The world of tax accounting can be complex and overwhelming, especially for small business owners and self-employed individuals. One crucial aspect of tax compliance is the Pass-Through Statement, also known as Form 8958. This article aims to demystify the intricacies of Form 8958, explaining its purpose, benefits, and working mechanisms to help you navigate the tax landscape with confidence.

What is Form 8958?

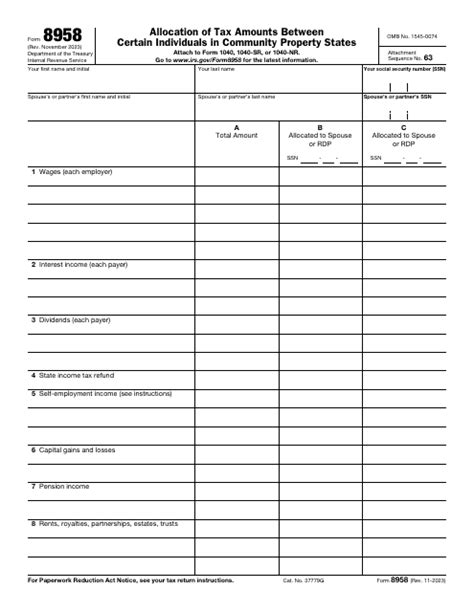

Form 8958 is a Pass-Through Statement used by the Internal Revenue Service (IRS) to report information from pass-through entities, such as S corporations, partnerships, and trusts. The form is designed to provide the IRS with a comprehensive picture of the entity's income, deductions, and credits, which are then allocated to the individual shareholders, partners, or beneficiaries.

Who Needs to File Form 8958?

The following entities are required to file Form 8958:

- S corporations (Form 1120S)

- Partnerships (Form 1065)

- Trusts (Form 1041)

- Estates (Form 1041)

- Real estate mortgage investment conduits (REMICs)

These entities must file Form 8958 if they have any of the following:

- Income, deductions, or credits that are subject to the alternative minimum tax (AMT)

- Income from foreign sources

- Deductions or credits that are subject to the passive activity loss rules

- Income or deductions that are subject to the at-risk rules

Benefits of Filing Form 8958

Filing Form 8958 provides several benefits, including:

- Accuracy: By reporting pass-through income, deductions, and credits, Form 8958 helps ensure accuracy in the allocation of these amounts to individual shareholders, partners, or beneficiaries.

- Compliance: Filing Form 8958 demonstrates compliance with IRS regulations and reduces the risk of penalties and fines.

- Simplification: The form helps simplify the tax reporting process by providing a single document that summarizes the pass-through entity's tax information.

How to Complete Form 8958

Completing Form 8958 requires careful attention to detail and accuracy. The form is divided into several sections, including:

- Entity information: This section requires the entity's name, address, and Employer Identification Number (EIN).

- Pass-through income: This section reports the entity's pass-through income, including ordinary income, capital gains, and dividends.

- Pass-through deductions: This section reports the entity's pass-through deductions, including business expenses, charitable contributions, and mortgage interest.

- Pass-through credits: This section reports the entity's pass-through credits, including the earned income tax credit (EITC) and the child tax credit.

Tips for Filing Form 8958

To ensure accurate and timely filing of Form 8958, follow these tips:

- Consult with a tax professional or accountant to ensure you understand the form's requirements and deadlines.

- Keep accurate and detailed records of the entity's income, deductions, and credits.

- Use tax preparation software or consult with a tax professional to help complete the form.

- File Form 8958 by the required deadline, which is typically March 15th for S corporations and April 15th for partnerships and trusts.

Common Mistakes to Avoid

When filing Form 8958, avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to report all pass-through income, deductions, and credits

- Incorrect allocation of pass-through amounts to individual shareholders, partners, or beneficiaries

- Failure to file the form by the required deadline

Conclusion

Form 8958 is a critical component of tax compliance for pass-through entities. By understanding the form's purpose, benefits, and working mechanisms, you can ensure accurate and timely filing, reducing the risk of penalties and fines. Remember to consult with a tax professional or accountant to ensure you comply with IRS regulations and take advantage of the benefits offered by Form 8958.

What's Next?

Take the next step in understanding Form 8958 by consulting with a tax professional or accountant. They can help you navigate the complex world of tax compliance and ensure you are taking advantage of the benefits offered by the Pass-Through Statement.

Share your thoughts and experiences with Form 8958 in the comments below. Have you encountered any challenges or successes with filing this form? Your insights can help others navigate the tax landscape with confidence.

What is the purpose of Form 8958?

+Form 8958 is used to report information from pass-through entities, such as S corporations, partnerships, and trusts, to provide the IRS with a comprehensive picture of the entity's income, deductions, and credits.

Who needs to file Form 8958?

+Entities that are required to file Form 8958 include S corporations, partnerships, trusts, estates, and REMICs that have pass-through income, deductions, or credits subject to the alternative minimum tax (AMT), foreign income, or passive activity loss rules.

What are the benefits of filing Form 8958?

+Filing Form 8958 provides accuracy in the allocation of pass-through amounts to individual shareholders, partners, or beneficiaries, demonstrates compliance with IRS regulations, and simplifies the tax reporting process.