As the housing market continues to evolve, lenders and borrowers alike must navigate the complexities of mortgage regulations. One crucial aspect of this process is compliance with the Federal Housing Administration's (FHA) guidelines, particularly when it comes to the HUD 92458 form. In this article, we will delve into the world of FHA loan compliance, exploring the ins and outs of the HUD 92458 form and its significance in the mortgage industry.

The Federal Housing Administration (FHA) plays a vital role in promoting affordable housing and ensuring that mortgage lending practices are fair and transparent. To achieve this goal, the FHA has established a set of guidelines and regulations that lenders must follow when originating and servicing FHA-insured loans. The HUD 92458 form is a critical component of this process, serving as a tool for lenders to demonstrate compliance with FHA regulations.

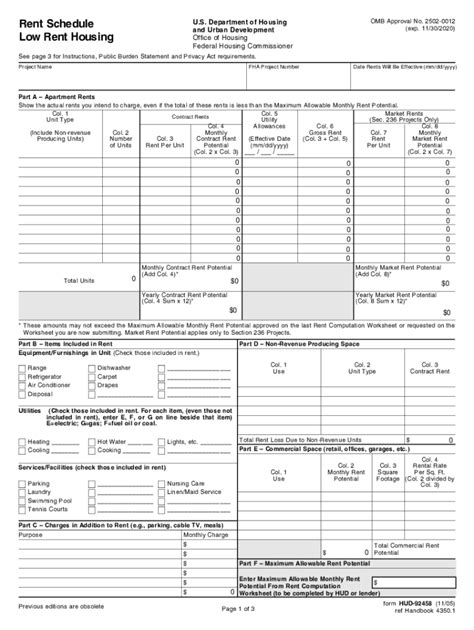

What is the HUD 92458 Form?

The HUD 92458 form, also known as the "SF 92458: FHA Loan Application, Single Family Housing," is a standardized document used by lenders to collect and verify borrower information for FHA-insured loans. The form is designed to ensure that lenders comply with FHA regulations and guidelines, providing a clear and transparent record of the loan application process.

The HUD 92458 form typically includes the following information:

- Borrower identification and contact information

- Property details, including the address and type of property

- Loan terms, including the loan amount, interest rate, and repayment terms

- Credit and income information, including credit scores and employment history

- Appraisal and inspection reports, if applicable

By collecting and verifying this information, lenders can ensure that borrowers meet the FHA's eligibility requirements and that the loan is originated in compliance with FHA regulations.

Key Components of the HUD 92458 Form

The HUD 92458 form is divided into several sections, each addressing a specific aspect of the loan application process. Some of the key components of the form include:

- Section I: Borrower Information

- Section II: Property Information

- Section III: Loan Terms

- Section IV: Credit and Income Information

- Section V: Appraisal and Inspection Reports

Lenders must carefully review and complete each section of the form to ensure accuracy and compliance with FHA regulations.

Benefits of Using the HUD 92458 Form

The HUD 92458 form offers several benefits for lenders and borrowers alike. Some of the key advantages of using this form include:

- Improved compliance with FHA regulations

- Enhanced transparency and accountability throughout the loan application process

- Reduced risk of errors and discrepancies

- Streamlined loan origination and servicing processes

- Increased borrower satisfaction and confidence

By using the HUD 92458 form, lenders can ensure that they are meeting the FHA's guidelines and regulations, reducing the risk of non-compliance and associated penalties.

Common Challenges and Solutions

While the HUD 92458 form is designed to simplify the loan application process, lenders and borrowers may still encounter challenges and obstacles. Some common issues and solutions include:

- Incomplete or inaccurate information: Lenders must carefully review and verify borrower information to ensure accuracy and completeness.

- Non-compliance with FHA regulations: Lenders must stay up-to-date with the latest FHA guidelines and regulations to ensure compliance.

- Technical issues with the form: Lenders may encounter technical issues with the form, such as formatting or printing problems.

To overcome these challenges, lenders can implement the following solutions:

- Provide clear and concise instructions to borrowers on how to complete the form

- Use technology, such as electronic signatures and document management systems, to streamline the loan application process

- Offer training and support to staff on FHA regulations and guidelines

By addressing these common challenges and implementing effective solutions, lenders can ensure a smooth and efficient loan application process.

Best Practices for Using the HUD 92458 Form

To ensure compliance with FHA regulations and streamline the loan application process, lenders should follow best practices when using the HUD 92458 form. Some recommended best practices include:

- Carefully review and verify borrower information to ensure accuracy and completeness

- Use technology to streamline the loan application process and reduce errors

- Provide clear and concise instructions to borrowers on how to complete the form

- Stay up-to-date with the latest FHA guidelines and regulations

- Offer training and support to staff on FHA regulations and guidelines

By following these best practices, lenders can ensure a smooth and efficient loan application process, reducing the risk of non-compliance and associated penalties.

Conclusion

In conclusion, the HUD 92458 form is a critical component of the FHA loan application process, providing a standardized tool for lenders to demonstrate compliance with FHA regulations. By understanding the key components of the form, benefits, and common challenges, lenders can ensure a smooth and efficient loan application process, reducing the risk of non-compliance and associated penalties.

We invite you to share your thoughts and experiences with the HUD 92458 form in the comments below. Have you encountered any challenges or obstacles when using the form? How have you overcome these challenges? Your input and insights can help others navigate the complexities of FHA loan compliance.

What is the purpose of the HUD 92458 form?

+The HUD 92458 form is used by lenders to collect and verify borrower information for FHA-insured loans, ensuring compliance with FHA regulations and guidelines.

What information is included on the HUD 92458 form?

+The HUD 92458 form includes borrower identification and contact information, property details, loan terms, credit and income information, and appraisal and inspection reports, if applicable.

What are the benefits of using the HUD 92458 form?

+The HUD 92458 form offers several benefits, including improved compliance with FHA regulations, enhanced transparency and accountability, reduced risk of errors and discrepancies, and streamlined loan origination and servicing processes.