Filing taxes can be a daunting task, especially when it comes to complex forms like the Form 8615. However, with the right tools and guidance, you can make the process much easier. In this article, we will explore five ways to file Form 8615 with TurboTax, making it a breeze to navigate the complexities of tax filing.

Tax season can be overwhelming, with numerous forms and deadlines to keep track of. Form 8615, also known as the Dependents' Investment Income, is one such form that can be particularly challenging to file. But don't worry, we're here to help you simplify the process. With TurboTax, you can file Form 8615 with ease and accuracy.

Understanding Form 8615

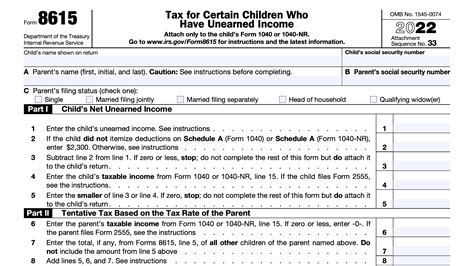

Before we dive into the ways to file Form 8615 with TurboTax, let's take a brief look at what this form is all about. Form 8615 is used to report the investment income of dependents, such as children, on a parent's tax return. This form is required when a dependent has investment income exceeding $2,100 in a given tax year.

Way 1: Using TurboTax's Interview-Style Process

One of the easiest ways to file Form 8615 with TurboTax is by using their interview-style process. This process guides you through a series of questions, making it easy to gather the necessary information and complete the form.

To start, simply log in to your TurboTax account and select the "Dependents" section. From there, you'll be prompted to answer a series of questions about your dependent's investment income. TurboTax will then use this information to complete Form 8615 for you.

Way 2: Importing Investment Income Information

If you have investment income information from your dependent's investment accounts, you can import this information directly into TurboTax. This can save you time and ensure accuracy.

To import investment income information, simply log in to your TurboTax account and select the "Investments" section. From there, you'll be prompted to upload or import the necessary information. TurboTax will then use this information to complete Form 8615 for you.

Benefits of Filing Form 8615 with TurboTax

Filing Form 8615 with TurboTax has numerous benefits, including:

- Accuracy: TurboTax ensures that your form is completed accurately and correctly, reducing the risk of errors and audits.

- Time-Saving: TurboTax's interview-style process and import features save you time and effort, making it easy to complete the form quickly.

- Convenience: With TurboTax, you can file Form 8615 from the comfort of your own home, at any time.

Additional Tips for Filing Form 8615

- Gather necessary documents: Before starting the filing process, gather all necessary documents, including investment account statements and tax returns from previous years.

- Consult with a tax professional: If you're unsure about any aspect of the filing process, consider consulting with a tax professional for guidance.

- Double-check your work: Before submitting your form, double-check your work to ensure accuracy and completeness.

Way 3: Using TurboTax's Form-Based Process

If you prefer to complete Form 8615 manually, you can use TurboTax's form-based process. This process allows you to complete the form line by line, using TurboTax's guidance and instructions.

To start, simply log in to your TurboTax account and select the "Forms" section. From there, you'll be prompted to complete Form 8615 line by line. TurboTax will provide guidance and instructions along the way, ensuring that your form is completed accurately and correctly.

Way 4: Seeking Help from TurboTax's Support Team

If you're having trouble filing Form 8615 or have questions about the process, don't worry! TurboTax's support team is here to help.

You can contact TurboTax's support team by phone, email, or live chat. They'll provide guidance and assistance, ensuring that you complete the form accurately and correctly.

Way 5: Using TurboTax's Audit Protection

Finally, if you're concerned about audits or errors, consider using TurboTax's audit protection feature. This feature provides an additional layer of protection, ensuring that your form is accurate and complete.

To activate audit protection, simply log in to your TurboTax account and select the "Audit Protection" section. From there, you'll be prompted to review and confirm the necessary information.

Filing Form 8615 with TurboTax is a breeze, thanks to their user-friendly interface and expert guidance. By following these five ways, you can ensure that your form is completed accurately and correctly, reducing the risk of errors and audits.

Don't let tax season stress you out. With TurboTax, you can file Form 8615 with ease and confidence.

FAQ Section

What is Form 8615 used for?

+Form 8615 is used to report the investment income of dependents, such as children, on a parent's tax return.

Do I need to file Form 8615 if my dependent has no investment income?

+No, you do not need to file Form 8615 if your dependent has no investment income.

Can I file Form 8615 electronically with TurboTax?

+Yes, you can file Form 8615 electronically with TurboTax.

We hope this article has been helpful in guiding you through the process of filing Form 8615 with TurboTax. If you have any further questions or concerns, don't hesitate to reach out to us. Happy tax filing!