Transferring accounts from Merrill Lynch can be a daunting task, especially when it comes to navigating the required paperwork. One of the most essential documents you'll need to complete is the Merrill Lynch transfer form. In this article, we'll break down the 5 steps to complete the Merrill Lynch transfer form, ensuring a seamless transition of your accounts.

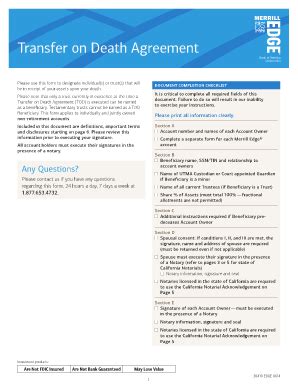

Understanding the Merrill Lynch Transfer Form

Why Do I Need to Complete the Merrill Lynch Transfer Form?

You'll need to complete the Merrill Lynch transfer form if you want to transfer your accounts from Merrill Lynch to another financial institution. This form helps to facilitate the transfer process, ensuring that your assets are moved correctly and efficiently.Step 1: Gather Required Information and Documents

- Your Merrill Lynch account number

- The name and address of the receiving institution

- The type of account you're transferring (e.g., individual, joint, IRA)

- The account registration information (e.g., account holder's name, address, social security number)

- Any other relevant documentation, such as a voided check or a letter of authorization

What If I Don't Have All the Required Information?

If you're missing any of the required information, you may need to contact Merrill Lynch or the receiving institution to obtain the necessary details. It's essential to ensure that you have all the required information before proceeding with the transfer.Step 2: Download and Print the Merrill Lynch Transfer Form

Can I Complete the Form Online?

Some financial institutions may offer online transfer forms, but it's essential to check with Merrill Lynch to see if this option is available. If not, you'll need to print and complete the form manually.Step 3: Fill Out the Merrill Lynch Transfer Form Accurately

- Read the instructions carefully

- Complete all required fields accurately

- Use black ink and sign in blue ink

- Avoid using correction fluid or erasing mistakes

- Attach any required documentation

What If I Make a Mistake on the Form?

If you make a mistake on the form, do not correct it. Instead, start again with a new form. Any corrections or alterations may delay the transfer process.Step 4: Sign and Date the Merrill Lynch Transfer Form

Do I Need to Notarize the Form?

Check with Merrill Lynch to see if notarization is required. If so, make sure to sign the form in the presence of a notary public.Step 5: Submit the Completed Merrill Lynch Transfer Form

- Mailing the form to the specified address

- Faxing the form to the specified number

- Uploading the form online, if available

What Happens After I Submit the Form?

After submitting the form, the transfer process will begin. This may take several days or weeks, depending on the complexity of the transfer and the institutions involved.By following these 5 steps, you'll be able to complete the Merrill Lynch transfer form accurately and efficiently. Remember to take your time, and don't hesitate to seek help if you need it. If you have any questions or concerns, feel free to comment below, and we'll do our best to assist you.

What is the Merrill Lynch transfer form used for?

+The Merrill Lynch transfer form is used to transfer accounts from Merrill Lynch to another financial institution.

Do I need to notarize the Merrill Lynch transfer form?

+Check with Merrill Lynch to see if notarization is required. If so, make sure to sign the form in the presence of a notary public.

How long does the transfer process take?

+The transfer process may take several days or weeks, depending on the complexity of the transfer and the institutions involved.