Oklahoma Form 538-S is a crucial document for businesses operating in the state, as it relates to the Sales and Use Tax Return. Understanding the process of filing this form is essential to ensure compliance with state tax regulations and avoid any potential penalties. In this article, we will break down the step-by-step instructions for filing Oklahoma Form 538-S.

Understanding the Importance of Form 538-S

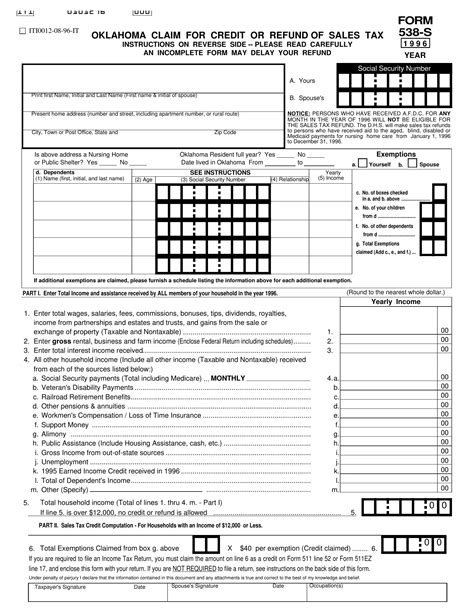

Before we dive into the filing instructions, it's essential to understand the significance of Form 538-S. This form is used by businesses to report and pay sales and use taxes to the Oklahoma Tax Commission. Sales tax is levied on the sale of tangible personal property, while use tax is imposed on the use or consumption of tangible personal property within the state. By filing Form 538-S, businesses can ensure they are meeting their tax obligations and avoiding any potential penalties.

Gathering Required Information

Before starting the filing process, businesses need to gather the necessary information. This includes:

- Business name and address

- Oklahoma Sales Tax Permit Number

- Federal Employer Identification Number (FEIN)

- Sales and use tax data for the reporting period

Step 1: Determine the Filing Frequency

The first step in filing Form 538-S is to determine the filing frequency. Businesses in Oklahoma can file their sales and use tax returns on a monthly, quarterly, or annual basis. The filing frequency is determined by the business's average monthly sales tax liability.

- Monthly filers: Businesses with an average monthly sales tax liability of $2,500 or more

- Quarterly filers: Businesses with an average monthly sales tax liability of $833 or more but less than $2,500

- Annual filers: Businesses with an average monthly sales tax liability of less than $833

Step 2: Complete Form 538-S

Once the filing frequency is determined, businesses can complete Form 538-S. The form requires the following information:

- Business name and address

- Oklahoma Sales Tax Permit Number

- Federal Employer Identification Number (FEIN)

- Reporting period

- Sales and use tax data

Businesses can file Form 538-S electronically through the Oklahoma Tax Commission's website or by mail.

Step 3: Calculate Sales and Use Tax

The next step is to calculate the sales and use tax due. Businesses need to calculate the total sales and use tax liability for the reporting period. This includes:

- Sales tax: Multiply the total sales by the applicable sales tax rate

- Use tax: Multiply the total use tax liability by the applicable use tax rate

Step 4: Report and Pay Sales and Use Tax

After calculating the sales and use tax liability, businesses need to report and pay the taxes due. This can be done electronically through the Oklahoma Tax Commission's website or by mail.

Step 5: Maintain Records

Finally, businesses need to maintain accurate records of their sales and use tax data. This includes:

- Sales and use tax invoices

- Sales and use tax returns

- Payment receipts

Maintaining accurate records is essential to ensure compliance with state tax regulations and avoid any potential penalties.

Common Mistakes to Avoid

When filing Form 538-S, businesses should avoid the following common mistakes:

- Failing to file on time

- Underreporting sales and use tax liability

- Failing to maintain accurate records

By avoiding these common mistakes, businesses can ensure compliance with state tax regulations and avoid any potential penalties.

Conclusion

Filing Oklahoma Form 538-S is a critical step in ensuring compliance with state tax regulations. By following the step-by-step instructions outlined in this article, businesses can ensure they are meeting their tax obligations and avoiding any potential penalties. Remember to gather required information, determine the filing frequency, complete Form 538-S, calculate sales and use tax, report and pay sales and use tax, and maintain accurate records.

Additional Resources

For more information on Oklahoma Form 538-S, businesses can visit the Oklahoma Tax Commission's website. Additional resources include:

- Oklahoma Tax Commission: Sales and Use Tax Guide

- Oklahoma Tax Commission: Form 538-S Instructions

FAQs

What is the purpose of Form 538-S?

+Form 538-S is used by businesses to report and pay sales and use taxes to the Oklahoma Tax Commission.

How often do I need to file Form 538-S?

+The filing frequency is determined by the business's average monthly sales tax liability. Businesses can file on a monthly, quarterly, or annual basis.

What information do I need to gather before filing Form 538-S?

+Businesses need to gather the business name and address, Oklahoma Sales Tax Permit Number, Federal Employer Identification Number (FEIN), and sales and use tax data for the reporting period.