As a shareholder or investor, managing your investments can be a daunting task, especially when it comes to granting authority to a third-party agent to act on your behalf. One essential document that allows you to do so is the Vanguard Full Agent Authorization Form. In this article, we will delve into the details of this form, its importance, and what it entails.

What is the Vanguard Full Agent Authorization Form?

The Vanguard Full Agent Authorization Form is a legal document that grants a third-party agent, typically a financial advisor or attorney, the authority to manage and make decisions on your behalf regarding your Vanguard investments. This form is also known as a "power of attorney" document. By signing this form, you are essentially granting the agent the power to act as your representative, making decisions and taking actions that affect your investments.

Why is the Vanguard Full Agent Authorization Form Important?

The Vanguard Full Agent Authorization Form is crucial for several reasons:

- Convenience: By granting authority to an agent, you can avoid the hassle of managing your investments personally, especially if you have a large portfolio or lack the expertise to make informed decisions.

- Expertise: A financial advisor or attorney can provide valuable guidance and make informed decisions on your behalf, potentially leading to better investment outcomes.

- Flexibility: This form allows you to grant authority to an agent for a specific period or until you revoke it, giving you flexibility in managing your investments.

What does the Vanguard Full Agent Authorization Form Entail?

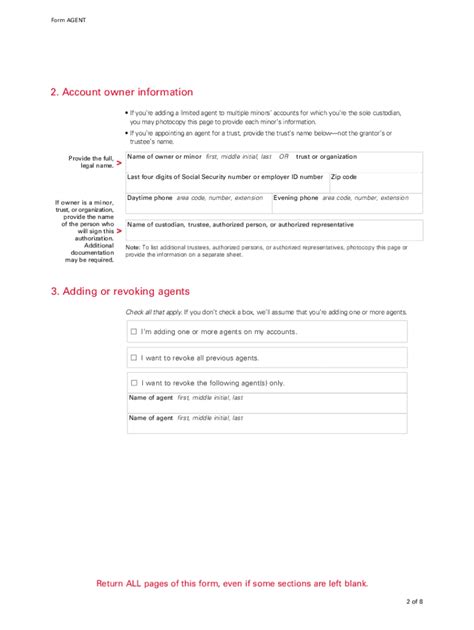

The Vanguard Full Agent Authorization Form typically includes the following information:

- Grantor Information: Your name, address, and contact information as the grantor (the person granting authority).

- Agent Information: The name, address, and contact information of the agent (the person or entity being granted authority).

- Scope of Authority: A description of the specific powers and authority being granted to the agent, such as the ability to buy, sell, or exchange securities.

- Term of Authority: The duration for which the agent has authority to act on your behalf, which can be a specific period or until revoked.

- Revocation: Information on how to revoke the agent's authority, if needed.

What are the Benefits of Using the Vanguard Full Agent Authorization Form?

Using the Vanguard Full Agent Authorization Form provides several benefits, including:

- Streamlined Investment Management: By granting authority to an agent, you can simplify the process of managing your investments, allowing you to focus on other aspects of your life.

- Expert Guidance: A financial advisor or attorney can provide valuable insights and make informed decisions on your behalf, potentially leading to better investment outcomes.

- Flexibility and Control: This form allows you to grant authority for a specific period or until you revoke it, giving you flexibility and control over your investments.

How to Complete the Vanguard Full Agent Authorization Form

To complete the Vanguard Full Agent Authorization Form, follow these steps:

- Download the Form: Obtain the Vanguard Full Agent Authorization Form from the Vanguard website or by contacting their customer service.

- Review the Form: Carefully review the form to ensure you understand the scope of authority and terms.

- Fill in the Required Information: Complete the form by filling in the required information, including your name, address, and contact information, as well as the agent's information.

- Sign the Form: Sign the form in the presence of a notary public, if required.

- Submit the Form: Submit the completed form to Vanguard, either by mail or fax, as instructed on the form.

What are the Potential Risks and Considerations?

While the Vanguard Full Agent Authorization Form can be a useful tool for managing your investments, there are potential risks and considerations to be aware of:

- Loss of Control: By granting authority to an agent, you may lose control over your investments, which can be a concern if the agent makes decisions that do not align with your goals or risk tolerance.

- Fiduciary Duty: The agent has a fiduciary duty to act in your best interests, but there is still a risk that they may not make decisions that align with your goals or risk tolerance.

- Revocation: If you need to revoke the agent's authority, it may take time and effort to do so, which can be a concern if you need to make urgent changes to your investments.

Conclusion

In conclusion, the Vanguard Full Agent Authorization Form is a powerful tool for managing your investments. By granting authority to a third-party agent, you can simplify the process of managing your investments, gain expert guidance, and maintain flexibility and control. However, it is essential to carefully review the form, understand the scope of authority, and be aware of the potential risks and considerations.

We encourage you to share your experiences or ask questions about the Vanguard Full Agent Authorization Form in the comments below.

What is the Vanguard Full Agent Authorization Form used for?

+The Vanguard Full Agent Authorization Form is used to grant a third-party agent the authority to manage and make decisions on your behalf regarding your Vanguard investments.

Who can be an agent on the Vanguard Full Agent Authorization Form?

+A financial advisor or attorney can be an agent on the Vanguard Full Agent Authorization Form.

How do I complete the Vanguard Full Agent Authorization Form?

+To complete the Vanguard Full Agent Authorization Form, download the form from the Vanguard website, review the form, fill in the required information, sign the form, and submit it to Vanguard.