Understanding the W-4 form is crucial for individuals to accurately report their income and claim the correct number of allowances for tax purposes. In this article, we will delve into the intricacies of the W-4 form and provide you with a comprehensive guide to help you grasp its concepts.

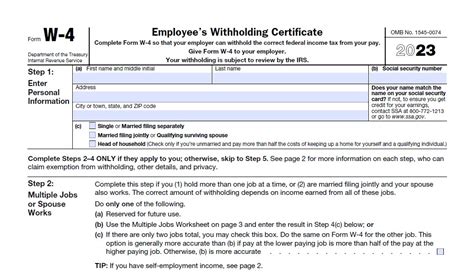

The W-4 form, also known as the Employee's Withholding Certificate, is a document that employees submit to their employers to determine the amount of federal income tax to withhold from their wages. The form requires individuals to provide personal and financial information to calculate the correct amount of tax to withhold.

1. Understanding the Purpose of the W-4 Form

The primary purpose of the W-4 form is to ensure that employees have the correct amount of federal income tax withheld from their wages. This form helps employers determine the amount of tax to withhold based on the employee's filing status, number of allowances, and other factors.

To better comprehend the W-4 form, it's essential to understand the concept of allowances. An allowance is an exemption from income tax, and the number of allowances you claim affects the amount of tax withheld from your wages. The more allowances you claim, the less tax will be withheld.

How Allowances Work

When you claim an allowance, you're essentially telling your employer to reduce the amount of tax withheld from your wages. For example, if you're single and have no dependents, you may claim one allowance. If you're married and have two dependents, you may claim three allowances.

However, it's crucial to note that claiming too many allowances can result in under-withholding, which may lead to a tax bill when you file your tax return. On the other hand, claiming too few allowances can result in over-withholding, which may lead to a refund when you file your tax return.

2. Filing Status and the W-4 Form

Your filing status plays a significant role in determining the number of allowances you can claim on the W-4 form. The most common filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Your filing status affects the number of allowances you can claim, which in turn affects the amount of tax withheld from your wages. For example, if you're married and file jointly, you may claim two allowances. However, if you're married and file separately, you may claim only one allowance.

How to Determine Your Filing Status

To determine your filing status, you'll need to consider your marital status, dependents, and other factors. Here are some general guidelines to help you determine your filing status:

- If you're single, you'll file as single.

- If you're married, you'll file as married filing jointly or married filing separately.

- If you're a qualifying widow(er), you'll file as qualifying widow(er).

- If you're the head of household, you'll file as head of household.

3. Claiming Dependents on the W-4 Form

Claiming dependents on the W-4 form can affect the number of allowances you can claim. A dependent is someone who relies on you for financial support, such as a child or elderly parent.

To claim a dependent on the W-4 form, you'll need to provide the dependent's name, Social Security number, and relationship to you. You'll also need to indicate whether the dependent is a qualifying child or qualifying relative.

Qualifying Child vs. Qualifying Relative

A qualifying child is a child who meets certain age, relationship, and residency tests. A qualifying relative is a relative who meets certain tests, such as a parent, grandparent, or sibling.

Here are some general guidelines to help you determine whether a dependent is a qualifying child or qualifying relative:

- A qualifying child is a child who is under age 19, or under age 24 if a full-time student.

- A qualifying relative is a relative who meets certain tests, such as a parent, grandparent, or sibling.

4. Other Factors That Affect the W-4 Form

Several other factors can affect the W-4 form, including:

- Multiple jobs: If you have multiple jobs, you may need to adjust your withholding to avoid under-withholding or over-withholding.

- Self-employment income: If you're self-employed, you may need to adjust your withholding to account for self-employment tax.

- Dividend and interest income: If you have dividend and interest income, you may need to adjust your withholding to account for this income.

How to Adjust Your Withholding

To adjust your withholding, you'll need to complete a new W-4 form and submit it to your employer. You can adjust your withholding at any time during the year, but it's recommended that you review your withholding regularly to ensure you're not under-withholding or over-withholding.

5. W-4 Form Quizlet: Practice Questions

To help you better understand the W-4 form, we've created a series of practice questions. These questions will test your knowledge of the W-4 form and help you prepare for the quiz.

Here are five practice questions to get you started:

- What is the primary purpose of the W-4 form? a) To determine the amount of federal income tax to withhold from wages b) To report income and claim deductions c) To claim dependents and exemptions d) To file for unemployment benefits

Answer: a) To determine the amount of federal income tax to withhold from wages

- What is an allowance, and how does it affect the W-4 form? a) An allowance is an exemption from income tax, and claiming more allowances reduces the amount of tax withheld b) An allowance is a deduction from income tax, and claiming more allowances increases the amount of tax withheld c) An allowance is a credit against income tax, and claiming more allowances reduces the amount of tax withheld d) An allowance is a penalty for under-withholding, and claiming more allowances increases the amount of tax withheld

Answer: a) An allowance is an exemption from income tax, and claiming more allowances reduces the amount of tax withheld

- What is the difference between a qualifying child and a qualifying relative? a) A qualifying child is a child who meets certain age and relationship tests, while a qualifying relative is a relative who meets certain tests b) A qualifying child is a relative who meets certain tests, while a qualifying relative is a child who meets certain age and relationship tests c) A qualifying child is a dependent who meets certain income tests, while a qualifying relative is a dependent who meets certain relationship tests d) A qualifying child is a dependent who meets certain relationship tests, while a qualifying relative is a dependent who meets certain income tests

Answer: a) A qualifying child is a child who meets certain age and relationship tests, while a qualifying relative is a relative who meets certain tests

- How do multiple jobs affect the W-4 form? a) Multiple jobs require you to claim more allowances to avoid under-withholding b) Multiple jobs require you to claim fewer allowances to avoid over-withholding c) Multiple jobs do not affect the W-4 form d) Multiple jobs require you to file a separate W-4 form for each job

Answer: b) Multiple jobs require you to claim fewer allowances to avoid over-withholding

- What is the purpose of the W-4 form's "Two-Earners Worksheet"? a) To calculate the amount of federal income tax to withhold from wages b) To determine the number of allowances to claim c) To calculate the amount of self-employment tax d) To determine the amount of dividend and interest income

Answer: a) To calculate the amount of federal income tax to withhold from wages

We hope this article has helped you understand the W-4 form and its intricacies. Remember to review your withholding regularly to ensure you're not under-withholding or over-withholding. If you have any questions or concerns, don't hesitate to reach out to a tax professional or financial advisor.

What's your experience with the W-4 form? Have you ever had to adjust your withholding? Share your story in the comments below!

What is the W-4 form used for?

+The W-4 form is used to determine the amount of federal income tax to withhold from wages.

How do allowances affect the W-4 form?

+Claiming more allowances reduces the amount of tax withheld, while claiming fewer allowances increases the amount of tax withheld.

What is the difference between a qualifying child and a qualifying relative?

+A qualifying child is a child who meets certain age and relationship tests, while a qualifying relative is a relative who meets certain tests.