As the COVID-19 pandemic continues to impact individuals and families worldwide, the United States government has introduced various relief measures to support those affected. One such measure is the Qualifying COVID-19 Relief, which allows eligible individuals to claim a refundable tax credit. To claim this credit, individuals must complete Form 8915-F, which can be a complex process. In this article, we will provide a comprehensive guide to help you understand the Qualifying COVID-19 Relief and navigate the Form 8915-F.

What is Qualifying COVID-19 Relief?

Qualifying COVID-19 Relief is a refundable tax credit introduced by the US government to support individuals who have been affected by the COVID-19 pandemic. The credit is designed to provide financial assistance to those who have experienced economic hardship due to the pandemic, such as job loss, reduced working hours, or closure of their business.

To be eligible for the Qualifying COVID-19 Relief, individuals must meet certain criteria, including:

- Being a US citizen or resident

- Having a valid Social Security number

- Having experienced economic hardship due to the COVID-19 pandemic

- Having received a qualified COVID-19 distribution from a retirement plan or an IRA

What is Form 8915-F?

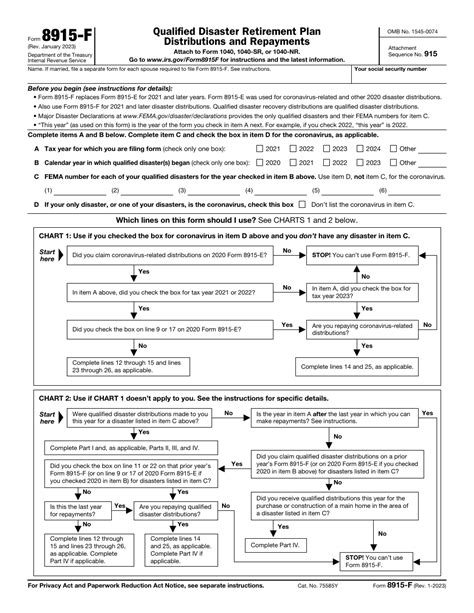

Form 8915-F is the form used to claim the Qualifying COVID-19 Relief tax credit. The form is used to report the qualified COVID-19 distribution received from a retirement plan or an IRA and to calculate the tax credit amount.

The form consists of several sections, including:

- Section 1: Identifying information, including name, address, and Social Security number

- Section 2: Information about the qualified COVID-19 distribution, including the amount received and the date of receipt

- Section 3: Calculation of the tax credit amount

- Section 4: Certification and signature

How to Complete Form 8915-F

Completing Form 8915-F requires careful attention to detail and accurate information. Here are the steps to follow:

- Gather required documents, including:

- 1099-R form showing the qualified COVID-19 distribution

- Proof of economic hardship, such as a letter from your employer or a medical professional

- Complete Section 1: Identifying information

- Complete Section 2: Information about the qualified COVID-19 distribution

- Calculate the tax credit amount using the formula provided in Section 3

- Complete Section 4: Certification and signature

- Attach supporting documents, including the 1099-R form and proof of economic hardship

Common Mistakes to Avoid

When completing Form 8915-F, it is essential to avoid common mistakes that can delay or deny your tax credit. Some common mistakes to avoid include:

- Inaccurate or incomplete identifying information

- Failure to attach supporting documents

- Incorrect calculation of the tax credit amount

- Failure to certify and sign the form

Benefits of Qualifying COVID-19 Relief

The Qualifying COVID-19 Relief provides several benefits to eligible individuals, including:

- A refundable tax credit of up to $10,000

- No income tax liability on qualified COVID-19 distributions

- No penalty for early withdrawal from a retirement plan or IRA

Who is Eligible for Qualifying COVID-19 Relief?

To be eligible for the Qualifying COVID-19 Relief, individuals must meet certain criteria, including:

- Being a US citizen or resident

- Having a valid Social Security number

- Having experienced economic hardship due to the COVID-19 pandemic

- Having received a qualified COVID-19 distribution from a retirement plan or an IRA

Conclusion

In conclusion, the Qualifying COVID-19 Relief is a vital measure introduced by the US government to support individuals affected by the COVID-19 pandemic. Form 8915-F is the form used to claim the tax credit, and it requires accurate and complete information. By following the steps outlined in this guide, individuals can ensure that they complete the form correctly and receive the tax credit they are eligible for. Remember to avoid common mistakes and take advantage of the benefits provided by the Qualifying COVID-19 Relief.

We invite you to share your thoughts and questions about the Qualifying COVID-19 Relief and Form 8915-F in the comments section below. Your feedback is essential in helping us improve our content and provide better guidance to our readers.

What is the deadline for filing Form 8915-F?

+The deadline for filing Form 8915-F is typically April 15th of each year, but it may vary depending on your individual circumstances. It is essential to check with the IRS or a tax professional for specific guidance.

Can I claim the Qualifying COVID-19 Relief if I received a qualified distribution from multiple retirement plans or IRAs?

+Yes, you can claim the Qualifying COVID-19 Relief for each qualified distribution received from multiple retirement plans or IRAs. However, you must complete a separate Form 8915-F for each distribution.

Can I amend my tax return if I forgot to claim the Qualifying COVID-19 Relief?

+Yes, you can amend your tax return to claim the Qualifying COVID-19 Relief. You will need to complete Form 1040-X and attach Form 8915-F. It is essential to follow the IRS instructions for amending your tax return.