What is Vystar Direct Deposit and How Does it Work?

Direct deposit is a convenient and efficient way to receive your payments, and Vystar Credit Union offers this service to its members. With Vystar direct deposit, your funds are deposited directly into your account, eliminating the need for paper checks and the waiting period associated with them. This means you can access your money as soon as it's deposited, without having to visit a branch or ATM.

In this article, we'll guide you through the easy enrollment process for Vystar direct deposit, highlighting the benefits and steps involved.

Benefits of Vystar Direct Deposit

- Convenience: Direct deposit eliminates the need to physically visit a branch or ATM to deposit your checks.

- Speed: Your funds are available immediately, so you can access your money as soon as it's deposited.

- Security: Direct deposit reduces the risk of lost, stolen, or damaged checks.

- Environmentally friendly: Reduces paper usage and minimizes waste.

How to Enroll in Vystar Direct Deposit

Enrolling in Vystar direct deposit is a straightforward process that can be completed in a few steps:

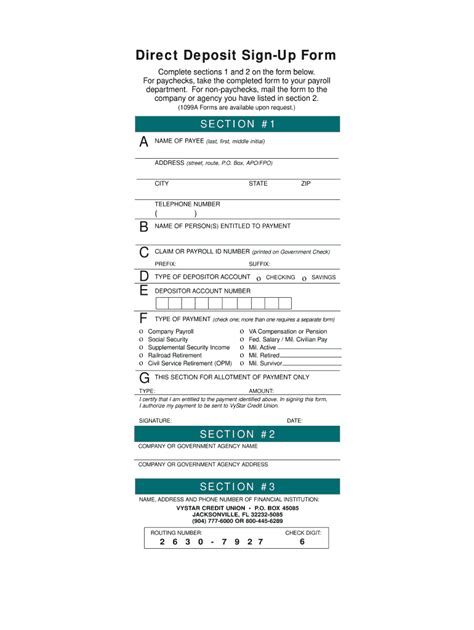

- Gather required information: You'll need to provide your Vystar account number, routing number, and other identifying information.

- Obtain a direct deposit form: You can download the Vystar direct deposit form from the credit union's website or pick one up at a local branch.

- Fill out the form: Complete the form accurately, making sure to include all required information.

- Submit the form: Return the completed form to Vystar Credit Union via mail, fax, or in-person at a local branch.

- Verify your account: Once the form is processed, verify that your account has been set up for direct deposit by checking your account online or contacting Vystar's customer service.

What Information is Required for Direct Deposit?

- Account number: Your Vystar account number, which can be found on your account statement or online banking profile.

- Routing number: Vystar's routing number, which is 263182558.

- Account type: Indicate whether your account is a checking or savings account.

- Payee information: Provide the name and address of the payee (the person or company sending the direct deposit).

Troubleshooting Common Issues with Vystar Direct Deposit

While Vystar direct deposit is a reliable service, issues can arise. Here are some common problems and their solutions:

- Missing or delayed deposits: Verify that the deposit was sent correctly and that your account information is accurate. Contact Vystar's customer service if the issue persists.

- Incorrect account information: Double-check that your account number, routing number, and account type are correct. Update your information if necessary.

- Technical issues: Try accessing your account online or through the mobile app to verify that the issue is not related to your device or internet connection.

Security Measures for Vystar Direct Deposit

- Encryption: Vystar uses encryption to protect your sensitive information.

- Secure servers: The credit union's servers are protected by robust security measures to prevent unauthorized access.

- Monitoring: Vystar continuously monitors its systems to detect and prevent potential security threats.

Conclusion

In conclusion, Vystar direct deposit is a convenient and secure way to receive your payments. By following the easy enrollment process and understanding the benefits and troubleshooting tips, you can enjoy the convenience of direct deposit. If you have any further questions or concerns, please don't hesitate to comment below or reach out to Vystar's customer service.

We encourage you to share this article with others who may benefit from Vystar direct deposit.

What is the routing number for Vystar Credit Union?

+The routing number for Vystar Credit Union is 263182558.

How long does it take for direct deposit to be processed?

+Direct deposit is typically processed immediately, but may take up to 24 hours to be available in your account.