As a business owner in Utah, navigating the complexities of state taxation can be a daunting task. One crucial aspect of tax compliance is obtaining tax-exempt status for qualified organizations. In this article, we will delve into the Utah Tax Exempt Form TC-721G, providing a step-by-step guide to help you understand the process and ensure you're taking advantage of the tax benefits available to your organization.

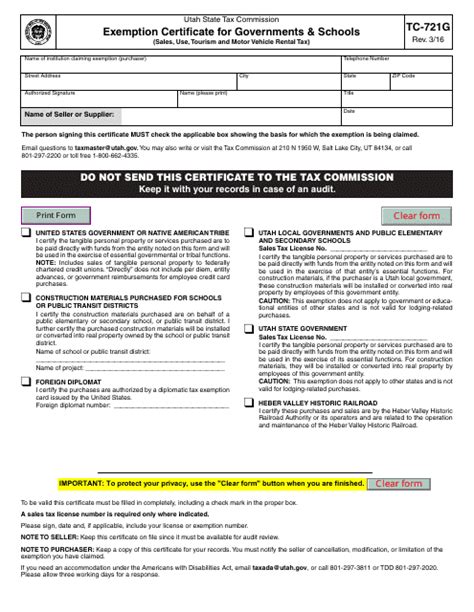

Utah Tax Exempt Form TC-721G is used to apply for or renew tax-exempt status for organizations that qualify under Section 501(c)(3) of the Internal Revenue Code. This form is typically used by non-profit organizations, such as charities, educational institutions, and religious organizations.

Who Needs to File Form TC-721G?

To determine if your organization needs to file Form TC-721G, you'll need to assess whether you meet the qualifications for tax-exempt status. The following types of organizations typically qualify:

- 501(c)(3) organizations, including charities, educational institutions, and religious organizations

- Organizations exempt from federal income tax under Section 501(a)

- Organizations that are exempt from state income tax under Utah Code Ann. § 59-10-103

If your organization falls into one of these categories, you'll need to file Form TC-721G to obtain or maintain tax-exempt status.

Step-by-Step Guide to Filing Form TC-721G

Filing Form TC-721G can seem like a daunting task, but breaking it down into smaller steps can make the process more manageable. Here's a step-by-step guide to help you navigate the form:

Step 1: Gather Required Documents and Information

Before starting the application process, make sure you have the following documents and information:

- Your organization's federal tax ID number (EIN)

- A copy of your organization's articles of incorporation or bylaws

- A copy of your organization's federal tax-exempt determination letter (if applicable)

- Information about your organization's purpose, activities, and financial information

Step 2: Complete the Application

Form TC-721G consists of several sections that require detailed information about your organization. Be sure to complete all sections accurately and thoroughly.

- Section 1: Organization Information

- Section 2: Purpose and Activities

- Section 3: Financial Information

- Section 4: Certifications and Signatures

Step 3: Submit the Application

Once you've completed the application, submit it to the Utah State Tax Commission along with any required supporting documentation.

- Mail the application to: Utah State Tax Commission, 210 N 1950 W, Salt Lake City, UT 84134

- Fax the application to: (801) 297-3811

- Email the application to:

Step 4: Wait for Approval or Request for Additional Information

After submitting your application, the Utah State Tax Commission will review your request for tax-exempt status. You may receive a request for additional information or clarification on certain aspects of your application.

- Be prepared to respond promptly to any requests for additional information

- Keep a record of your application and any subsequent correspondence

Tips and Reminders

To ensure a smooth application process, keep the following tips and reminders in mind:

- Submit your application well in advance of the deadline to avoid delays

- Ensure accuracy and completeness when filling out the application

- Keep a record of your application and any subsequent correspondence

- Respond promptly to any requests for additional information

By following these steps and tips, you'll be well on your way to obtaining or maintaining tax-exempt status for your organization in Utah.

Common Mistakes to Avoid

When filing Form TC-721G, it's essential to avoid common mistakes that can delay or even reject your application. Here are some common mistakes to watch out for:

- Incomplete or inaccurate information

- Failure to provide required supporting documentation

- Not responding promptly to requests for additional information

- Not keeping a record of your application and subsequent correspondence

By being aware of these common mistakes, you can avoid delays and ensure a successful application process.

Conclusion

Filing Form TC-721G is a crucial step in obtaining or maintaining tax-exempt status for your organization in Utah. By following the step-by-step guide outlined in this article, you'll be well on your way to navigating the application process with confidence. Remember to avoid common mistakes and keep a record of your application and subsequent correspondence. With accurate and complete information, you'll be able to take advantage of the tax benefits available to your organization.

We encourage you to share your experiences or ask questions about the Utah Tax Exempt Form TC-721G in the comments section below. Your input will help others navigate the application process and ensure they're taking advantage of the tax benefits available to their organizations.

What is the purpose of Form TC-721G?

+Form TC-721G is used to apply for or renew tax-exempt status for organizations that qualify under Section 501(c)(3) of the Internal Revenue Code.

Who needs to file Form TC-721G?

+501(c)(3) organizations, including charities, educational institutions, and religious organizations, need to file Form TC-721G to obtain or maintain tax-exempt status.

What documents and information are required for the application?

+Your organization's federal tax ID number (EIN), articles of incorporation or bylaws, federal tax-exempt determination letter (if applicable), and information about your organization's purpose, activities, and financial information are required.