Filing taxes can be a daunting task, especially for those who are new to the process or have recently moved to a new state. Wisconsin residents who are required to file state taxes may need to submit Form 1NPR, which is used to report nonresident income tax. In this article, we will provide five tips for filing WI Form 1NPR to help make the process smoother and less overwhelming.

Understanding Form 1NPR

Before we dive into the tips, it's essential to understand what Form 1NPR is and who needs to file it. Form 1NPR is a tax form used by nonresidents of Wisconsin who have earned income from sources within the state. This can include wages, tips, and other compensation earned while working in Wisconsin. Nonresidents who are required to file Form 1NPR will need to report their Wisconsin income and pay any taxes owed to the state.

Tip 1: Determine if You Need to File

The first step in filing Form 1NPR is to determine if you need to file. If you are a nonresident of Wisconsin and have earned income from sources within the state, you may be required to file. However, there are some exceptions and exemptions. For example, if you are a resident of Illinois, Indiana, Kentucky, or Minnesota, you may not need to file Form 1NPR. It's essential to review the Wisconsin Department of Revenue's guidelines to determine if you need to file.

Tip 2: Gather Required Documents

To file Form 1NPR, you will need to gather several documents, including:

- Your W-2 forms from all Wisconsin employers

- Your 1099 forms for any freelance or contract work performed in Wisconsin

- Your federal tax return (Form 1040)

- Any other relevant tax documents

Make sure you have all the necessary documents before starting the filing process. This will help ensure that you have all the information you need to complete the form accurately.

Tip 3: Use the Correct Filing Status

When filing Form 1NPR, you will need to select the correct filing status. Your filing status will depend on your marital status, number of dependents, and other factors. Make sure you choose the correct filing status to avoid errors or delays in processing your return.

Tip 4: Report All Income

When completing Form 1NPR, it's essential to report all income earned from Wisconsin sources. This includes:

- Wages, tips, and other compensation

- Interest and dividends

- Capital gains and losses

- Other income earned in Wisconsin

Make sure you report all income accurately to avoid errors or penalties.

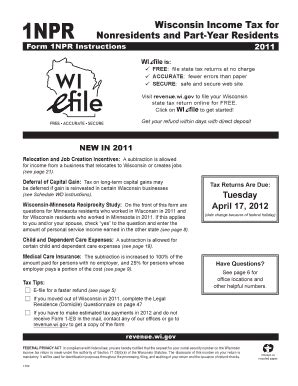

Tip 5: File Electronically or by Mail

Finally, you will need to decide how to file your Form 1NPR. You can file electronically or by mail. Filing electronically is generally faster and more convenient, but you can also file by mail if you prefer. Make sure you follow the Wisconsin Department of Revenue's guidelines for filing deadlines and payment options.

Benefits of Filing Form 1NPR Electronically

Filing Form 1NPR electronically offers several benefits, including:

- Faster processing times

- Reduced errors

- Ability to track the status of your return

- Option to pay electronically

If you are required to file Form 1NPR, consider filing electronically to take advantage of these benefits.

Common Mistakes to Avoid When Filing Form 1NPR

When filing Form 1NPR, there are several common mistakes to avoid, including:

- Failing to report all income earned in Wisconsin

- Using the incorrect filing status

- Missing the filing deadline

- Failing to pay any taxes owed

Avoid these mistakes by carefully reviewing the Wisconsin Department of Revenue's guidelines and taking your time when completing the form.

Conclusion and Next Steps

Filing WI Form 1NPR can seem overwhelming, but by following these five tips, you can make the process smoother and less stressful. Remember to determine if you need to file, gather required documents, use the correct filing status, report all income, and file electronically or by mail. By taking the time to review the Wisconsin Department of Revenue's guidelines and carefully completing the form, you can avoid errors and ensure that you are in compliance with state tax laws.

FAQ Section

Who needs to file Form 1NPR?

+Nonresidents of Wisconsin who have earned income from sources within the state may need to file Form 1NPR.

What documents do I need to file Form 1NPR?

+You will need to gather your W-2 forms, 1099 forms, federal tax return, and any other relevant tax documents.

Can I file Form 1NPR electronically?

+Yes, you can file Form 1NPR electronically or by mail.