Filing taxes can be a daunting task, especially for individuals who are new to the process. In Wisconsin, the Form 1 NPR is a crucial document that needs to be filed by certain taxpayers. In this article, we will provide a comprehensive guide on how to file the Wisconsin Form 1 NPR, making the process easier and less overwhelming.

The Wisconsin Form 1 NPR is used to report income that is not subject to withholding, such as self-employment income, interest, dividends, and capital gains. If you are a Wisconsin resident and have income that is not subject to withholding, you are required to file this form. Failure to file the Form 1 NPR can result in penalties and interest on any taxes owed.

Who Needs to File the Wisconsin Form 1 NPR?

To determine if you need to file the Wisconsin Form 1 NPR, you need to check if you meet certain requirements. These requirements include:

- Being a Wisconsin resident

- Having income that is not subject to withholding, such as self-employment income, interest, dividends, and capital gains

- Having a tax liability of $500 or more

If you meet these requirements, you are required to file the Wisconsin Form 1 NPR.

Gathering Required Documents

Before you start filing the Wisconsin Form 1 NPR, you need to gather all the required documents. These documents include:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN (if filing jointly)

- Your dependents' social security numbers or ITINs

- Form W-2, Wage and Tax Statement

- Form 1099-MISC, Miscellaneous Income

- Form 1099-INT, Interest Income

- Form 1099-DIV, Dividend Income

- Schedule K-1, Partner's Share of Income, Deductions, Credits, etc.

- Records of any other income not reported on a Form W-2 or 1099

Having all the required documents will make the filing process easier and less time-consuming.

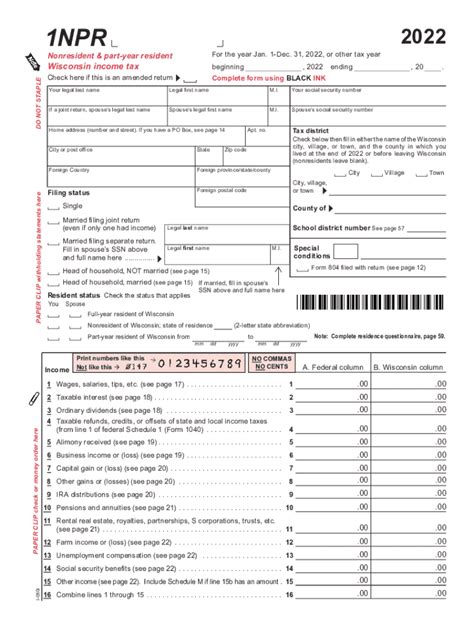

Step-by-Step Filing Guide

Now that you have gathered all the required documents, it's time to start filing the Wisconsin Form 1 NPR. Here's a step-by-step guide to help you through the process:

- Determine Your Filing Status: Determine your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report Your Income: Report all your income from various sources, including wages, salaries, tips, interest, dividends, and capital gains.

- Calculate Your Tax Liability: Calculate your tax liability based on your income and filing status.

- Claim Your Deductions and Credits: Claim any deductions and credits you are eligible for, such as the standard deduction, itemized deductions, and earned income tax credit.

- Complete the Form: Complete the Wisconsin Form 1 NPR, making sure to sign and date it.

- Submit the Form: Submit the form to the Wisconsin Department of Revenue, either electronically or by mail.

Paying Your Tax Liability

If you have a tax liability, you need to pay it by the due date to avoid penalties and interest. You can pay your tax liability online, by phone, or by mail. You can also set up a payment plan if you are unable to pay your tax liability in full.

Avoiding Common Mistakes

To avoid common mistakes when filing the Wisconsin Form 1 NPR, make sure to:

- Use the correct form and instructions

- Report all your income accurately

- Claim all the deductions and credits you are eligible for

- Sign and date the form

- Submit the form on time

By following these tips, you can avoid common mistakes and ensure that your tax filing process goes smoothly.

Conclusion

Filing the Wisconsin Form 1 NPR can be a complex process, but by following the steps outlined in this guide, you can make it easier and less overwhelming. Remember to gather all the required documents, report your income accurately, and claim all the deductions and credits you are eligible for. If you have any questions or concerns, you can contact the Wisconsin Department of Revenue for assistance.

We hope this guide has been helpful in explaining the Wisconsin Form 1 NPR and how to file it. If you have any questions or comments, please feel free to share them below.

What is the Wisconsin Form 1 NPR?

+The Wisconsin Form 1 NPR is a tax form used to report income that is not subject to withholding, such as self-employment income, interest, dividends, and capital gains.

Who needs to file the Wisconsin Form 1 NPR?

+You need to file the Wisconsin Form 1 NPR if you are a Wisconsin resident and have income that is not subject to withholding, such as self-employment income, interest, dividends, and capital gains.

What is the deadline for filing the Wisconsin Form 1 NPR?

+The deadline for filing the Wisconsin Form 1 NPR is typically April 15th of each year, but it may vary depending on your individual circumstances.