In the realm of taxes, forms and calculations can often be bewildering. The IRS Form 2210 is a crucial document for individuals who are required to make estimated tax payments throughout the year, and one of its most critical components is Line 4. Understanding this line is key to accurately completing the form and avoiding potential penalties. Here, we will delve into four ways to grasp the concept of Form 2210 Line 4, making tax season less daunting.

Understanding Estimated Tax Payments

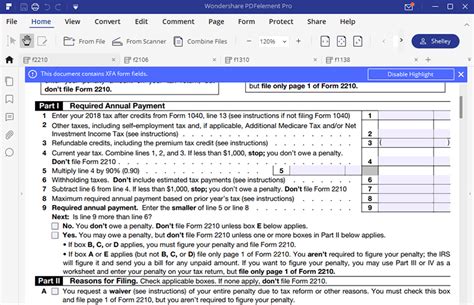

Before diving into Line 4 specifics, it's essential to understand the purpose of the IRS Form 2210. This form is used by the IRS to calculate the underpayment of estimated tax by individuals, estates, and trusts. It's required when the total of your estimated tax payments and any overpayment from the prior tax year is less than your current year's tax liability.

What is Form 2210 Line 4?

Breaking Down Line 4: Annualized Estimated Tax

Line 4 on Form 2210 deals with the annualized estimated tax. This line is where you calculate the amount of estimated tax you should have made based on your annual income, taking into account any fluctuations throughout the year. It's a critical step in determining whether you owe a penalty for underpayment.

4 Ways to Understand Line 4

1. Understand the Annualization Process

The annualization process on Line 4 is designed to account for the fact that your income may not be evenly distributed throughout the year. This could be due to various factors such as seasonal income, bonuses, or even selling a business. By annualizing your income, you're essentially calculating your estimated tax liability as if your income was spread out evenly.

2. Calculate Your Annualized Income

To fill out Line 4 accurately, you'll need to calculate your annualized income for each period of the year. This involves determining how much of your total income was earned in each quarter. The IRS provides a worksheet to help with this calculation, ensuring you account for any income fluctuations.

3. Apply the Estimated Tax Rate

Once you have your annualized income, you'll apply the estimated tax rate to each quarter's income. This rate is typically the same as your tax bracket. However, it's crucial to consider any tax law changes that might affect your tax rate from one year to the next.

4. Review and Adjust for Accuracy

Finally, review your calculations carefully and make any necessary adjustments. Ensure you've correctly accounted for all income, deductions, and credits that could impact your estimated tax liability. This step is crucial in avoiding errors that could lead to penalties or interest.

Common Mistakes and How to Avoid Them

Understanding Line 4 is just the first step. To avoid common mistakes, it's essential to:

- Keep accurate records: Maintain detailed records of your income and expenses throughout the year.

- Consult tax professionals: If you're unsure about any part of the process, consider consulting a tax professional.

- Stay updated on tax laws: Tax laws and rates can change, so it's crucial to stay informed.

Conclusion and Next Steps

In conclusion, understanding Form 2210 Line 4 is a critical step in managing your tax obligations effectively. By grasping the concept of annualized estimated tax, calculating your annualized income accurately, applying the correct tax rate, and reviewing your work for accuracy, you can ensure compliance with IRS regulations and avoid potential penalties. Don't hesitate to seek professional advice if needed, and remember to stay informed about tax law changes.

What's your experience with understanding Form 2210 Line 4? Share your insights or ask questions in the comments below.

What is Form 2210 used for?

+Form 2210 is used to calculate the underpayment of estimated tax by individuals, estates, and trusts.

How do I calculate my annualized income?

+Use the IRS worksheet provided with Form 2210 instructions to calculate your annualized income based on the income earned in each quarter.

What if I make a mistake on Line 4?

+If you find an error after submitting your form, you may need to file an amended return. Consult with a tax professional for guidance.