California is known for its strict tax laws, and the Franchise Tax Board (FTB) is responsible for administering these laws. One of the most important forms for California taxpayers is the CA Form 3532, specifically Schedule H (HOH). In this article, we will delve into the details of the CA Form 3532 Sch H (HOH) status, explaining what it is, its benefits, and how to qualify for it.

What is CA Form 3532 Sch H (HOH)?

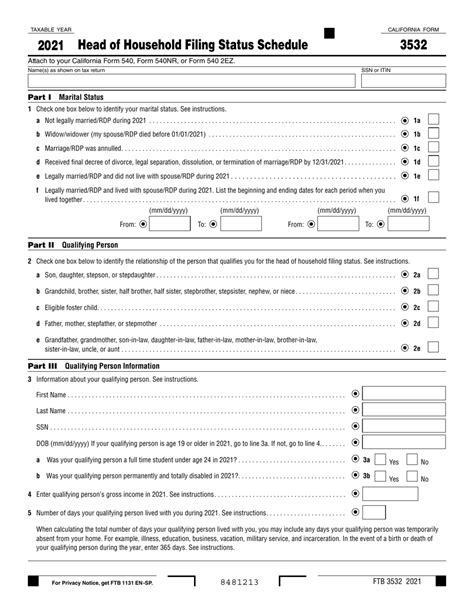

CA Form 3532 Sch H (HOH) is a part of the California tax return form that deals with the Head of Household (HOH) filing status. This status is designed for unmarried individuals or those who are considered unmarried for tax purposes, and who have paid more than half the cost of keeping up a home for the year. The HOH status is a crucial aspect of the tax return, as it determines the tax rates, deductions, and exemptions available to the taxpayer.

Benefits of Filing as Head of Household (HOH)

Filing as Head of Household (HOH) offers several benefits, including:

- Lower tax rates: The tax rates for HOH are generally lower than those for single filers.

- Higher standard deduction: The standard deduction for HOH is higher than that for single filers.

- More generous exemptions: HOH filers may claim more exemptions, such as the dependent exemption.

- Increased child tax credit: HOH filers may be eligible for a larger child tax credit.

Who Qualifies for Head of Household (HOH) Status?

To qualify for Head of Household (HOH) status, you must meet the following requirements:

- You are unmarried or considered unmarried for tax purposes.

- You have paid more than half the cost of keeping up a home for the year.

- You have a qualifying person, such as a dependent child or a relative who lived with you for more than six months.

- You are a U.S. citizen or resident, or a resident of Canada or Mexico.

Qualifying Person

A qualifying person is a critical component of the HOH status. A qualifying person can be:

- A dependent child who lived with you for more than six months.

- A relative who lived with you for more than six months and who meets certain income and support requirements.

- A foster child who lived with you for more than six months.

How to Claim Head of Household (HOH) Status on CA Form 3532 Sch H

To claim HOH status on CA Form 3532 Sch H, follow these steps:

- Complete Form 3532, Schedule H (HOH).

- Enter your name, address, and Social Security number.

- Check the box indicating that you are filing as Head of Household (HOH).

- List your qualifying person(s) and provide their Social Security number(s).

- Complete the rest of the form, following the instructions provided.

Tips and Reminders

When claiming HOH status on CA Form 3532 Sch H, keep the following tips and reminders in mind:

- Make sure you meet the eligibility requirements for HOH status.

- Keep accurate records of your household expenses and support payments.

- Ensure you have a qualifying person who meets the requirements.

- Consult with a tax professional if you are unsure about your eligibility or the filing process.

Common Mistakes to Avoid

When claiming HOH status on CA Form 3532 Sch H, avoid the following common mistakes:

- Failing to meet the eligibility requirements for HOH status.

- Incorrectly reporting household expenses or support payments.

- Failing to list a qualifying person or providing incorrect information.

- Not keeping accurate records to support your HOH status.

Conclusion

In conclusion, the CA Form 3532 Sch H (HOH) status is an important aspect of the California tax return form. By understanding the benefits and requirements of HOH status, you can ensure you are taking advantage of the tax savings available to you. Remember to carefully review the eligibility requirements, complete the form accurately, and avoid common mistakes. If you are unsure about your eligibility or the filing process, consult with a tax professional.

What is the purpose of CA Form 3532 Sch H (HOH)?

+CA Form 3532 Sch H (HOH) is used to claim Head of Household (HOH) status on the California tax return form.

Who is eligible for Head of Household (HOH) status?

+To be eligible for HOH status, you must be unmarried or considered unmarried for tax purposes, have paid more than half the cost of keeping up a home for the year, and have a qualifying person.

What is a qualifying person for HOH status?

+A qualifying person can be a dependent child who lived with you for more than six months, a relative who lived with you for more than six months and who meets certain income and support requirements, or a foster child who lived with you for more than six months.