The SSA-1020 form, also known as the "Application for Help with Medicare Expenses", is a crucial document for individuals seeking assistance with Medicare costs. Completing this form accurately and thoroughly is essential to ensure that your application is processed smoothly and efficiently. In this article, we will guide you through the process of completing the SSA-1020 form successfully, highlighting five key steps to help you navigate this complex application.

Understanding the SSA-1020 Form

The SSA-1020 form is designed for individuals who are eligible for Medicare and require financial assistance to cover their Medicare expenses. This form is typically used by people who are low-income or have limited resources. By completing this form, applicants can receive help with Medicare premiums, deductibles, and copayments.

Step 1: Gather Required Documents and Information

Before starting the application process, it is essential to gather all required documents and information. This includes:

- Identification documents (driver's license, passport, or state ID)

- Proof of income (pay stubs, tax returns, or Social Security award letter)

- Proof of resources (bank statements, investment accounts, or property deeds)

- Medicare card or proof of Medicare eligibility

- Information about your household members (names, dates of birth, and relationship to you)

Having all the necessary documents and information readily available will help you complete the form accurately and efficiently.

Step 2: Complete the Application Form

The SSA-1020 form consists of several sections, including:

- Section 1: Applicant Information

- Section 2: Household Information

- Section 3: Income Information

- Section 4: Resource Information

- Section 5: Medicare Information

Carefully complete each section, ensuring that you provide accurate and detailed information. If you are unsure about any section, consider seeking assistance from a Social Security representative or a qualified healthcare professional.

Step 3: Calculate Your Income and Resources

To determine your eligibility for Medicare assistance, you must calculate your income and resources. This includes:

- Countable income (e.g., wages, pensions, and Social Security benefits)

- Excluded income (e.g., certain types of government benefits and tax refunds)

- Countable resources (e.g., cash, bank accounts, and investments)

- Excluded resources (e.g., primary residence, vehicles, and certain types of insurance policies)

Use the SSA's income and resource calculation worksheets to ensure accuracy.

Step 4: Submit Your Application

Once you have completed the application form and calculated your income and resources, submit your application to the Social Security Administration. You can submit your application:

- Online through the SSA's website

- By mail to your local Social Security office

- In person at your local Social Security office

Ensure that you keep a copy of your application and supporting documents for your records.

Step 5: Follow Up on Your Application

After submitting your application, follow up with the Social Security Administration to ensure that your application is being processed. You can:

- Call the SSA's national customer service number

- Visit your local Social Security office

- Check the status of your application online

By following up on your application, you can help prevent delays and ensure that you receive the assistance you need to cover your Medicare expenses.

Additional Tips and Reminders

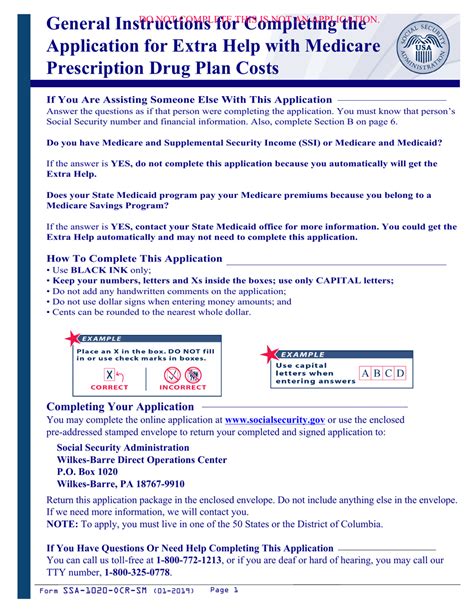

- Use black ink to complete the application form

- Do not sign the form until you are certain that all information is accurate

- Keep a copy of your application and supporting documents for your records

- If you need assistance, consider seeking help from a Social Security representative or a qualified healthcare professional

By following these five steps and additional tips, you can successfully complete the SSA-1020 form and receive the assistance you need to cover your Medicare expenses.

We hope this article has been informative and helpful. If you have any questions or concerns, please do not hesitate to comment below. Share this article with others who may benefit from this information.

What is the SSA-1020 form used for?

+The SSA-1020 form is used to apply for help with Medicare expenses.

What documents do I need to complete the SSA-1020 form?

+You will need identification documents, proof of income, proof of resources, Medicare card or proof of Medicare eligibility, and information about your household members.

How do I submit my SSA-1020 form application?

+You can submit your application online, by mail, or in person at your local Social Security office.