The world of employee tax withholding can be complex and overwhelming, especially for small business owners and HR professionals. One crucial aspect of this process is the W4 sandwich form, which plays a vital role in determining the correct amount of taxes to withhold from an employee's paycheck. In this article, we will delve into the world of W4 sandwich forms, exploring their importance, benefits, and how to navigate the process with ease.

Understanding the W4 Sandwich Form

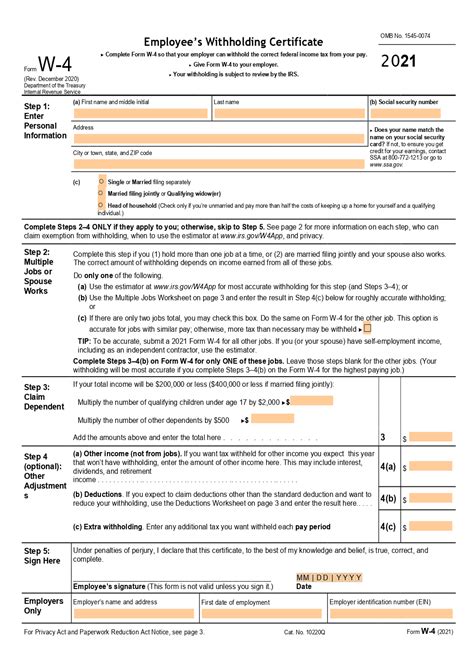

The W4 sandwich form, also known as the Employee's Withholding Certificate, is a document that employees complete to provide their employer with the necessary information to determine the correct amount of taxes to withhold from their paycheck. The form is typically completed by new hires or when an employee's tax situation changes. The W4 form is divided into three sections: the employee's personal information, the number of allowances claimed, and any additional withholding requests.

The Importance of Accurate W4 Forms

Accurate W4 forms are crucial for both employees and employers. For employees, an accurate W4 form ensures that the correct amount of taxes is withheld from their paycheck, avoiding any potential tax liabilities or penalties when filing their tax return. For employers, accurate W4 forms help to avoid any errors or discrepancies in tax withholding, which can result in costly fines and penalties.

Benefits of W4 Sandwich Forms

W4 sandwich forms offer several benefits for both employees and employers. Some of the key benefits include:

- Accurate Tax Withholding: W4 forms ensure that the correct amount of taxes is withheld from an employee's paycheck, avoiding any potential tax liabilities or penalties.

- Simplified Tax Filing: Accurate W4 forms make it easier for employees to file their tax return, reducing the risk of errors or discrepancies.

- Reduced Administrative Burden: W4 forms help to reduce the administrative burden on employers, minimizing the risk of errors or discrepancies in tax withholding.

How to Complete a W4 Sandwich Form

Completing a W4 sandwich form is a straightforward process. Here's a step-by-step guide to help you navigate the process:

- Employee Information: The employee should provide their personal information, including their name, address, and Social Security number.

- Number of Allowances: The employee should claim the number of allowances they are eligible for, based on their tax filing status and the number of dependents they claim.

- Additional Withholding Requests: The employee can request additional withholding, if necessary, to account for any tax liabilities or penalties.

Common Mistakes to Avoid

When completing a W4 sandwich form, there are several common mistakes to avoid. Some of the most common mistakes include:

- Incorrect Number of Allowances: Claiming too many or too few allowances can result in incorrect tax withholding.

- Failure to Update Information: Failing to update information, such as a change in address or marital status, can result in incorrect tax withholding.

- Incomplete Information: Failing to complete all sections of the W4 form can result in delays or errors in tax withholding.

Best Practices for Employers

As an employer, it's essential to follow best practices when handling W4 sandwich forms. Some of the key best practices include:

- Verify Employee Information: Verify the employee's personal information, including their Social Security number and address.

- Provide Clear Instructions: Provide clear instructions to employees on how to complete the W4 form.

- Maintain Accurate Records: Maintain accurate records of employee W4 forms, including any updates or changes.

Tax Implications of W4 Forms

W4 forms have significant tax implications for both employees and employers. Some of the key tax implications include:

- Tax Withholding: W4 forms determine the amount of taxes withheld from an employee's paycheck.

- Tax Liabilities: Inaccurate W4 forms can result in tax liabilities or penalties for employees.

- Employer Penalties: Employers can face penalties for failing to withhold the correct amount of taxes or for failing to maintain accurate records.

Conclusion

In conclusion, W4 sandwich forms play a vital role in determining the correct amount of taxes to withhold from an employee's paycheck. By understanding the importance of accurate W4 forms, the benefits of W4 sandwich forms, and how to complete the form correctly, employees and employers can avoid any potential tax liabilities or penalties. By following best practices and maintaining accurate records, employers can ensure compliance with tax regulations and avoid any costly fines or penalties.

Take Action

If you're an employee or employer looking to navigate the world of W4 sandwich forms, take action today. Review your W4 form, ensure accurate information, and follow best practices to avoid any potential tax liabilities or penalties. Share this article with your colleagues or friends to help them understand the importance of accurate W4 forms.

What is a W4 sandwich form?

+A W4 sandwich form, also known as the Employee's Withholding Certificate, is a document that employees complete to provide their employer with the necessary information to determine the correct amount of taxes to withhold from their paycheck.

Why is it important to complete a W4 form accurately?

+Accurate W4 forms ensure that the correct amount of taxes is withheld from an employee's paycheck, avoiding any potential tax liabilities or penalties when filing their tax return.

What are the common mistakes to avoid when completing a W4 form?

+Common mistakes to avoid include incorrect number of allowances, failure to update information, and incomplete information.