In the state of Utah, individuals and businesses are required to file their tax returns by the designated deadline to avoid penalties and interest. However, there may be situations where additional time is needed to gather necessary documents or resolve other issues. This is where the Utah Tax Extension Form TC-546 comes in handy. In this article, we will walk you through the process of filing the Utah Tax Extension Form TC-546 in 5 easy steps.

Why File for a Tax Extension?

Before we dive into the steps, it's essential to understand why filing for a tax extension is necessary. Filing for a tax extension provides individuals and businesses with additional time to file their tax returns, which can help avoid penalties and interest associated with late filing. This is particularly helpful for those who need more time to gather necessary documents, resolve errors, or consult with a tax professional.

Step 1: Determine Eligibility and Deadline

The first step in filing the Utah Tax Extension Form TC-546 is to determine eligibility and the deadline for submission. In Utah, individuals and businesses can file for a tax extension if they need more time to file their tax returns. The deadline for filing the tax extension is typically the same as the original tax filing deadline. For individual tax returns, this is usually April 15th, while for business tax returns, it's typically March 15th or April 15th, depending on the type of business.

Who is Eligible?

To be eligible for a tax extension, individuals and businesses must meet specific requirements. These include:

- Filing a complete and accurate tax return

- Paying any estimated tax due

- Submitting the tax extension request on or before the original tax filing deadline

Step 2: Gather Required Documents

Once eligibility is determined, the next step is to gather required documents. For the Utah Tax Extension Form TC-546, the following documents are typically needed:

- A copy of the tax return (Form TC-40 or Form TC-20)

- Payment voucher (Form TC-547)

- Any supporting documentation (e.g., W-2s, 1099s, receipts)

Tips for Gathering Documents

When gathering documents, it's essential to ensure accuracy and completeness. Here are some tips to keep in mind:

- Verify all information is accurate and up-to-date

- Make sure to include all required supporting documentation

- Keep a copy of all documents for your records

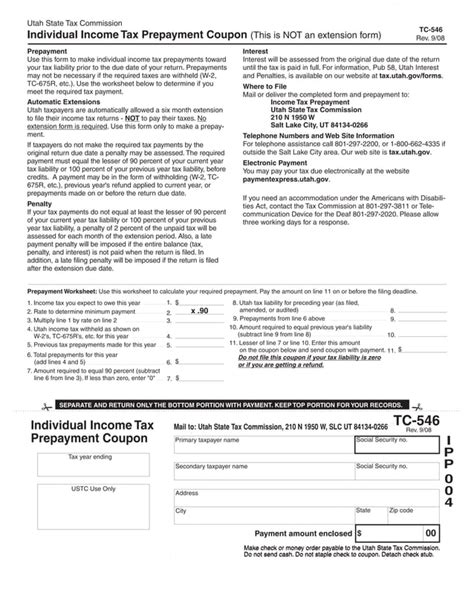

Step 3: Complete the Utah Tax Extension Form TC-546

With all required documents in hand, the next step is to complete the Utah Tax Extension Form TC-546. This form can be downloaded from the Utah State Tax Commission website or obtained from a tax professional.

Key Information to Include

When completing the form, make sure to include the following key information:

- Name and address

- Taxpayer identification number (SSN or EIN)

- Tax year and type of return

- Estimated tax due and payment information

Step 4: Submit the Tax Extension Request

Once the Utah Tax Extension Form TC-546 is complete, the next step is to submit the tax extension request. This can be done online, by mail, or through a tax professional.

Submission Options

There are several submission options available:

- Online: through the Utah State Tax Commission website

- Mail: send the completed form and supporting documentation to the address listed on the form

- Tax Professional: have a tax professional submit the request on your behalf

Step 5: Follow Up and File the Tax Return

The final step is to follow up and file the tax return. After submitting the tax extension request, it's essential to follow up with the Utah State Tax Commission to confirm receipt and processing.

Tips for Filing the Tax Return

When filing the tax return, keep the following tips in mind:

- File the tax return on or before the extended deadline

- Make sure to include all required supporting documentation

- Pay any estimated tax due to avoid penalties and interest

What is the deadline for filing the Utah Tax Extension Form TC-546?

+The deadline for filing the Utah Tax Extension Form TC-546 is typically the same as the original tax filing deadline. For individual tax returns, this is usually April 15th, while for business tax returns, it's typically March 15th or April 15th, depending on the type of business.

What documents are required to file the Utah Tax Extension Form TC-546?

+To file the Utah Tax Extension Form TC-546, the following documents are typically needed: a copy of the tax return (Form TC-40 or Form TC-20), payment voucher (Form TC-547), and any supporting documentation (e.g., W-2s, 1099s, receipts).

How do I submit the Utah Tax Extension Form TC-546?

+The Utah Tax Extension Form TC-546 can be submitted online, by mail, or through a tax professional.

In conclusion, filing the Utah Tax Extension Form TC-546 is a straightforward process that provides individuals and businesses with additional time to file their tax returns. By following these 5 easy steps, you can ensure a smooth and stress-free experience. If you have any further questions or concerns, feel free to comment below or reach out to a tax professional for guidance.