The complexities of tax forms can be overwhelming for many individuals and businesses. One such form that may require attention is Form 8958, which is used to report certain types of allocations to partners in a partnership. But who exactly needs to file this form, and what are the key requirements? In this article, we will delve into the details of Form 8958, its purpose, and who is required to file it.

As a partner in a partnership, understanding the tax implications of your business structure is crucial. The IRS requires partnerships to report certain allocations to partners, and Form 8958 is the designated form for this purpose. This form is used to report allocations of income, gain, loss, deduction, and credit to partners in a partnership. The form is typically filed annually, and it's essential to understand who is required to file it to avoid any penalties or fines.

Who Must File Form 8958?

To determine who must file Form 8958, let's examine the requirements set by the IRS. The form is required to be filed by partnerships that have made allocations of income, gain, loss, deduction, or credit to partners. This includes:

- General partnerships

- Limited partnerships

- Limited liability partnerships (LLPs)

- Limited liability companies (LLCs) that are treated as partnerships for tax purposes

The IRS requires partnerships to file Form 8958 if they have made any of the following allocations to partners:

- Income or gain

- Loss or deduction

- Credit

- Basis adjustments

Partnerships that do not make any of these allocations are not required to file Form 8958.

Additional Requirements

In addition to the types of partnerships and allocations mentioned above, there are some additional requirements to note:

- The partnership must have a tax year that ends on or after December 31, 2019.

- The partnership must have at least one partner who is a "specified partner" (more on this below).

- The partnership must have made an allocation of income, gain, loss, deduction, or credit to a partner who is not a specified partner.

A specified partner is a partner who:

- Is a general partner

- Has a 10% or greater interest in the partnership's profits or capital

- Has a 10% or greater interest in the partnership's assets

If a partnership meets any of these additional requirements, it is required to file Form 8958.

How to File Form 8958

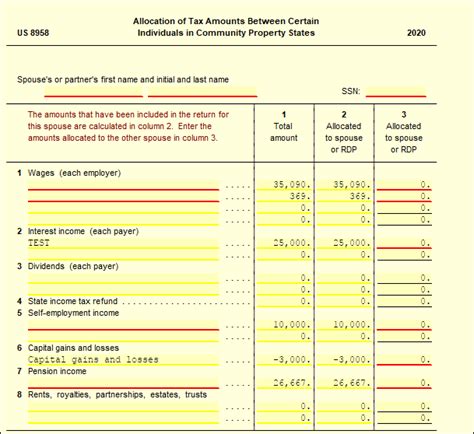

Filing Form 8958 requires some basic information about the partnership and its partners. The form consists of several sections, including:

- Partnership information (name, address, EIN, etc.)

- Partner information (name, address, EIN, etc.)

- Allocation information (income, gain, loss, deduction, credit, etc.)

To file Form 8958, follow these steps:

- Gather all required information and documentation.

- Complete the form according to the instructions.

- File the form with the IRS by the required deadline (typically March 15th for partnerships).

- Keep a copy of the form for your records.

Penalties for Failure to File

Failure to file Form 8958 can result in penalties and fines. The IRS may impose penalties of up to $250 per partner for each year the form is not filed. Additionally, interest may be charged on any unpaid penalties.

To avoid these penalties, it's essential to file Form 8958 on time and accurately.

Conclusion

Form 8958 is an essential tax form for partnerships that make allocations to partners. By understanding who must file this form and how to file it, partnerships can avoid penalties and ensure compliance with IRS regulations. If you're unsure about your partnership's requirements, consult with a tax professional or the IRS to ensure you're meeting all necessary obligations.

We hope this article has provided valuable insights into Form 8958 and its requirements. If you have any questions or comments, please share them below.

What is Form 8958 used for?

+Form 8958 is used to report allocations of income, gain, loss, deduction, and credit to partners in a partnership.

Who is required to file Form 8958?

+Partnerships that have made allocations of income, gain, loss, deduction, or credit to partners are required to file Form 8958.

What are the penalties for failure to file Form 8958?

+The IRS may impose penalties of up to $250 per partner for each year the form is not filed, plus interest on any unpaid penalties.