Dealing with tax debt can be a stressful and overwhelming experience. However, the IRS offers various payment options to help individuals manage their tax liabilities. One of these options is the Installment Agreement (IA), which allows taxpayers to pay their tax debt in monthly installments. To initiate the IA process, taxpayers need to submit Form 9465, also known as the Installment Agreement Request. But where should you mail Form 9465 for IRS Installment Agreements?

Understanding Form 9465

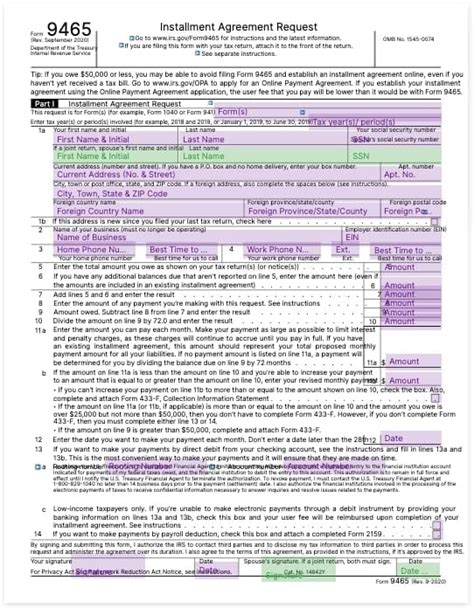

Before we dive into the mailing address, let's quickly review what Form 9465 is and what it's used for. Form 9465 is a request for an Installment Agreement, which is a payment plan that allows taxpayers to pay their tax debt in monthly installments. This form is typically submitted by individuals or businesses that are unable to pay their tax debt in full by the original due date.

Benefits of an Installment Agreement

An Installment Agreement offers several benefits, including:

- Avoiding additional penalties and interest

- Reducing the risk of IRS collection actions, such as wage garnishment or bank levies

- Providing a structured payment plan to help manage tax debt

Mailing Address for Form 9465

Now, let's get to the important part – where to mail Form 9465. The mailing address for Form 9465 varies depending on your location and the type of tax return you're filing. Here are the addresses:

- If you're filing Form 1040 (Individual Income Tax Return) and you live in:

- Alabama, Georgia, Kentucky, North Carolina, South Carolina, Tennessee, or Virginia, mail Form 9465 to: Internal Revenue Service, 401 W. Peachtree St., NW, Stop 421-D, Atlanta, GA 30308

- Alaska, Arizona, California, Hawaii, Idaho, Montana, Nevada, Oregon, Utah, Washington, or Wyoming, mail Form 9465 to: Internal Revenue Service, 1301 Clay St., Oakland, CA 94612

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, or Wisconsin, mail Form 9465 to: Internal Revenue Service, 1111 Constitution Ave., NW, Washington, DC 20224

- Colorado, Connecticut, Delaware, District of Columbia, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New Mexico, New York, Pennsylvania, Rhode Island, or Vermont, mail Form 9465 to: Internal Revenue Service, 1111 Constitution Ave., NW, Washington, DC 20224

- If you're filing Form 1120 (Corporation Income Tax Return) or Form 1120S (S Corporation Income Tax Return), mail Form 9465 to: Internal Revenue Service, 1111 Constitution Ave., NW, Washington, DC 20224

Additional Tips

When mailing Form 9465, make sure to:

- Use a secure and trackable mail service, such as certified mail or a courier service

- Keep a copy of the form and any supporting documentation for your records

- Include a check or money order for the first installment payment, if applicable

E-Filing Option

If you prefer to e-file Form 9465, you can do so through the IRS Online Account or the Electronic Federal Tax Payment System (EFTPS). E-filing can help expedite the processing of your Installment Agreement request.

Benefits of E-Filing

E-filing Form 9465 offers several benefits, including:

- Faster processing times

- Reduced risk of errors or lost documents

- Increased security and confidentiality

Conclusion

In conclusion, mailing Form 9465 to the correct address is crucial for initiating the Installment Agreement process. By following the instructions outlined above, you can ensure that your request is processed efficiently and effectively. Remember to also consider e-filing as a convenient and secure alternative.

What is the purpose of Form 9465?

+Form 9465 is used to request an Installment Agreement, which is a payment plan that allows taxpayers to pay their tax debt in monthly installments.

Can I e-file Form 9465?

+Yes, you can e-file Form 9465 through the IRS Online Account or the Electronic Federal Tax Payment System (EFTPS).

What are the benefits of an Installment Agreement?

+An Installment Agreement offers several benefits, including avoiding additional penalties and interest, reducing the risk of IRS collection actions, and providing a structured payment plan to help manage tax debt.