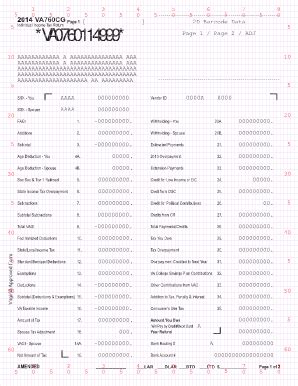

Filing tax returns can be a daunting task, especially for individuals who are new to the process or are unfamiliar with the specific requirements of their state. In Virginia, residents are required to file Form 760, which is the individual income tax return form. However, some taxpayers may need to file an additional form, known as the Virginia Form 760CG, to claim certain credits or deductions. In this article, we will provide five tips for filing Virginia Form 760CG successfully.

Understanding Virginia Form 760CG

Before we dive into the tips for filing Virginia Form 760CG, it's essential to understand what this form is and who needs to file it. The Virginia Form 760CG is a supplemental form that is used to claim certain credits or deductions that are not reported on the standard Form 760. This form is typically filed by individuals who have made contributions to certain organizations or have incurred expenses related to their employment.

Tip 1: Determine If You Need to File Form 760CG

Not all taxpayers need to file Form 760CG. To determine if you need to file this form, review the instructions provided by the Virginia Department of Taxation or consult with a tax professional. Some common situations that may require the filing of Form 760CG include:

- Making contributions to a Virginia 529 college savings plan

- Incurring expenses related to your employment, such as business use of your home or travel expenses

- Claiming the earned income tax credit (EITC)

Gathering Required Documents

To file Form 760CG successfully, you will need to gather certain documents and information. This may include:

- Your Form 760, which is your individual income tax return

- Proof of contributions to a Virginia 529 college savings plan, such as a statement from the plan administrator

- Records of employment-related expenses, such as receipts or a log of business use of your home

- Information about your earned income tax credit (EITC) eligibility

Tip 2: Use the Correct Filing Status

When filing Form 760CG, it's essential to use the correct filing status. Your filing status will determine the amount of credits or deductions you are eligible for. The most common filing statuses for Form 760CG include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

Claiming Credits and Deductions

The primary purpose of Form 760CG is to claim certain credits or deductions that are not reported on the standard Form 760. Some common credits and deductions that can be claimed on Form 760CG include:

- The Virginia college savings plan credit

- The earned income tax credit (EITC)

- Employment-related expenses, such as business use of your home or travel expenses

Tip 3: Follow the Instructions Carefully

The instructions for Form 760CG can be complex, so it's essential to follow them carefully. Make sure to read the instructions thoroughly and complete each section accurately. If you are unsure about any part of the form, consider consulting with a tax professional.

Common Errors to Avoid

When filing Form 760CG, there are several common errors to avoid. These include:

- Failing to sign the form

- Failing to include required documentation

- Claiming incorrect credits or deductions

Tip 4: Double-Check Your Math

Math errors can be costly when filing tax returns. To avoid errors, double-check your math carefully. Make sure to use a calculator or software to ensure accuracy.

Seeking Professional Help

If you are unsure about any part of the Form 760CG filing process, consider seeking professional help. A tax professional can help you navigate the complex instructions and ensure that you are claiming the correct credits and deductions.

Tip 5: File Electronically

Filing electronically can save you time and reduce the risk of errors. The Virginia Department of Taxation offers electronic filing options for Form 760CG. Consider using a tax software program or consulting with a tax professional to file electronically.

By following these five tips, you can ensure a successful filing of Virginia Form 760CG. Remember to determine if you need to file the form, gather required documents, use the correct filing status, claim credits and deductions carefully, and double-check your math. If you are unsure about any part of the process, consider seeking professional help.

We encourage you to share your experiences with filing Virginia Form 760CG in the comments below. Have you encountered any challenges or successes? What tips do you have for others who may be filing this form? Share your thoughts and help others navigate the complex world of tax filing.

What is Virginia Form 760CG?

+Virginia Form 760CG is a supplemental form used to claim certain credits or deductions that are not reported on the standard Form 760.

Who needs to file Form 760CG?

+Individuals who have made contributions to certain organizations or have incurred expenses related to their employment may need to file Form 760CG.

What credits and deductions can be claimed on Form 760CG?

+Common credits and deductions that can be claimed on Form 760CG include the Virginia college savings plan credit, the earned income tax credit (EITC), and employment-related expenses.