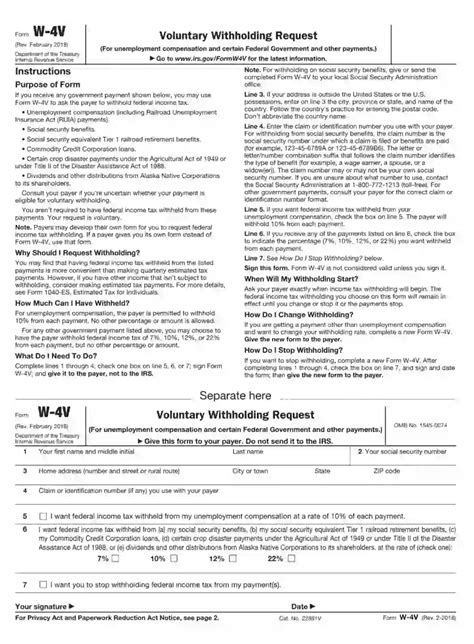

As the tax season approaches, it's essential to understand the correct procedures for submitting tax-related forms to the Internal Revenue Service (IRS). One such form is the Form W-4V, also known as the Voluntary Withholding Request. This form is used by individuals who want to request voluntary withholding from certain government payments, such as Social Security benefits or unemployment compensation.

When it comes to submitting the Form W-4V, one of the most critical steps is ensuring it reaches the correct IRS address. In this article, we will guide you through the top 2 IRS addresses for mailing Form W-4V and provide additional information to help you navigate the process smoothly.

Why is it essential to mail Form W-4V to the correct IRS address?

Mailing Form W-4V to the correct IRS address is crucial to avoid delays or rejection of your request. The IRS has specific addresses designated for different types of forms, and using the incorrect address may lead to processing issues. By using the correct address, you can ensure that your Form W-4V is processed promptly and efficiently.

Top 2 IRS Addresses for Mailing Form W-4V

The IRS has designated two primary addresses for mailing Form W-4V, depending on the type of payment you're requesting voluntary withholding from.

Address 1: For Social Security Benefits and Supplemental Security Income (SSI) Payments

Internal Revenue Service 611 S. Dupont Hwy. Dover, DE 19901

This address is specifically for Form W-4V requests related to Social Security benefits and SSI payments. If you're a recipient of these benefits and want to request voluntary withholding, use this address.

Address 2: For Unemployment Compensation and Other Government Payments

Internal Revenue Service 11501 Roosevelt Blvd. Philadelphia, PA 19154-4832

This address is for Form W-4V requests related to unemployment compensation and other government payments, such as railroad retirement benefits or civil service retirement benefits. If you're a recipient of these payments and want to request voluntary withholding, use this address.

Additional Tips for Mailing Form W-4V

Before mailing your Form W-4V, ensure you follow these tips:

- Use a secure and trackable mail method, such as USPS Certified Mail or FedEx.

- Double-check the address and ensure it matches the type of payment you're requesting voluntary withholding from.

- Include a copy of your identification, such as a driver's license or passport, if required.

- Keep a copy of your Form W-4V and supporting documentation for your records.

What to Expect After Mailing Form W-4V

After mailing your Form W-4V, you can expect the IRS to process your request within a few weeks. The IRS will review your form and verify the information provided. If your request is approved, you'll start seeing the voluntary withholding on your payments.

Conclusion

Mailing Form W-4V to the correct IRS address is crucial to ensure prompt processing of your voluntary withholding request. By following the top 2 IRS addresses provided in this article and adhering to the additional tips, you can ensure a smooth and efficient process. If you have any further questions or concerns, feel free to comment below or seek guidance from a tax professional.

What is the purpose of Form W-4V?

+Form W-4V is used to request voluntary withholding from certain government payments, such as Social Security benefits or unemployment compensation.

Can I submit Form W-4V online?

+No, Form W-4V must be submitted by mail to the designated IRS addresses.

How long does it take for the IRS to process Form W-4V?

+The IRS typically processes Form W-4V within a few weeks. However, processing times may vary depending on the workload and complexity of the request.