As a veteran or a surviving spouse, navigating the world of veterans' benefits can be overwhelming. One crucial document that plays a significant role in the process is the VA Form 29-8636, also known as the "Application for Veterans' Group Life Insurance" or "VGLI." If you're new to this form or want to understand its significance, keep reading to learn the top 5 essential facts about VA Form 29-8636.

What is VA Form 29-8636?

VA Form 29-8636 is a crucial document that allows eligible veterans to apply for Veterans' Group Life Insurance (VGLI). This insurance provides coverage for veterans who want to continue their life insurance after leaving the military. The form is used to enroll in VGLI, which is a converted version of the Servicemembers' Group Life Insurance (SGLI) that veterans had while serving in the military.

Eligibility Requirements

To be eligible to apply for VGLI using VA Form 29-8636, you must meet specific requirements. These include:

- Being a veteran who had SGLI coverage while serving in the military

- Being within one year and 120 days of separation from the military

- Having less than $400,000 in VGLI coverage

- Being under the age of 60 (although some exceptions apply)

Benefits of VGLI

VGLI offers several benefits to eligible veterans, including:

- Tax-free death benefit

- Monthly premiums based on age and coverage amount

- No medical exam required for coverage up to $400,000

- Coverage available up to age 60 (or 65 with some restrictions)

- Opportunity to increase coverage by $25,000 every five years up to age 60

How to Apply for VGLI

To apply for VGLI, you'll need to complete VA Form 29-8636 and submit it to the Office of Servicemembers' Group Life Insurance (OSGLI). You can apply online, by mail, or through the mail using a paper application. Be sure to follow the instructions carefully and provide all required documentation to avoid delays in processing your application.

Key Features of VA Form 29-8636

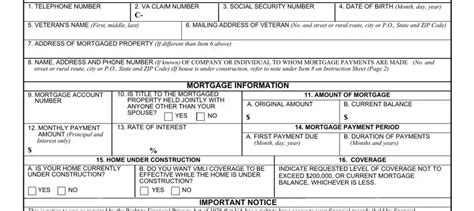

VA Form 29-8636 is a straightforward document that requires you to provide essential information, including:

- Personal details, such as name, date of birth, and Social Security number

- Military service information, including branch and dates of service

- Coverage amount and premium payment information

- Beneficiary information (if applicable)

Common Mistakes to Avoid

When completing VA Form 29-8636, be sure to avoid common mistakes that can delay or reject your application. These include:

- Incomplete or inaccurate information

- Failure to sign the application

- Not providing required documentation, such as proof of military service

- Applying outside the eligibility timeframe

Conclusion: What's Next?

In conclusion, VA Form 29-8636 is a vital document for eligible veterans who want to continue their life insurance coverage after leaving the military. By understanding the essential facts about this form, you can navigate the application process with confidence. If you have any questions or concerns, don't hesitate to reach out to the OSGLI for assistance.

What's your experience with VA Form 29-8636? Share your thoughts or ask questions in the comments below!

What is the deadline to apply for VGLI using VA Form 29-8636?

+You must apply for VGLI within one year and 120 days of separation from the military.

Can I apply for VGLI online?

+Yes, you can apply for VGLI online through the OSGLI website.

Do I need to provide medical documentation to apply for VGLI?

+No medical exam is required for coverage up to $400,000. However, you may need to provide medical documentation for coverage above $400,000.