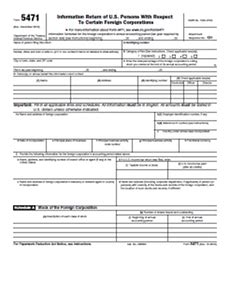

The Form 5471 is a crucial document for U.S. taxpayers with interests in controlled foreign corporations (CFCs). As part of the Form 5471, Worksheet A is a critical component that requires careful attention to detail. In this article, we will delve into the world of Worksheet A and provide you with 5 essential tips to ensure you navigate it with ease.

Understanding the Importance of Worksheet A

Before we dive into the tips, it's essential to understand the purpose of Worksheet A. This worksheet is used to calculate the undistributed earnings of a CFC, which is a critical component of the Form 5471. The worksheet helps taxpayers calculate the CFC's earnings and profits, which are then used to determine the U.S. taxpayer's share of the CFC's income.

Tip 1: Identify the Correct Filing Status

To complete Worksheet A accurately, you must first determine the correct filing status of the CFC. This involves identifying whether the CFC is a controlled foreign corporation, a non-controlled foreign corporation, or a foreign corporation with a U.S. trade or business. The filing status will impact the information required on Worksheet A.

Tip 2: Gather Required Information

To complete Worksheet A, you will need to gather specific information about the CFC, including:

- The CFC's name and employer identification number (EIN)

- The CFC's country of incorporation and tax residence

- The CFC's financial statements, including the balance sheet and income statement

- Information about the CFC's shareholders and their respective ownership percentages

Having this information readily available will ensure that you can complete Worksheet A accurately and efficiently.

Tip 3: Calculate Earnings and Profits Correctly

The calculation of earnings and profits is a critical component of Worksheet A. To do this correctly, you must follow the specific instructions provided in the Form 5471 instructions. This involves calculating the CFC's earnings and profits using the CFC's financial statements and applying specific adjustments and allocations.

Some common mistakes to avoid when calculating earnings and profits include:

- Failing to account for foreign taxes paid by the CFC

- Incorrectly applying the CFC's accounting method

- Failing to include all income and expenses in the calculation

Tip 4: Apply the Correct Exchange Rates

When completing Worksheet A, you will need to apply the correct exchange rates to convert the CFC's financial statements from the functional currency to U.S. dollars. This involves using the average exchange rate for the tax year, unless the CFC's financial statements are already denominated in U.S. dollars.

Using the correct exchange rates is essential to ensure that the CFC's earnings and profits are accurately calculated.

Tip 5: Review and Reconcile

Finally, it's essential to review and reconcile Worksheet A to ensure that it accurately reflects the CFC's earnings and profits. This involves reviewing the worksheet for mathematical errors, ensuring that all required information is included, and reconciling the worksheet to the CFC's financial statements.

By following these 5 essential tips, you can ensure that you complete Worksheet A accurately and efficiently. Remember to stay up-to-date with the latest changes to the Form 5471 and its instructions to ensure compliance with all applicable tax laws and regulations.

Common Challenges and Solutions

In this section, we will address some common challenges and solutions related to completing Worksheet A.

Challenge 1: Inconsistent Accounting Methods

Solution: Ensure that the CFC's accounting method is consistent with the method used by the U.S. taxpayer. This may require adjustments to the CFC's financial statements to ensure consistency.

Challenge 2: Foreign Tax Credits

Solution: Ensure that foreign tax credits are properly accounted for on Worksheet A. This may require calculating the foreign tax credit limitation and applying it to the CFC's earnings and profits.

Challenge 3: Exchange Rate Fluctuations

Solution: Use the average exchange rate for the tax year, unless the CFC's financial statements are already denominated in U.S. dollars. This will help to minimize the impact of exchange rate fluctuations on the CFC's earnings and profits.

Best Practices

In this section, we will provide some best practices for completing Worksheet A.

Best Practice 1: Use a Worksheet A Template

Using a template can help to ensure that you complete Worksheet A accurately and efficiently. You can find templates online or create your own using spreadsheet software.

Best Practice 2: Review and Reconcile Regularly

Regular review and reconciliation of Worksheet A can help to identify errors and ensure that the worksheet accurately reflects the CFC's earnings and profits.

Best Practice 3: Seek Professional Advice

If you are unsure about how to complete Worksheet A or have complex tax situations, it's essential to seek professional advice from a qualified tax professional.

By following these best practices and tips, you can ensure that you complete Worksheet A accurately and efficiently.

Conclusion

Completing Worksheet A is a critical component of the Form 5471. By following the 5 essential tips outlined in this article, you can ensure that you complete Worksheet A accurately and efficiently. Remember to review and reconcile regularly, use a template, and seek professional advice when needed. With the right knowledge and tools, you can navigate the complexities of Worksheet A with ease.

What is the purpose of Worksheet A?

+Worksheet A is used to calculate the undistributed earnings of a controlled foreign corporation (CFC), which is a critical component of the Form 5471.

What information is required to complete Worksheet A?

+To complete Worksheet A, you will need to gather specific information about the CFC, including the CFC's name and employer identification number (EIN), the CFC's country of incorporation and tax residence, the CFC's financial statements, and information about the CFC's shareholders and their respective ownership percentages.

How do I calculate earnings and profits on Worksheet A?

+To calculate earnings and profits on Worksheet A, you must follow the specific instructions provided in the Form 5471 instructions. This involves calculating the CFC's earnings and profits using the CFC's financial statements and applying specific adjustments and allocations.