Dependent care benefits are a valuable part of many employee benefit plans, allowing workers to claim reimbursements for expenses related to caring for their dependents, such as children or elderly relatives. However, to ensure that these benefits are used properly and in compliance with relevant regulations, employers often require employees to complete a Wex Dependent Care Verification Form. In this article, we will guide you through the process of filling out this form, explaining the importance of accurate and timely submission, and highlighting key considerations for employers and employees alike.

Dependent care benefits can be a game-changer for working families, helping to alleviate some of the financial burdens associated with childcare or eldercare. These benefits can take many forms, including Flexible Spending Accounts (FSAs), Dependent Care Assistance Programs (DCAPs), and tax credits. However, to claim these benefits, employees must provide proof that their dependents are eligible for care and that the expenses incurred are qualified under the plan.

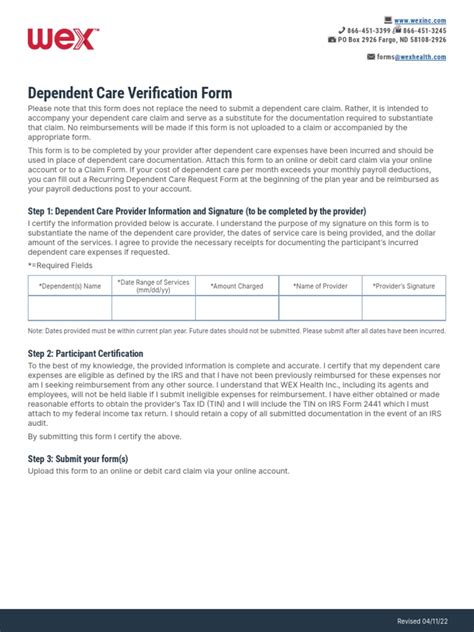

What is a Wex Dependent Care Verification Form?

A Wex Dependent Care Verification Form is a document used by employers to verify the eligibility of an employee's dependents for dependent care benefits. The form typically requires employees to provide information about their dependents, including their names, dates of birth, and relationships to the employee. Additionally, the form may ask for details about the care provider, including their name, address, and tax identification number.

Why is the Wex Dependent Care Verification Form Important?

The Wex Dependent Care Verification Form is essential for several reasons:

- Compliance with regulations: The form helps employers ensure that they are in compliance with relevant regulations, such as the Internal Revenue Code (IRC) and the Employee Retirement Income Security Act (ERISA).

- Prevention of errors and fraud: By verifying the eligibility of dependents and the qualifications of care providers, employers can prevent errors and fraudulent claims.

- Accurate reimbursement: The form ensures that employees receive accurate reimbursements for their dependent care expenses.

Step-by-Step Guide to Filling Out the Wex Dependent Care Verification Form

Filling out the Wex Dependent Care Verification Form can seem daunting, but it's a relatively straightforward process. Here's a step-by-step guide to help you navigate the form:

- Gather required information: Before starting the form, make sure you have all the necessary information, including:

- Dependent's name and date of birth

- Dependent's relationship to you (e.g., child, spouse, parent)

- Care provider's name, address, and tax identification number

- Complete Section 1: Dependent Information: Fill in the required information about your dependent, including their name, date of birth, and relationship to you.

- Complete Section 2: Care Provider Information: Provide the required information about the care provider, including their name, address, and tax identification number.

- Sign and date the form: Once you've completed the form, sign and date it. Make sure to keep a copy for your records.

Tips for Employers and Employees

Here are some tips for employers and employees to keep in mind when dealing with the Wex Dependent Care Verification Form:

- Submit the form timely: Employees should submit the form as soon as possible after enrolling in the dependent care benefit plan.

- Keep records: Employers and employees should keep copies of the completed form and supporting documentation, such as receipts and invoices, for at least three years.

- Review and update: Employers should review and update the form annually to ensure that the information is accurate and up-to-date.

Common Mistakes to Avoid

When filling out the Wex Dependent Care Verification Form, there are several common mistakes to avoid:

- Inaccurate information: Make sure to double-check the information you provide, as inaccuracies can delay or prevent reimbursement.

- Missing signatures: Don't forget to sign and date the form, as this is a required step in the verification process.

- Incomplete documentation: Ensure that you provide all required documentation, including receipts and invoices, to support your claims.

Conclusion

The Wex Dependent Care Verification Form is an essential document for employees and employers alike, ensuring that dependent care benefits are used properly and in compliance with relevant regulations. By following the step-by-step guide outlined in this article, employees can ensure that their dependents are eligible for care and that they receive accurate reimbursements for their expenses. Employers can also use this guide to review and update the form annually, preventing errors and fraudulent claims.

Take Action

If you're an employee, take the time to review and complete the Wex Dependent Care Verification Form carefully. If you're an employer, ensure that you're providing clear guidance and support to your employees throughout the verification process. By working together, we can ensure that dependent care benefits are used effectively and efficiently, supporting working families and promoting a healthier work-life balance.

What is the purpose of the Wex Dependent Care Verification Form?

+The Wex Dependent Care Verification Form is used to verify the eligibility of an employee's dependents for dependent care benefits and to ensure compliance with relevant regulations.

What information do I need to provide on the Wex Dependent Care Verification Form?

+You will need to provide information about your dependent, including their name, date of birth, and relationship to you, as well as information about the care provider, including their name, address, and tax identification number.

How often should I update the Wex Dependent Care Verification Form?

+Employers should review and update the form annually to ensure that the information is accurate and up-to-date.