DD Form 1351-2, provide instructions on how to obtain a fillable version, and offer additional information on the importance of this form.

Why is the DD Form 1351-2 necessary?

The DD Form 1351-2 is a requirement for DoD contractors who need to claim state tax exemptions on certain purchases. The form serves as proof of exemption from state sales and use taxes, allowing contractors to avoid paying taxes on eligible items. This form is typically submitted to vendors or suppliers to certify that the contractor is exempt from state taxes.

How to obtain a fillable DD Form 1351-2?

To obtain a fillable DD Form 1351-2, you can follow these steps:

- Visit the official website of the Department of Defense or the Defense Logistics Agency (DLA).

- Search for the DD Form 1351-2 and select the fillable version.

- Download the form to your computer or mobile device.

- Use a PDF editor or viewer to fill out the form electronically.

- Save the completed form and print it out or submit it electronically to the required parties.

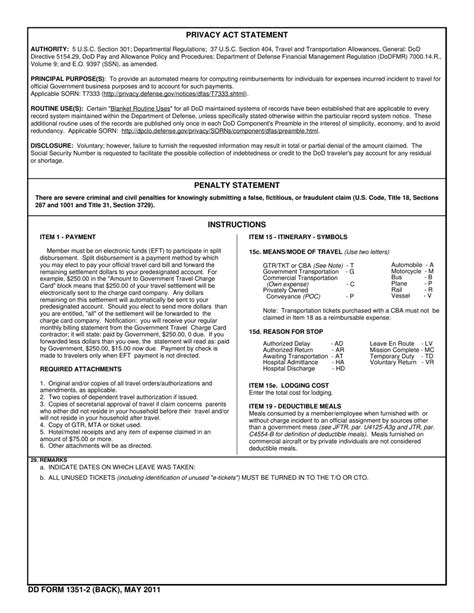

Instructions for filling out the DD Form 1351-2

When filling out the DD Form 1351-2, make sure to provide accurate and complete information. Here are some instructions to guide you:

- Contractor's Name and Address: Provide the contractor's name, address, and contact information.

- Contractor's Taxpayer Identification Number (TIN): Enter the contractor's TIN, which can be their Employer Identification Number (EIN) or Social Security Number (SSN).

- State Tax Exemption Information: Provide the state tax exemption number, exemption type, and expiration date.

- Eligible Purchases: List the eligible purchases that are exempt from state taxes.

- Certification: Certify that the information provided is accurate and true.

Common mistakes to avoid when filling out the DD Form 1351-2

When filling out the DD Form 1351-2, it's essential to avoid common mistakes that can lead to delays or rejection. Here are some mistakes to avoid:

- Incomplete or inaccurate information

- Failure to provide required documentation

- Incorrect state tax exemption information

- Eligible purchases not clearly listed

- Certification not signed or dated

Benefits of using a fillable DD Form 1351-2

Using a fillable DD Form 1351-2 offers several benefits, including:

- Convenience: Fill out the form electronically and save time.

- Accuracy: Reduce errors and ensure accurate information.

- Efficiency: Submit the form electronically and avoid mailing delays.

- Environmentally friendly: Reduce paper usage and minimize environmental impact.

Conclusion: Simplifying the DD Form 1351-2 process

In conclusion, the DD Form 1351-2 is a crucial document for DoD contractors who need to claim state tax exemptions. By following the instructions and avoiding common mistakes, contractors can simplify the process and ensure accurate and complete information. Using a fillable DD Form 1351-2 offers several benefits, including convenience, accuracy, efficiency, and environmental sustainability.

What is the purpose of the DD Form 1351-2?

+The DD Form 1351-2 is used to certify that a contractor is exempt from state sales and use taxes on eligible purchases.

Where can I obtain a fillable DD Form 1351-2?

+You can obtain a fillable DD Form 1351-2 from the official website of the Department of Defense or the Defense Logistics Agency (DLA).

What information is required on the DD Form 1351-2?

+The DD Form 1351-2 requires the contractor's name and address, taxpayer identification number, state tax exemption information, eligible purchases, and certification.