As a small business owner or freelancer, navigating the world of taxes can be a daunting task. One of the most important tax forms you'll encounter is the K-40 form, also known as the "Statement for Recipient of Certain Payments". In this article, we'll delve into the world of the K-40 tax form, explaining its purpose, how to fill it out, and what you need to know to avoid any potential pitfalls.

What is the K-40 Tax Form?

The K-40 tax form is used to report certain types of payments made to individuals or businesses during the tax year. This includes payments such as freelance work, rents, royalties, and other income. The form is used by the payer to report these payments to the recipient and to the IRS.

Who Needs to File the K-40 Tax Form?

You'll need to file the K-40 tax form if you made payments to someone or a business during the tax year that exceeded $600. This includes payments for services, rents, royalties, and other types of income. You'll also need to provide a copy of the form to the recipient by January 31st of each year.

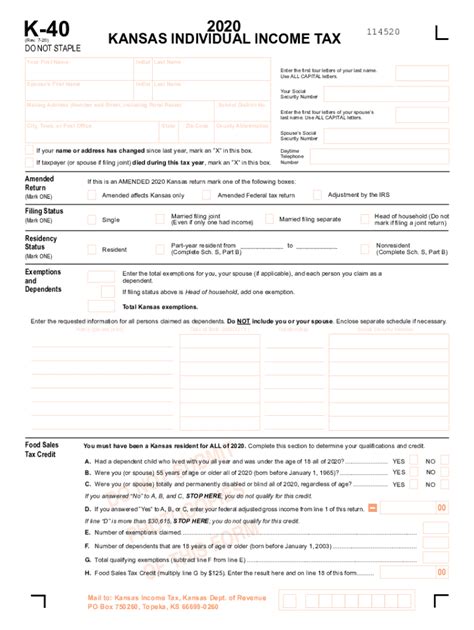

How to Fill Out the K-40 Tax Form

Filling out the K-40 tax form can seem intimidating, but it's actually quite straightforward. Here's a step-by-step guide to help you get started:

- Recipient's Information: Enter the recipient's name, address, and tax identification number (TIN) in the top section of the form.

- Payer's Information: Enter your name, address, and TIN in the bottom section of the form.

- Payment Information: Report the total amount of payments made to the recipient during the tax year.

- Box 1: Rents: Report any rents paid to the recipient.

- Box 2: Royalties: Report any royalties paid to the recipient.

- Box 3: Other Income: Report any other income paid to the recipient, such as freelance work or consulting fees.

- Box 4: Federal Income Tax Withheld: Report any federal income tax withheld from the payments.

- Box 5: State Tax Withheld: Report any state tax withheld from the payments.

Common Mistakes to Avoid

When filling out the K-40 tax form, there are a few common mistakes to avoid:

- Incorrect Recipient Information: Make sure to enter the recipient's correct name, address, and TIN.

- Incorrect Payment Information: Double-check the payment amounts and ensure they're accurate.

- Missing Information: Make sure to complete all required fields on the form.

- Late Filing: Ensure you provide a copy of the form to the recipient by January 31st of each year.

Consequences of Not Filing the K-40 Tax Form

Failure to file the K-40 tax form or providing incorrect information can result in penalties and fines. The IRS can impose penalties of up to $100 per form for failure to file or provide incorrect information.

Best Practices for Filing the K-40 Tax Form

To ensure you're filing the K-40 tax form correctly, follow these best practices:

- Keep Accurate Records: Keep accurate records of all payments made to recipients during the tax year.

- Use Tax Preparation Software: Consider using tax preparation software to help you fill out the form accurately and efficiently.

- Consult a Tax Professional: If you're unsure about any aspect of the form, consider consulting a tax professional.

Conclusion

The K-40 tax form may seem daunting, but by following these simple steps and best practices, you'll be able to fill it out accurately and efficiently. Remember to keep accurate records, use tax preparation software, and consult a tax professional if needed. By doing so, you'll avoid any potential pitfalls and ensure you're in compliance with the IRS.

What is the deadline for filing the K-40 tax form?

+The deadline for filing the K-40 tax form is January 31st of each year.

Who needs to file the K-40 tax form?

+You'll need to file the K-40 tax form if you made payments to someone or a business during the tax year that exceeded $600.

What are the consequences of not filing the K-40 tax form?

+Failure to file the K-40 tax form or providing incorrect information can result in penalties and fines. The IRS can impose penalties of up to $100 per form for failure to file or provide incorrect information.