The coal industry has long been a significant contributor to the global energy landscape, providing a substantial portion of the world's electricity. As the world shifts towards cleaner and more sustainable energy sources, the coal industry is undergoing a significant transformation. The Advanced Coal Project Tax Credit, also known as the Section 48A tax credit, is a crucial incentive for companies investing in advanced coal-based power generation and industrial gasification projects. To qualify for these tax credits, companies must submit IRS Form 8834, which can be a complex and time-consuming process.

What are Advanced Coal Project Tax Credits?

Advanced Coal Project Tax Credits are a type of tax incentive provided by the Internal Revenue Service (IRS) to encourage companies to invest in advanced coal-based power generation and industrial gasification projects. The Section 48A tax credit is a crucial component of the Energy Policy Act of 2005, which aims to promote the development of clean and efficient energy technologies. The tax credit is available for qualified projects that integrate gasification technology, advanced combustion systems, or other innovative technologies to reduce greenhouse gas emissions and improve energy efficiency.

Eligibility Criteria for Advanced Coal Project Tax Credits

To qualify for the Advanced Coal Project Tax Credit, a project must meet specific eligibility criteria. These criteria include:

- The project must involve the integration of gasification technology, advanced combustion systems, or other innovative technologies to reduce greenhouse gas emissions and improve energy efficiency.

- The project must be designed to produce electricity or industrial products, such as chemicals or fuels.

- The project must be located in the United States.

- The project must have a total capital cost of at least $5 million.

- The project must be commenced construction before December 31, 2011.

How to Qualify for Advanced Coal Project Tax Credits using IRS Form 8834

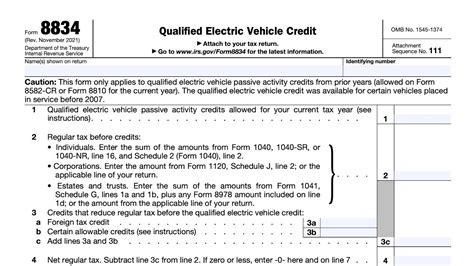

To qualify for the Advanced Coal Project Tax Credit, companies must submit IRS Form 8834, which is a comprehensive application that requires detailed information about the project. The form is divided into several sections, including:

- Section 1: Project Description, which requires a detailed description of the project, including its location, technology, and capital costs.

- Section 2: Eligibility Criteria, which requires the applicant to certify that the project meets the eligibility criteria outlined above.

- Section 3: Project Costs, which requires the applicant to provide a detailed breakdown of the project's capital costs.

- Section 4: Tax Credit Calculation, which requires the applicant to calculate the tax credit amount based on the project's capital costs.

Steps to Complete IRS Form 8834

Completing IRS Form 8834 requires careful attention to detail and a thorough understanding of the tax credit program. Here are the steps to complete the form:

- Review the eligibility criteria and ensure that the project meets all the requirements.

- Gather all necessary documentation, including project plans, cost estimates, and technical specifications.

- Complete Section 1 of the form, providing a detailed description of the project.

- Complete Section 2 of the form, certifying that the project meets the eligibility criteria.

- Complete Section 3 of the form, providing a detailed breakdown of the project's capital costs.

- Complete Section 4 of the form, calculating the tax credit amount based on the project's capital costs.

- Review the form carefully to ensure accuracy and completeness.

- Submit the form to the IRS, along with all supporting documentation.

Benefits of Advanced Coal Project Tax Credits

The Advanced Coal Project Tax Credit provides significant benefits to companies investing in advanced coal-based power generation and industrial gasification projects. These benefits include:

- Reduced greenhouse gas emissions and improved energy efficiency

- Increased competitiveness in the global energy market

- Improved profitability through reduced capital costs

- Increased investment in clean energy technologies

- Job creation and economic growth in local communities

Challenges and Opportunities

While the Advanced Coal Project Tax Credit provides significant benefits to companies investing in advanced coal-based power generation and industrial gasification projects, there are also challenges and opportunities to consider. These include:

- The tax credit program is highly competitive, and only a limited number of projects are selected for funding each year.

- The application process is complex and time-consuming, requiring significant resources and expertise.

- The tax credit amount is based on the project's capital costs, which can be unpredictable and subject to change.

- The tax credit program is subject to change or termination, which can impact the project's financial viability.

Conclusion

The Advanced Coal Project Tax Credit is a crucial incentive for companies investing in advanced coal-based power generation and industrial gasification projects. To qualify for these tax credits, companies must submit IRS Form 8834, which requires careful attention to detail and a thorough understanding of the tax credit program. While there are challenges and opportunities to consider, the benefits of the tax credit program far outweigh the costs. By investing in clean energy technologies and reducing greenhouse gas emissions, companies can improve their profitability, competitiveness, and sustainability in the global energy market.

What is the Advanced Coal Project Tax Credit?

+The Advanced Coal Project Tax Credit is a type of tax incentive provided by the Internal Revenue Service (IRS) to encourage companies to invest in advanced coal-based power generation and industrial gasification projects.

How do I qualify for the Advanced Coal Project Tax Credit?

+To qualify for the Advanced Coal Project Tax Credit, a project must meet specific eligibility criteria, including the integration of gasification technology, advanced combustion systems, or other innovative technologies to reduce greenhouse gas emissions and improve energy efficiency.

What is IRS Form 8834?

+IRS Form 8834 is a comprehensive application that requires detailed information about the project, including its location, technology, and capital costs.