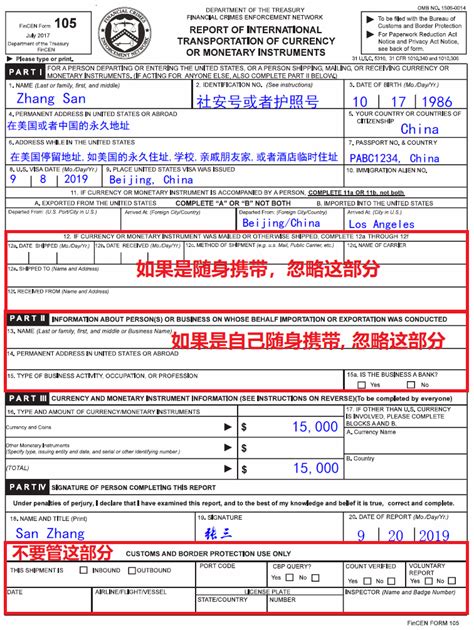

When traveling internationally, it's essential to understand the regulations surrounding the transportation of large amounts of cash, monetary instruments, and other valuable items. One critical aspect of this is filing the FinCEN Form 105, also known as the Report of International Transportation of Currency or Monetary Instruments. This form is required by the Financial Crimes Enforcement Network (FinCEN) for individuals transporting $10,000 or more in cash, cashier's checks, traveler's checks, or other monetary instruments across the U.S. border. In this article, we'll delve into the five things to expect after filing FinCEN Form 105.

What Happens After Filing FinCEN Form 105?

After filing the FinCEN Form 105, you can expect several outcomes, which we'll outline below.

1. Review and Verification of Information

Upon receipt of the form, FinCEN will review the information provided to ensure accuracy and completeness. This process typically takes a few days to a week, depending on the workload of the agency. During this time, FinCEN may contact you to clarify any discrepancies or request additional information.

2. Potential Delay or Seizure of Funds

If FinCEN detects any suspicious activity or discrepancies in the information provided, they may delay or seize the funds. This is usually done to prevent money laundering, terrorist financing, or other financial crimes. In such cases, you may be required to provide additional documentation or explanations to resolve the issue.

3. Reporting to Other Agencies

FinCEN may share the information provided on the form with other government agencies, such as the Internal Revenue Service (IRS), the Department of Homeland Security (DHS), or the U.S. Customs and Border Protection (CBP). This is done to facilitate the enforcement of laws related to taxation, customs, and border security.

4. Record Keeping and Retention

FinCEN requires that a copy of the filed form be retained for a period of five years. This is to ensure compliance with the Bank Secrecy Act (BSA) and to facilitate any future audits or investigations.

5. Penalties for Non-Compliance

Failure to file the FinCEN Form 105 or providing false information can result in significant penalties, including fines and imprisonment. It is essential to understand the regulations and comply with the requirements to avoid any adverse consequences.

Best Practices for Filing FinCEN Form 105

To ensure a smooth process and avoid any issues, it is recommended to follow these best practices:

- Accurately complete the form, providing all required information.

- Ensure timely filing of the form, ideally before transporting the funds.

- Retain a copy of the filed form for the required five-year period.

- Be prepared to provide additional information or documentation if requested by FinCEN.

Conclusion

Filing the FinCEN Form 105 is a critical step in complying with U.S. regulations when transporting large amounts of cash or monetary instruments across the border. By understanding the process and potential outcomes, individuals can ensure a smooth and compliant experience. Remember to follow best practices and be prepared to provide additional information if required.

We invite you to share your experiences or ask questions about filing the FinCEN Form 105 in the comments below.

What is the purpose of the FinCEN Form 105?

+The FinCEN Form 105 is used to report the transportation of $10,000 or more in cash, cashier's checks, traveler's checks, or other monetary instruments across the U.S. border.

Who is required to file the FinCEN Form 105?

+Individuals transporting $10,000 or more in cash, cashier's checks, traveler's checks, or other monetary instruments across the U.S. border are required to file the FinCEN Form 105.

What are the consequences of non-compliance with the FinCEN Form 105 requirements?

+Failure to file the FinCEN Form 105 or providing false information can result in significant penalties, including fines and imprisonment.