When it comes to managing your taxes, it's essential to understand the various forms and documents involved in the process. One such form that plays a crucial role in determining the amount of taxes withheld from your paycheck is the W4V tax form. As a taxpayer, it's vital to grasp the fundamentals of this form to ensure you're not overpaying or underpaying your taxes.

For those who are unfamiliar with the W4V tax form, it's a crucial document that helps the government determine the correct amount of taxes to withhold from your Social Security benefits. In this article, we'll delve into the world of W4V tax forms, exploring five essential facts that every taxpayer should know.

What is a W4V Tax Form?

Understanding the Purpose of the W4V Tax Form

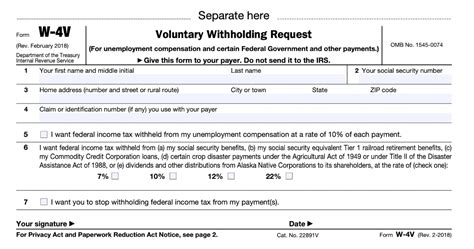

The W4V tax form, also known as the Voluntary Withholding Request, is a document that allows taxpayers to request that the government withhold federal income taxes from their Social Security benefits. This form is typically used by retirees or individuals who receive Social Security benefits and want to avoid owing a large amount of taxes when they file their tax return.

Who Needs to File a W4V Tax Form?

Identifying the Eligible Taxpayers

Not everyone needs to file a W4V tax form. This document is primarily designed for individuals who receive Social Security benefits and want to request voluntary withholding of federal income taxes. To be eligible, you must be a U.S. citizen or resident, and you must be receiving Social Security benefits. Additionally, you must not have any other income that would require you to file a tax return.

How to Complete a W4V Tax Form

A Step-by-Step Guide to Filing the W4V Tax Form

Completing a W4V tax form is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Download the W4V tax form from the IRS website or obtain a copy from your local Social Security office.

- Fill out the form with your personal details, including your name, address, and Social Security number.

- Specify the amount of taxes you want to withhold from your Social Security benefits.

- Sign and date the form.

- Submit the form to the Social Security Administration (SSA) or the IRS.

What are the Benefits of Filing a W4V Tax Form?

Understanding the Advantages of Voluntary Withholding

Filing a W4V tax form can provide several benefits, including:

- Avoiding a large tax bill when you file your tax return

- Reducing the amount of taxes you owe

- Simplifying your tax filing process

- Ensuring you're in compliance with tax laws and regulations

Common Mistakes to Avoid When Filing a W4V Tax Form

Tips for Avoiding Errors and Penalties

When filing a W4V tax form, it's essential to avoid common mistakes that can lead to errors and penalties. Here are some tips to help you steer clear of trouble:

- Ensure you're eligible to file a W4V tax form

- Use the correct form and follow the instructions carefully

- Provide accurate and complete information

- Sign and date the form correctly

- Submit the form on time

By understanding these essential facts about the W4V tax form, you can ensure you're taking the right steps to manage your taxes and avoid any potential issues. Remember to file your W4V tax form correctly and on time to enjoy the benefits of voluntary withholding.

Stay Informed and Take Action

We hope this article has provided you with valuable insights into the world of W4V tax forms. If you have any questions or concerns, feel free to comment below or share this article with others who may find it helpful. Remember to stay informed and take action to manage your taxes effectively.