Wisconsin residents who expect to owe state income tax are required to make estimated tax payments throughout the year. This is typically the case for individuals who have income that is not subject to withholding, such as self-employment income, rental income, or investment income. In this article, we will delve into the world of Wisconsin Form 1-ES, exploring its purpose, benefits, and a step-by-step guide on how to complete and submit it.

What is Wisconsin Form 1-ES?

Wisconsin Form 1-ES is a quarterly estimated tax payment form used by individuals to report and pay their estimated state income tax liability. The form is designed to help taxpayers avoid penalties and interest by making timely payments throughout the year. The Wisconsin Department of Revenue requires individuals to make estimated tax payments if they expect to owe more than $500 in state income tax for the year.

Benefits of Making Estimated Tax Payments

Making estimated tax payments offers several benefits to Wisconsin taxpayers. Some of the advantages include:

- Avoiding penalties and interest: By making timely estimated tax payments, individuals can avoid penalties and interest that may be assessed on their tax bill.

- Reducing tax liability: Estimated tax payments can help reduce the amount of taxes owed at the end of the year, making it easier to manage tax liability.

- Improving cash flow: By making quarterly payments, individuals can spread out their tax liability throughout the year, improving their cash flow and reducing the financial burden of a large tax bill.

Who Needs to Make Estimated Tax Payments?

Not all Wisconsin taxpayers need to make estimated tax payments. However, individuals who meet certain criteria are required to make quarterly payments. These include:

- Self-employed individuals: Individuals who are self-employed and expect to owe more than $500 in state income tax are required to make estimated tax payments.

- Rental income earners: Individuals who earn rental income and expect to owe more than $500 in state income tax are required to make estimated tax payments.

- Investment income earners: Individuals who earn investment income and expect to owe more than $500 in state income tax are required to make estimated tax payments.

- Individuals with other income: Individuals who have other income that is not subject to withholding, such as alimony or prizes, and expect to owe more than $500 in state income tax are required to make estimated tax payments.

How to Complete Wisconsin Form 1-ES

Completing Wisconsin Form 1-ES is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Determine your estimated tax liability: Calculate your estimated state income tax liability for the year. You can use Form 1-ES to estimate your tax liability based on your prior year's tax return or your current year's income.

- Choose your payment method: You can make estimated tax payments online, by phone, or by mail. Choose the method that works best for you.

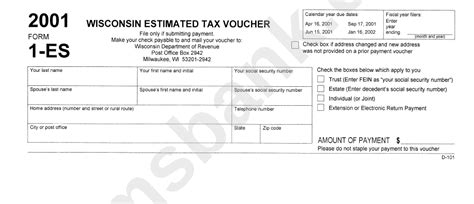

- Complete Form 1-ES: Fill out Form 1-ES, making sure to include your name, address, and social security number. You will also need to provide your estimated tax liability and the payment amount.

- Make your payment: Once you've completed Form 1-ES, make your payment using your chosen method.

Payment Methods

Wisconsin offers several payment methods for estimated tax payments. These include:

- Online payment: You can make online payments through the Wisconsin Department of Revenue's website.

- Phone payment: You can make phone payments by calling the Wisconsin Department of Revenue.

- Mail payment: You can mail your payment to the Wisconsin Department of Revenue.

Due Dates

Estimated tax payments are due on a quarterly basis. The due dates for Wisconsin Form 1-ES are:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Penalties and Interest

Failure to make estimated tax payments or underpayment of estimated taxes can result in penalties and interest. The Wisconsin Department of Revenue may assess penalties and interest on your tax bill if you:

- Fail to make estimated tax payments

- Underpay your estimated tax liability

- Fail to file Form 1-ES

Conclusion

Wisconsin Form 1-ES is an essential tool for individuals who expect to owe state income tax. By making estimated tax payments, individuals can avoid penalties and interest, reduce their tax liability, and improve their cash flow. If you're required to make estimated tax payments, be sure to complete and submit Form 1-ES on time to avoid any penalties or interest.

What is the purpose of Wisconsin Form 1-ES?

+Wisconsin Form 1-ES is a quarterly estimated tax payment form used by individuals to report and pay their estimated state income tax liability.

Who needs to make estimated tax payments in Wisconsin?

+Individuals who expect to owe more than $500 in state income tax, including self-employed individuals, rental income earners, investment income earners, and individuals with other income that is not subject to withholding.

What are the due dates for Wisconsin Form 1-ES?

+The due dates for Wisconsin Form 1-ES are April 15th, June 15th, September 15th, and January 15th of the following year.