Rent verification is a crucial step in the mortgage application process, particularly when dealing with Fannie Mae loans. One of the most commonly used forms for rent verification is the Fannie Mae Form 1007, also known as the "Single Family Comparable Rent Schedule" or the Fannie Mae Form 1007/Single Family Rent Schedule. This form is used to verify a borrower's rental income, which is essential for determining their creditworthiness and ability to repay the loan.

The importance of accurate rent verification cannot be overstated. Inaccurate or incomplete rent verification can lead to delays in the mortgage application process, or even loan denial. In this article, we will explore five ways to verify rent with Fannie Mae Form, and provide tips and best practices for ensuring accurate and complete rent verification.

What is Fannie Mae Form 1007?

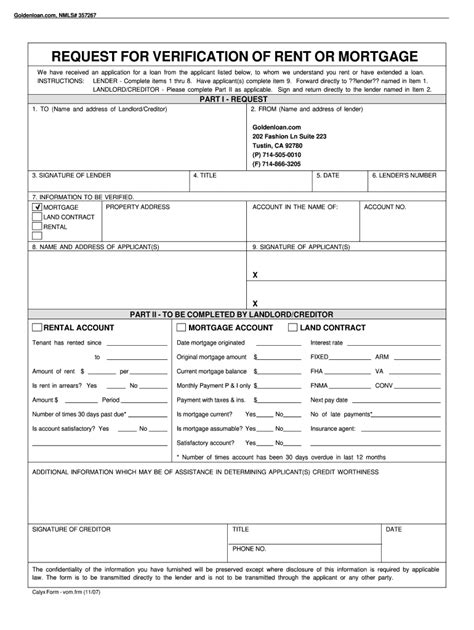

Fannie Mae Form 1007 is a standardized form used to verify a borrower's rental income. The form requires the borrower to provide detailed information about their rental income, including the rent amount, lease terms, and landlord information. The form is typically completed by the borrower and their landlord, and is used by lenders to verify the borrower's rental income.

5 Ways to Verify Rent with Fannie Mae Form

Verifying rent with Fannie Mae Form 1007 requires careful attention to detail and accurate documentation. Here are five ways to verify rent with Fannie Mae Form:

1. Verify Rent Payment History

Verifying a borrower's rent payment history is crucial for determining their creditworthiness. Lenders typically require 12-24 months of rent payment history, which can be verified through cancelled checks, bank statements, or a landlord statement. Borrowers should provide documentation showing timely rent payments, and any late payments or NSF fees should be explained.

2. Obtain a Landlord Statement

A landlord statement is a written confirmation from the landlord that the borrower is a tenant and has paid rent on time. The statement should include the rent amount, lease terms, and any payment history. Lenders typically require a landlord statement to verify the borrower's rental income.

3. Review Lease Agreements

Reviewing lease agreements is essential for verifying the borrower's rental income. Lenders should review the lease agreement to confirm the rent amount, lease terms, and any payment history. Borrowers should provide a copy of the lease agreement, and any amendments or renewals.

4. Verify Rental Income through Bank Statements

Verifying rental income through bank statements is another way to confirm a borrower's rental income. Lenders can review bank statements to verify rent payments, and any late payments or NSF fees. Borrowers should provide 12-24 months of bank statements to verify their rental income.

5. Use a Rent Verification Service

Using a rent verification service is a convenient way to verify a borrower's rental income. Rent verification services provide a comprehensive report on the borrower's rental income, including payment history and landlord information. Lenders can use these services to verify rental income quickly and accurately.

Best Practices for Verifying Rent with Fannie Mae Form

Verifying rent with Fannie Mae Form 1007 requires careful attention to detail and accurate documentation. Here are some best practices for verifying rent with Fannie Mae Form:

- Use a standardized form, such as Fannie Mae Form 1007, to verify rental income.

- Verify rent payment history through cancelled checks, bank statements, or a landlord statement.

- Obtain a landlord statement to confirm the borrower's rental income.

- Review lease agreements to verify the rent amount, lease terms, and payment history.

- Use a rent verification service to verify rental income quickly and accurately.

Conclusion

Verifying rent with Fannie Mae Form 1007 is a critical step in the mortgage application process. By following these five ways to verify rent with Fannie Mae Form, lenders can ensure accurate and complete rent verification. Borrowers should provide detailed information about their rental income, including rent payment history, lease agreements, and landlord statements. By following these best practices, lenders can verify rent quickly and accurately, and borrowers can enjoy a smooth mortgage application process.

What is Fannie Mae Form 1007?

+Fannie Mae Form 1007 is a standardized form used to verify a borrower's rental income.

Why is rent verification important?

+Rent verification is important to determine a borrower's creditworthiness and ability to repay the loan.

What documents are required for rent verification?

+Documents required for rent verification include cancelled checks, bank statements, landlord statements, and lease agreements.