The VA Form 0750, also known as the "Uniform Residential Loan Application," is a crucial document for veterans and service members who are looking to purchase, refinance, or improve a home using their VA loan benefits. As a veteran or service member, understanding the VA Form 0750 is essential to navigate the home loan process successfully. In this article, we will delve into the 5 essential facts about VA Form 0750 that you need to know.

What is VA Form 0750?

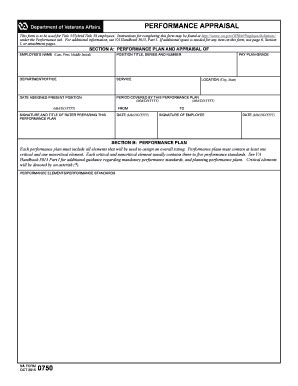

The VA Form 0750 is a standardized form used by the Department of Veterans Affairs (VA) to collect information from borrowers who are applying for a VA-guaranteed home loan. The form is designed to help lenders assess the borrower's creditworthiness and determine their eligibility for a VA loan. The form typically includes information about the borrower's income, credit history, employment, and assets, as well as the property being purchased or refinanced.

Why is VA Form 0750 Required?

The VA Form 0750 is required by the VA to ensure that borrowers meet the necessary credit and income requirements for a VA-guaranteed loan. The form helps lenders to verify the borrower's identity, income, and credit history, which are essential factors in determining their eligibility for a VA loan. By requiring the VA Form 0750, the VA can help protect borrowers from taking on too much debt and reduce the risk of default.

Benefits of VA Form 0750

The VA Form 0750 provides several benefits to borrowers, including:

- Streamlined loan application process: The VA Form 0750 helps to simplify the loan application process by providing a standardized format for lenders to collect information from borrowers.

- Improved accuracy: The form helps to reduce errors and inaccuracies in the loan application process by ensuring that all necessary information is collected and verified.

- Enhanced creditworthiness assessment: The VA Form 0750 provides lenders with a comprehensive view of the borrower's creditworthiness, which helps to determine their eligibility for a VA loan.

How to Fill Out VA Form 0750

Filling out the VA Form 0750 can seem daunting, but it's essential to ensure that all information is accurate and complete. Here are some tips to help you fill out the form:

- Read the instructions carefully: Before starting to fill out the form, read the instructions carefully to understand what information is required and how to complete each section.

- Gather necessary documents: Make sure you have all necessary documents, such as pay stubs, bank statements, and tax returns, to complete the form.

- Be honest and accurate: Ensure that all information provided is honest and accurate. Inaccurate or incomplete information can lead to delays or even loan denial.

Common Mistakes to Avoid

When filling out the VA Form 0750, it's essential to avoid common mistakes that can lead to delays or loan denial. Here are some common mistakes to avoid:

- Incomplete or inaccurate information: Ensure that all information provided is complete and accurate.

- Failure to sign the form: Make sure to sign the form in the designated areas.

- Missing documents: Ensure that all necessary documents are attached to the form.

VA Form 0750 vs. Other Loan Applications

The VA Form 0750 is unique compared to other loan applications. Here are some key differences:

- Standardized format: The VA Form 0750 provides a standardized format for lenders to collect information from borrowers.

- VA-specific requirements: The form includes VA-specific requirements, such as verification of military service and creditworthiness.

- Streamlined process: The VA Form 0750 helps to simplify the loan application process by providing a comprehensive view of the borrower's creditworthiness.

Benefits of VA Loans

VA loans offer several benefits to eligible borrowers, including:

- Zero down payment: VA loans offer zero down payment options, which can help borrowers purchase a home with little to no upfront costs.

- Lower interest rates: VA loans often offer lower interest rates compared to other loan options.

- Lower fees: VA loans often have lower fees compared to other loan options.

Conclusion: Key Takeaways

In conclusion, the VA Form 0750 is a critical component of the VA loan process. By understanding the 5 essential facts about VA Form 0750, borrowers can navigate the home loan process successfully. Remember to fill out the form accurately and completely, avoid common mistakes, and take advantage of the benefits offered by VA loans.

We encourage you to share your thoughts and experiences with VA Form 0750 in the comments section below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the purpose of VA Form 0750?

+The purpose of VA Form 0750 is to collect information from borrowers who are applying for a VA-guaranteed home loan. The form helps lenders to assess the borrower's creditworthiness and determine their eligibility for a VA loan.

How do I fill out VA Form 0750?

+To fill out VA Form 0750, read the instructions carefully, gather necessary documents, and ensure that all information provided is honest and accurate. Make sure to sign the form in the designated areas and attach all necessary documents.

What are the benefits of VA loans?

+VA loans offer several benefits, including zero down payment options, lower interest rates, and lower fees. VA loans also offer a streamlined loan application process and improved creditworthiness assessment.