Filling out a W-9 form is a crucial step for freelancers and independent contractors who want to work on Upwork, a popular platform that connects professionals with businesses and entrepreneurs. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is used by the Internal Revenue Service (IRS) to collect information about freelancers and independent contractors who earn income through Upwork. In this article, we will walk you through the 5 steps to fill up the Upwork W9 form.

Why Do You Need to Fill Out a W-9 Form on Upwork?

Before we dive into the steps to fill out the W-9 form, let's quickly discuss why it's necessary. Upwork is required by law to collect tax information from its freelancers and independent contractors, including their name, address, and taxpayer identification number (TIN). The W-9 form provides this information, which is used to generate a 1099-MISC form at the end of each tax year. The 1099-MISC form reports the amount of money earned by freelancers and independent contractors through Upwork to the IRS.

Step 1: Gather Your Information

Before you start filling out the W-9 form, make sure you have the following information:

- Your name and address

- Your taxpayer identification number (TIN), which is usually your Social Security number or Employer Identification Number (EIN)

- Your business name and address (if you're a business owner)

Step 2: Log In to Your Upwork Account

To access the W-9 form, you need to log in to your Upwork account. Go to the Upwork website and click on the "Log In" button. Enter your email address and password to access your account.

Accessing the W-9 Form on Upwork

Once you're logged in, click on your profile picture or icon in the top right corner of the screen. From the drop-down menu, select "Settings." Scroll down to the "Tax Information" section and click on "Complete W-9 Form."

Step 3: Fill Out the W-9 Form

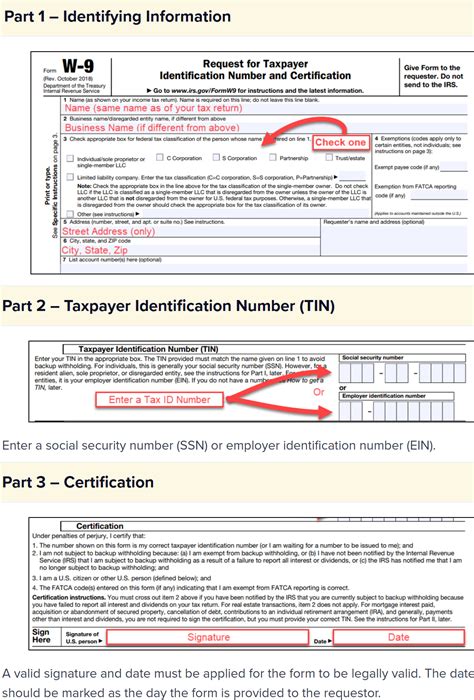

The W-9 form is a simple, one-page document that requires you to provide your tax information. Fill out the form as follows:

- Line 1: Enter your name as it appears on your tax return.

- Line 2: Enter your business name (if you're a business owner).

- Line 3: Enter your address.

- Line 4: Enter your taxpayer identification number (TIN).

- Line 5: Sign and date the form.

Tips for Filling Out the W-9 Form

- Make sure to enter your information accurately and completely.

- Use your full name and address as they appear on your tax return.

- If you're a business owner, use your business name and address.

- Sign and date the form electronically or print it out and sign it manually.

Step 4: Submit the W-9 Form

Once you've filled out the W-9 form, click on the "Submit" button to send it to Upwork. You'll receive a confirmation email from Upwork once your form has been processed.

What to Expect After Submitting the W-9 Form

After submitting the W-9 form, you'll receive a confirmation email from Upwork. You can also log in to your Upwork account to verify that your tax information has been updated.

Step 5: Verify Your Tax Information

Finally, verify that your tax information has been updated in your Upwork account. You can do this by logging in to your account and checking your tax information in the "Settings" section.

Why Verifying Your Tax Information is Important

Verifying your tax information ensures that Upwork has the correct information to generate your 1099-MISC form at the end of each tax year. This form is used to report your income to the IRS, so it's essential to ensure that your tax information is accurate and up-to-date.

By following these 5 steps, you can easily fill out the Upwork W9 form and ensure that your tax information is accurate and up-to-date. Remember to verify your tax information regularly to avoid any issues with your 1099-MISC form.

If you have any questions or concerns about filling out the W-9 form, feel free to comment below or reach out to Upwork support for assistance.

What is a W-9 form?

+A W-9 form is a document used by the IRS to collect tax information from freelancers and independent contractors.

Why do I need to fill out a W-9 form on Upwork?

+Upwork is required by law to collect tax information from its freelancers and independent contractors, including their name, address, and taxpayer identification number (TIN).

What information do I need to provide on the W-9 form?

+You need to provide your name, address, and taxpayer identification number (TIN), which is usually your Social Security number or Employer Identification Number (EIN).