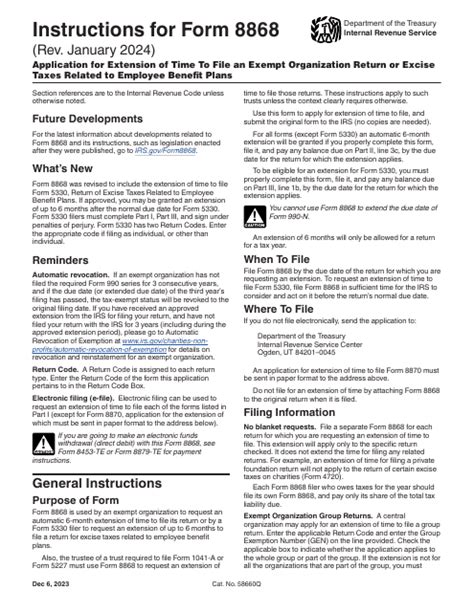

The Internal Revenue Service (IRS) provides an automatic six-month extension of time to file certain business tax returns, including Form 1120 (U.S. Corporation Income Tax Return), Form 1120S (U.S. Income Tax Return for an S Corporation), and Form 1065 (U.S. Return of Partnership Income), among others. To obtain this extension, businesses must file Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return. In this article, we will provide a comprehensive guide on how to file Form 8868 and the requirements for requesting an IRS extension.

Why File Form 8868?

Filing Form 8868 provides an automatic six-month extension of time to file the required tax return, allowing businesses to avoid late-filing penalties and interest. This extension can be beneficial for several reasons:

- Insufficient time to gather necessary documentation

- Complexity of the tax return

- Need for additional time to resolve tax-related issues

- Avoidance of late-filing penalties and interest

Who Can File Form 8868?

Form 8868 can be filed by:

- Exempt organizations (e.g., charitable organizations, social clubs)

- Cooperatives

- Certain employee benefit plans

- Certain trusts

- Estates of deceased individuals

- Trusts that are required to file Form 1041 (U.S. Income Tax Return for Estates and Trusts)

How to File Form 8868

To file Form 8868, follow these steps:

- Determine the Filing Deadline: Identify the original filing deadline for the tax return. For most exempt organizations, the filing deadline is May 15th for calendar-year filers.

- Complete Form 8868: Download and complete Form 8868, ensuring accuracy and completeness. The form requires basic business information, including the Employer Identification Number (EIN) and the type of tax return being extended.

- File Form 8868: Submit Form 8868 by the original filing deadline to avoid late-filing penalties and interest. The form can be filed electronically or by mail.

- Pay Any Estimated Tax: If the business expects to owe taxes, pay any estimated tax due by the original filing deadline to avoid penalties and interest.

Filing Form 8868 Electronically

The IRS encourages electronic filing of Form 8868. To e-file, businesses can use:

- IRS Free File: A free e-filing option for eligible businesses

- Authorized IRS e-file Providers: Paid e-filing services that offer additional support and features

- IRS Online Account: A secure online account that allows businesses to e-file and manage their tax accounts

Form 8868 Due Dates

The due date for Form 8868 is the same as the original filing deadline for the tax return. For most exempt organizations, the due date is:

- May 15th: For calendar-year filers

- 15th day of the 5th month: For fiscal-year filers

Consequences of Late Filing

Failure to file Form 8868 by the due date may result in:

- Late-filing penalties: Up to 47.6% of the unpaid tax

- Interest: Accrues on the unpaid tax and penalties

- Loss of tax-exempt status: For exempt organizations that fail to file required tax returns for three consecutive years

FAQs

What is the purpose of Form 8868?

+Form 8868 is used to request an automatic six-month extension of time to file certain business tax returns.

Who can file Form 8868?

+Form 8868 can be filed by exempt organizations, cooperatives, certain employee benefit plans, certain trusts, estates of deceased individuals, and trusts that are required to file Form 1041.

What is the due date for Form 8868?

+The due date for Form 8868 is the same as the original filing deadline for the tax return. For most exempt organizations, the due date is May 15th for calendar-year filers.

By following the guidelines outlined in this article, businesses can ensure accurate and timely filing of Form 8868, avoiding late-filing penalties and interest. If you have any further questions or concerns, please don't hesitate to ask. Share your thoughts and experiences with filing Form 8868 in the comments section below.