As an employer in Texas, it is mandatory to report all new hires to the Texas Workforce Commission (TWC) within 20 days of their start date. This is a requirement under the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996. The Texas New Hire Reporting Form is used to collect information about new employees, which helps the state to track and enforce child support orders, as well as to detect and prevent unemployment insurance and workers' compensation fraud.

Complying with new hire reporting requirements is crucial to avoid penalties and fines. In this article, we will guide you through the 6 steps to complete the Texas New Hire Reporting Form.

Step 1: Gather Required Information

Before starting to fill out the Texas New Hire Reporting Form, you will need to gather certain information about the new employee. This includes:

- Employee's name and Social Security number

- Employee's date of birth

- Employee's address

- Employee's start date

- Employee's job title

- Employer's name and address

- Employer's Federal Employer Identification Number (FEIN)

Make sure to have all this information readily available before proceeding to the next step.

Why is this information necessary?

The information collected on the Texas New Hire Reporting Form is used to:

- Verify the identity of the employee

- Determine the employee's eligibility for benefits

- Track and enforce child support orders

- Detect and prevent unemployment insurance and workers' compensation fraud

Step 2: Choose the Correct Reporting Method

You can report new hires to the Texas Workforce Commission using one of the following methods:

- Online reporting through the Texas New Hire Reporting website

- Fax reporting using the Texas New Hire Reporting Form

- Mail reporting using the Texas New Hire Reporting Form

- Electronic reporting through a third-party service provider

Choose the method that is most convenient for your business.

Benefits of online reporting

Online reporting is the fastest and most efficient way to report new hires to the Texas Workforce Commission. It allows you to:

- Report new hires 24/7

- Receive instant confirmation of receipt

- Reduce errors and improve data quality

- Save time and reduce paperwork

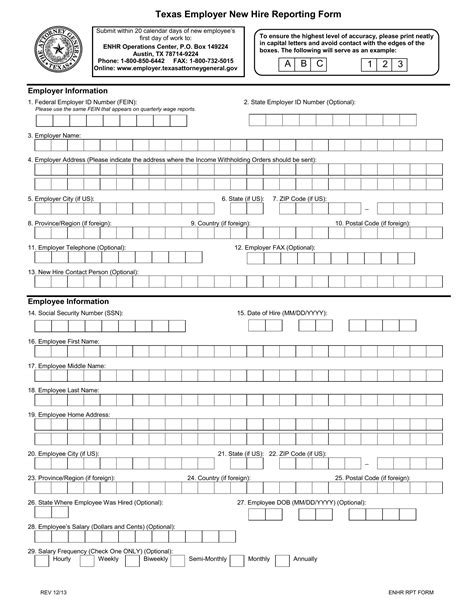

Step 3: Fill Out the Texas New Hire Reporting Form

If you choose to report new hires using the Texas New Hire Reporting Form, you will need to fill out the form completely and accurately. Make sure to:

- Use black ink or type

- Print or write clearly

- Use the correct employee and employer information

- Sign and date the form

Common mistakes to avoid

When filling out the Texas New Hire Reporting Form, avoid the following common mistakes:

- Incomplete or missing information

- Incorrect employee or employer information

- Illegible handwriting or printing

- Failure to sign and date the form

Step 4: Submit the Form

Once you have completed the Texas New Hire Reporting Form, submit it to the Texas Workforce Commission using your chosen reporting method.

- Online reporting: click the "Submit" button

- Fax reporting: fax the form to (512) 936-0489

- Mail reporting: mail the form to Texas Workforce Commission, New Hire Reporting, P.O. Box 149026, Austin, TX 78714-9026

- Electronic reporting: follow the instructions provided by your third-party service provider

What happens after submission?

After submitting the Texas New Hire Reporting Form, the Texas Workforce Commission will:

- Review the form for completeness and accuracy

- Verify the employee's identity and employment information

- Update the state's new hire database

- Use the information to track and enforce child support orders, as well as to detect and prevent unemployment insurance and workers' compensation fraud

Step 5: Maintain Records

As an employer, you are required to maintain records of all new hire reports submitted to the Texas Workforce Commission. This includes:

- A copy of the Texas New Hire Reporting Form

- Proof of submission (e.g. confirmation number, fax receipt, or mail receipt)

- Employee's start date and job title

Maintain these records for at least 3 years from the date of submission.

Why are records important?

Maintaining accurate and complete records of new hire reports is crucial to:

- Demonstrate compliance with new hire reporting requirements

- Verify employee information

- Respond to audits and investigations

- Detect and prevent unemployment insurance and workers' compensation fraud

Step 6: Review and Update

Finally, review and update your new hire reporting process regularly to ensure compliance with Texas Workforce Commission requirements.

- Review your reporting method and update as necessary

- Verify that all new hire reports are complete and accurate

- Update employee information as necessary

- Maintain accurate records of new hire reports

By following these 6 steps, you can ensure compliance with Texas new hire reporting requirements and avoid penalties and fines.

We hope this article has been helpful in guiding you through the process of completing the Texas New Hire Reporting Form. If you have any questions or need further assistance, please don't hesitate to contact us.

Share your thoughts and experiences with new hire reporting in the comments below!

What is the deadline for reporting new hires to the Texas Workforce Commission?

+New hires must be reported to the Texas Workforce Commission within 20 days of their start date.

What information do I need to report on the Texas New Hire Reporting Form?

+You will need to report the employee's name, Social Security number, date of birth, address, start date, job title, and employer's name and address.

Can I report new hires online?

+Yes, you can report new hires online through the Texas New Hire Reporting website.