Understanding and accurately completing tax forms is crucial for businesses and organizations to ensure compliance with tax laws and regulations. One such form is the Form 1125-E, used by certain entities to calculate their total income tax liability. This article aims to provide a comprehensive, step-by-step guide to completing Form 1125-E, ensuring that filers understand the requirements and can navigate the process with ease.

Importance of Form 1125-E

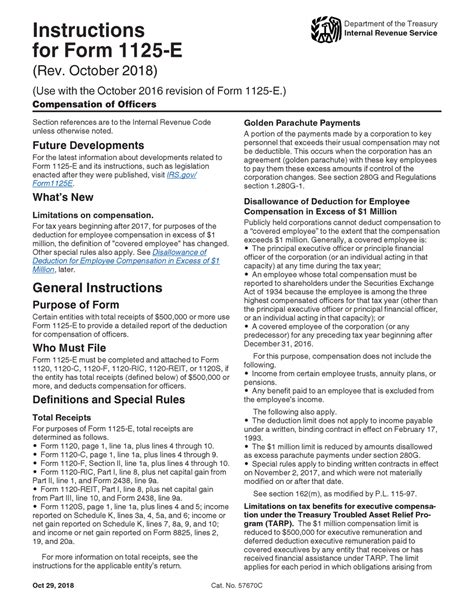

Form 1125-E, also known as the Compensation of Officers, is a crucial component of the U.S. corporate tax return. It is used by corporations to report the compensation of their officers, a step necessary for calculating the entity's total income tax liability. Accurate completion of this form is essential for compliance with tax laws and for avoiding any potential penalties or interest charges that might arise from errors or omissions.

Eligibility and Requirements

Not all businesses need to file Form 1125-E. It is specifically required for corporations that deduct the compensation of certain officers. This includes any officer whose compensation is required to be reported on the corporation's return, generally those whose compensation exceeds a certain threshold. It is essential for corporations to review the eligibility criteria carefully to ensure they meet the requirements for filing.

Step-by-Step Guide to Filling Out Form 1125-E

Section 1: Corporation Information

- Corporation Name and Address: Ensure the name and address of the corporation match the information on the corporate tax return (Form 1120 or Form 1120S).

- Employer Identification Number (EIN): Enter the corporation's EIN.

Section 2: Officer Information

- Name: List the name of each officer whose compensation is being reported.

- Title: Specify the title of each officer.

- Compensation: Enter the total compensation paid or accrued to each officer during the tax year. This includes salary, bonuses, stock awards, and any other benefits that are considered taxable income.

Section 3: Deductible Compensation

- Deductible Amount: Calculate the deductible amount of officer compensation based on the thresholds provided by the IRS. This step requires careful attention to the tax laws and regulations regarding deductible compensation.

Section 4: Total Compensation

- Total: Sum the total compensation reported for all officers.

Section 5: Calculation of Deductible Compensation

- Calculation: Perform the calculation to determine the deductible amount of compensation for the corporation.

Tips for Accurate Completion

- Use the Correct Form Version: Ensure you are using the most current version of Form 1125-E to avoid any errors or omissions.

- Double-Check Figures: Carefully review the compensation figures to ensure accuracy. Errors in this area can lead to significant discrepancies in the corporation's tax liability.

- Seek Professional Advice: If unsure about any aspect of completing Form 1125-E, consider consulting a tax professional. Their expertise can help navigate the complexities of tax law and ensure compliance.

Common Mistakes to Avoid

- Incorrect or Missing Information: Ensure all required information is complete and accurate. Missing or incorrect data can lead to delays in processing the tax return.

- Failure to Report All Compensation: All compensation that meets the criteria must be reported. Failure to do so can result in penalties and interest.

- Miscalculations: Double-check all calculations to ensure accuracy. Errors in calculation can affect the corporation's tax liability and lead to penalties.

Conclusion and Next Steps

Completing Form 1125-E accurately and on time is crucial for maintaining compliance with tax laws and regulations. By following the step-by-step guide outlined above, corporations can ensure they meet the requirements without incurring unnecessary penalties or delays. After completing the form, review it carefully for any errors or omissions, and seek professional advice if needed. Once satisfied with the form's accuracy, proceed with filing the corporate tax return, ensuring that all accompanying forms, including Form 1125-E, are included.

Call to Action

Now that you have a comprehensive understanding of Form 1125-E and how to complete it, take the next step in ensuring your corporation's tax compliance. Share this guide with colleagues and peers who might benefit from this information. If you have any questions or need further clarification on any points discussed, please leave a comment below. Your engagement helps us provide more accurate and helpful content in the future.

FAQ Section

What is the purpose of Form 1125-E?

+Form 1125-E is used by corporations to report the compensation of certain officers, which is necessary for calculating the entity's total income tax liability.

Who needs to file Form 1125-E?

+Corporations that deduct the compensation of certain officers are required to file Form 1125-E. This typically includes officers whose compensation exceeds a certain threshold.

What is the deadline for filing Form 1125-E?

+The deadline for filing Form 1125-E is the same as the deadline for the corporation's tax return (Form 1120 or Form 1120S), typically March 15th or April 15th of each year, depending on the corporation's tax year.