The railroad industry is a vital part of the US transportation network, employing thousands of workers across the country. If you're a railroad employee, you're likely familiar with the unique tax benefits that come with your job. One of the key documents that helps you claim these benefits is Form RRB-1099, which reports your railroad retirement tax benefits. In this article, we'll delve into the world of railroad retirement tax benefits, exploring how they work, the benefits they provide, and what you need to know about Form RRB-1099.

Understanding Railroad Retirement Tax Benefits

Railroad retirement tax benefits are a type of social insurance program specifically designed for railroad workers. The program is administered by the Railroad Retirement Board (RRB), an independent agency of the US government. The RRB provides retirement, disability, and unemployment benefits to eligible railroad workers and their families.

One of the key features of railroad retirement tax benefits is the way they're funded. Unlike Social Security, which is funded through payroll taxes, railroad retirement benefits are funded through a combination of payroll taxes, employer contributions, and investment income. This means that railroad workers pay a slightly higher payroll tax rate than other workers, but they also receive more generous benefits in retirement.

How Form RRB-1099 Works

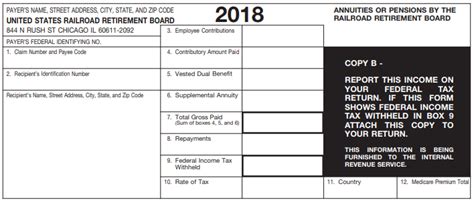

Form RRB-1099 is the document that reports your railroad retirement tax benefits to the Internal Revenue Service (IRS). The form shows the amount of benefits you received during the tax year, as well as any taxes withheld from those benefits. You'll receive a Form RRB-1099 from the RRB by January 31st of each year, covering the previous tax year.

The form is divided into several sections, including:

- Gross benefits: This section shows the total amount of benefits you received during the tax year.

- Tax withheld: This section shows the amount of taxes withheld from your benefits.

- Net benefits: This section shows the amount of benefits you received after taxes were withheld.

You'll use the information on Form RRB-1099 to report your railroad retirement tax benefits on your tax return. You'll report the net benefits (the amount after taxes were withheld) on Line 21 of your Form 1040.

Types of Benefits Reported on Form RRB-1099

Form RRB-1099 reports several types of railroad retirement tax benefits, including:

- Retirement benefits: These are the benefits you receive when you retire from railroad work.

- Disability benefits: These are the benefits you receive if you become disabled and are unable to work.

- Unemployment benefits: These are the benefits you receive if you're unemployed and looking for work.

- Sickness benefits: These are the benefits you receive if you're unable to work due to illness or injury.

Benefits of Railroad Retirement Tax Benefits

Railroad retirement tax benefits offer several advantages over traditional Social Security benefits. Some of the key benefits include:

- Higher benefit amounts: Railroad retirement benefits are generally higher than Social Security benefits, especially for workers with higher earnings.

- More generous disability benefits: Railroad retirement disability benefits are more generous than Social Security disability benefits, with higher benefit amounts and a more lenient eligibility process.

- Unemployment benefits: Railroad retirement unemployment benefits provide financial support during periods of unemployment, helping workers get back on their feet.

Eligibility Requirements

To be eligible for railroad retirement tax benefits, you must meet certain requirements, including:

- Age: You must be at least 60 years old to apply for retirement benefits.

- Service: You must have at least 10 years of credited railroad service to apply for retirement benefits.

- Disability: You must be disabled and unable to work to apply for disability benefits.

- Unemployment: You must be unemployed and looking for work to apply for unemployment benefits.

Taxation of Railroad Retirement Tax Benefits

Railroad retirement tax benefits are taxable, but the taxation rules are different from those for Social Security benefits. The IRS taxes railroad retirement benefits as ordinary income, but you may be able to exclude some or all of the benefits from taxation.

To determine the taxable amount of your railroad retirement benefits, you'll use the IRS's "Tier 1" and "Tier 2" system. Tier 1 benefits are taxed like Social Security benefits, with a maximum taxable amount of 85%. Tier 2 benefits are taxed as ordinary income, with no maximum taxable amount.

Conclusion

Railroad retirement tax benefits are a valuable resource for railroad workers, providing a more generous retirement income and more lenient disability benefits than traditional Social Security. Form RRB-1099 is the key document that reports these benefits to the IRS, helping you claim the benefits you're eligible for. By understanding how Form RRB-1099 works and the benefits it reports, you can make the most of your railroad retirement tax benefits and enjoy a more secure financial future.

We hope this article has been informative and helpful. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues who may be interested in learning more about railroad retirement tax benefits.

What is Form RRB-1099?

+Form RRB-1099 is a document that reports your railroad retirement tax benefits to the Internal Revenue Service (IRS).

How do I report my railroad retirement tax benefits on my tax return?

+You'll report the net benefits (the amount after taxes were withheld) on Line 21 of your Form 1040.

Are railroad retirement tax benefits taxable?

+Yes, railroad retirement tax benefits are taxable, but the taxation rules are different from those for Social Security benefits.