Understanding the Importance of W-4v Forms

The W-4v form, also known as the Voluntary Withholding Request, is a crucial document used by the Internal Revenue Service (IRS) to determine the amount of federal income tax to be withheld from certain government payments. This form is particularly important for individuals receiving social security benefits, unemployment compensation, and other government payments. Filling out the W-4v form correctly is essential to ensure that the right amount of taxes is withheld, avoiding any potential penalties or overpayments.

Why is it Crucial to Fill Out W-4v Forms Correctly?

Filling out the W-4v form correctly is vital to ensure that the IRS withholds the correct amount of taxes from your government payments. If you fail to fill out the form correctly, you may end up paying too much in taxes, which can lead to a larger refund when you file your tax return. On the other hand, if you don't have enough taxes withheld, you may end up owing money to the IRS when you file your tax return. By filling out the W-4v form correctly, you can avoid any potential penalties or overpayments.

5 Ways to Fill W-4v Forms Correctly

Filling out the W-4v form correctly can seem daunting, but by following these 5 simple steps, you can ensure that you fill out the form accurately.

1. Determine Your Eligibility

Before filling out the W-4v form, you need to determine if you are eligible to file the form. You can file the W-4v form if you receive any of the following government payments:

- Social security benefits

- Unemployment compensation

- Railroad retirement benefits

- Civil service retirement benefits

- Tier 1 railroad retirement benefits

Gather Required Information

Before filling out the W-4v form, you need to gather the required information. You will need to provide your name, address, and social security number. You will also need to provide information about your government payments, including the type of payment and the amount of payment.

Step-by-Step Instructions for Filling Out W-4v Forms

Filling out the W-4v form can seem overwhelming, but by following these step-by-step instructions, you can ensure that you fill out the form accurately.

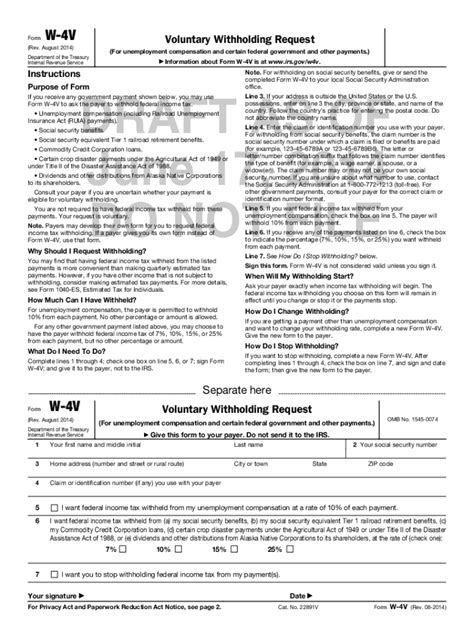

2. Complete Section 1: Name and Address

In section 1, you need to provide your name and address. Make sure to write your name and address clearly and accurately.

3. Complete Section 2: Social Security Number

In section 2, you need to provide your social security number. Make sure to write your social security number correctly to avoid any errors.

4. Complete Section 3: Government Payments

In section 3, you need to provide information about your government payments. You will need to check the box next to the type of payment you receive and provide the amount of payment.

5. Complete Section 4: Withholding Information

In section 4, you need to provide information about your withholding. You will need to check the box next to the percentage of taxes you want to withhold from your government payments.

Common Mistakes to Avoid When Filling Out W-4v Forms

When filling out the W-4v form, it's essential to avoid common mistakes that can lead to errors or delays. Here are some common mistakes to avoid:

- Failing to sign the form

- Providing incorrect information

- Failing to date the form

- Not checking the correct boxes

Conclusion: Filling Out W-4v Forms Correctly is Crucial

Filling out the W-4v form correctly is crucial to ensure that the IRS withholds the correct amount of taxes from your government payments. By following these 5 simple steps and avoiding common mistakes, you can ensure that you fill out the form accurately. Remember to gather the required information, complete the form correctly, and avoid common mistakes. If you have any questions or concerns, you can contact the IRS or seek professional help.

What is the purpose of the W-4v form?

+The W-4v form is used to determine the amount of federal income tax to be withheld from certain government payments, such as social security benefits and unemployment compensation.

Who is eligible to file the W-4v form?

+You can file the W-4v form if you receive social security benefits, unemployment compensation, railroad retirement benefits, civil service retirement benefits, or tier 1 railroad retirement benefits.

What information do I need to provide on the W-4v form?

+You need to provide your name, address, social security number, and information about your government payments, including the type of payment and the amount of payment.