The tax season can be a daunting time for many individuals and businesses, with numerous forms to fill out and deadlines to meet. One of the forms that can be particularly confusing for some taxpayers is the Turbotax Form 7203, also known as the "S Corporation Shareholder Stock Basis Adjusments and Other Shareholder Related Items" form. In this article, we will break down the process of filing Turbotax Form 7203, explaining the importance of this form, its purpose, and providing a step-by-step guide on how to file it accurately.

The Importance of Accurate Tax Filing

Accurate tax filing is crucial for individuals and businesses to avoid any potential penalties, fines, or even audits from the Internal Revenue Service (IRS). The IRS requires taxpayers to report their income, expenses, and other financial transactions accurately, and failure to do so can result in severe consequences. Turbotax Form 7203 is one of the essential forms that S corporations must file to report their shareholders' stock basis adjustments and other related items.

Understanding Turbotax Form 7203

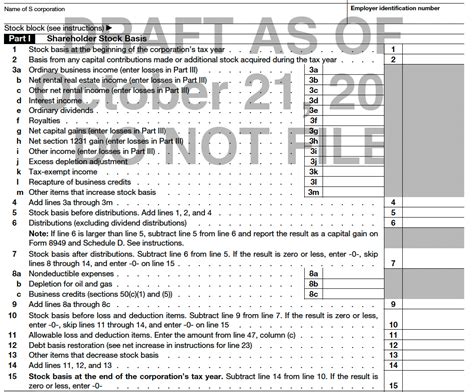

Turbotax Form 7203 is used by S corporations to report any adjustments to their shareholders' stock basis, which is the amount of money invested in the corporation. This form is also used to report other shareholder-related items, such as distributions, loans, and other transactions that affect the shareholder's basis in the corporation. The form is typically filed with the IRS along with the S corporation's annual tax return (Form 1120S).

Step-By-Step Guide to Filing Turbotax Form 7203

Filing Turbotax Form 7203 can seem overwhelming, but by following these steps, you can ensure that you file the form accurately and efficiently.

Step 1: Gather Required Information

Before you start filling out Turbotax Form 7203, gather all the necessary information, including:

- The S corporation's name, address, and employer identification number (EIN)

- The names, addresses, and social security numbers of all shareholders

- The number of shares owned by each shareholder

- The stock basis of each shareholder

- Any distributions, loans, or other transactions that affect the shareholder's basis

Step 2: Determine the Stock Basis Adjustment

Calculate the stock basis adjustment for each shareholder by taking into account any changes in the corporation's assets, liabilities, and equity. This adjustment will affect the shareholder's basis in the corporation.

Step 3: Complete Part I of the Form

Part I of Turbotax Form 7203 requires you to provide information about the S corporation, including its name, address, and EIN. You will also need to list the names, addresses, and social security numbers of all shareholders.

Step 4: Complete Part II of the Form

Part II of the form requires you to report the stock basis adjustments for each shareholder. You will need to calculate the adjustment by taking into account any changes in the corporation's assets, liabilities, and equity.

Step 5: Complete Part III of the Form

Part III of the form requires you to report any distributions, loans, or other transactions that affect the shareholder's basis in the corporation.

Step 6: Sign and Date the Form

Once you have completed all the parts of the form, sign and date it. Make sure to keep a copy of the form for your records.

Step 7: File the Form with the IRS

File Turbotax Form 7203 with the IRS along with the S corporation's annual tax return (Form 1120S).

Tips and Best Practices for Filing Turbotax Form 7203

- Make sure to file the form accurately and on time to avoid any penalties or fines.

- Keep accurate records of all transactions and calculations to support the information reported on the form.

- Consult with a tax professional if you are unsure about how to file the form or if you have any questions.

- Use tax software, such as Turbotax, to help you file the form accurately and efficiently.

Common Mistakes to Avoid When Filing Turbotax Form 7203

- Failing to report all required information, such as shareholder names and addresses

- Failing to calculate the stock basis adjustment accurately

- Failing to report all distributions, loans, or other transactions that affect the shareholder's basis

- Failing to sign and date the form

Conclusion

Filing Turbotax Form 7203 can seem overwhelming, but by following the steps outlined in this article, you can ensure that you file the form accurately and efficiently. Remember to gather all required information, calculate the stock basis adjustment accurately, and report all distributions, loans, or other transactions that affect the shareholder's basis. By avoiding common mistakes and following best practices, you can ensure that your S corporation is in compliance with the IRS and avoid any potential penalties or fines.

Take Action

If you are an S corporation owner or shareholder, make sure to file Turbotax Form 7203 accurately and on time. If you are unsure about how to file the form or have any questions, consult with a tax professional or use tax software, such as Turbotax, to help you file the form accurately and efficiently.

Share Your Thoughts

Have you ever had to file Turbotax Form 7203? What was your experience like? Share your thoughts and experiences in the comments below.

FAQs

What is Turbotax Form 7203?

+Turbotax Form 7203 is a tax form used by S corporations to report their shareholders' stock basis adjustments and other shareholder-related items.

Who needs to file Turbotax Form 7203?

+S corporations need to file Turbotax Form 7203 to report their shareholders' stock basis adjustments and other shareholder-related items.

What is the deadline for filing Turbotax Form 7203?

+The deadline for filing Turbotax Form 7203 is the same as the deadline for filing the S corporation's annual tax return (Form 1120S).