Filing taxes can be a daunting task, especially for those who are new to the process. Missouri Form 149, also known as the Individual Income Tax Return, is a crucial document that residents of Missouri must submit to the Missouri Department of Revenue (DOR) to report their income and claim any applicable credits or deductions. In this article, we will provide a comprehensive guide to help you navigate the process of filling out Missouri Form 149 with ease.

Understanding the Purpose of Missouri Form 149

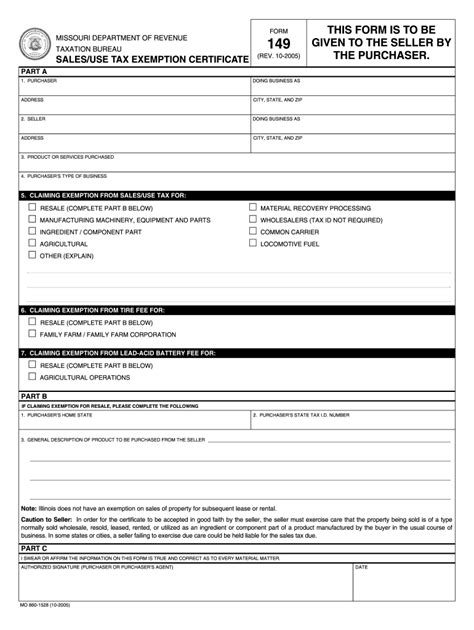

Missouri Form 149 is a state income tax return that must be filed by all Missouri residents who have income that is subject to Missouri state income tax. The form is used to report income from various sources, including wages, salaries, tips, and self-employment income, as well as claim any applicable credits or deductions.

Who Needs to File Missouri Form 149?

Not everyone is required to file Missouri Form 149. However, if you meet any of the following conditions, you are required to file a Missouri state income tax return:

- You are a Missouri resident and have income that is subject to Missouri state income tax.

- You are a non-resident of Missouri and have income from Missouri sources that is subject to Missouri state income tax.

- You have a Missouri tax liability and want to claim a refund.

Gathering Necessary Documents

Before you start filling out Missouri Form 149, you will need to gather several documents and information. These include:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN, if applicable

- Your dependent's social security number or ITIN, if applicable

- Form W-2, Wage and Tax Statement, from your employer

- Form 1099, Miscellaneous Income, for any freelance or contract work

- Form 1098, Mortgage Interest Statement, for any mortgage interest paid

- Form 1099-INT, Interest Income, for any interest earned on savings accounts or investments

- Any other relevant tax documents, such as child care receipts or charitable donation receipts

Understanding the Different Sections of Missouri Form 149

Missouri Form 149 is divided into several sections, each with its own specific purpose. The sections include:

- Section 1: Income

- Section 2: Adjustments to Income

- Section 3: Tax Computation

- Section 4: Credits

- Section 5: Payments and Refunds

Filling Out Missouri Form 149

Now that you have gathered all the necessary documents and information, it's time to start filling out Missouri Form 149. Here's a step-by-step guide to help you navigate the process:

- Section 1: Income

- Report your income from all sources, including wages, salaries, tips, and self-employment income.

- Use Form W-2 and Form 1099 to report your income.

- Section 2: Adjustments to Income

- Claim any applicable deductions, such as mortgage interest or charitable donations.

- Use Form 1098 and Form 1099-INT to report any interest earned on savings accounts or investments.

- Section 3: Tax Computation

- Calculate your total tax liability using the Missouri income tax tables.

- Claim any applicable credits, such as the earned income tax credit or the child tax credit.

- Section 4: Credits

- Claim any additional credits, such as the Missouri property tax credit or the Missouri sales tax credit.

- Section 5: Payments and Refunds

- Calculate your total tax payment or refund.

- Choose your payment method, such as electronic funds withdrawal or check.

Common Mistakes to Avoid

When filling out Missouri Form 149, there are several common mistakes to avoid. These include:

- Failing to report all income from all sources.

- Claiming incorrect or ineligible credits or deductions.

- Failing to sign and date the form.

- Failing to include all required supporting documentation.

E-Filing Missouri Form 149

Missouri offers an e-filing option for Form 149, which allows you to file your state income tax return electronically. To e-file, you will need to create an account on the Missouri Department of Revenue website and follow the prompts to complete your return.

Benefits of E-Filing

E-filing offers several benefits, including:

- Faster processing and refund times.

- Reduced errors and rejection rates.

- Increased security and confidentiality.

- Environmentally friendly and paperless.

Amending a Missouri Form 149

If you need to make changes to your Missouri Form 149 after it has been filed, you will need to file an amended return. To amend a return, you will need to complete Form 149 and attach a statement explaining the changes you are making.

Reasons for Amending a Return

There are several reasons why you may need to amend a return, including:

- Math errors or incorrect calculations.

- Forgotten or omitted income or deductions.

- Changes in filing status or dependents.

- Errors in tax credits or deductions.

Conclusion

Filling out Missouri Form 149 can be a complex and time-consuming process, but with the right guidance and support, it can be made easier. By following the steps outlined in this article and avoiding common mistakes, you can ensure that your return is accurate and complete. Remember to take advantage of e-filing and amend your return if necessary.

What is the deadline for filing Missouri Form 149?

+The deadline for filing Missouri Form 149 is April 15th of each year.

Can I e-file my Missouri Form 149?

+Yes, Missouri offers an e-filing option for Form 149.

How do I amend a Missouri Form 149?

+To amend a return, you will need to complete Form 149 and attach a statement explaining the changes you are making.