As a student or employee at the University of California, Santa Barbara (UCSB), it's essential to understand the tax implications of your education or employment. One crucial document that plays a significant role in this process is the UCSB tax form. In this article, we'll delve into the world of UCSB tax forms, explaining their purpose, types, and how to navigate them.

What is a UCSB Tax Form?

A UCSB tax form is a document that the university provides to students and employees to report specific financial information to the Internal Revenue Service (IRS). The primary purpose of these forms is to ensure compliance with tax laws and regulations. As a student or employee, you'll receive one or more of these forms, depending on your circumstances.

Types of UCSB Tax Forms

UCSB issues several types of tax forms, each serving a distinct purpose. Some of the most common forms include:

- Form 1098-T: Tuition Statement This form reports the tuition and fees you paid to UCSB during the tax year. It also includes any scholarships, grants, or other forms of financial aid you received.

- Form W-2: Wage and Tax Statement This form shows your income and taxes withheld from your UCSB employment. You'll receive a W-2 form if you worked for UCSB during the tax year.

- Form 1042-S: Foreign Person's U.S. Source Income Subject to Withholding If you're an international student or employee, you might receive this form. It reports income that's subject to withholding, such as scholarships or fellowships.

How to Read and Understand Your UCSB Tax Form

Receiving a tax form can be overwhelming, especially if you're not familiar with the terminology. Here's a breakdown of what you can expect to find on your UCSB tax form:

Understanding Your Form 1098-T

- Box 1: Payments received for qualified tuition and related expenses This box shows the total amount of tuition and fees you paid to UCSB during the tax year.

- Box 2: Amounts billed for qualified tuition and related expenses This box reports the total amount of tuition and fees that UCSB billed you during the tax year.

- Box 3: Check if you're a graduate student If you're a graduate student, this box will be checked.

Understanding Your Form W-2

- Box 1: Wages, tips, other compensation This box shows your total income from UCSB employment.

- Box 2: Federal income tax withheld This box reports the amount of federal income tax that was withheld from your UCSB income.

- Box 4: Social Security tax withheld This box shows the amount of Social Security tax that was withheld from your UCSB income.

What to Do with Your UCSB Tax Form

Once you receive your UCSB tax form, review it carefully to ensure accuracy. If you notice any errors, contact the UCSB Payroll or Student Affairs office promptly. You'll need to report the information from your tax form on your tax return, so keep it safe and secure.

Tax Credits and Deductions for Students

As a student, you might be eligible for tax credits and deductions that can help reduce your tax liability. Some popular options include:

- American Opportunity Tax Credit (AOTC): Up to $2,500 credit for qualified education expenses

- Lifetime Learning Credit (LLC): Up to $2,000 credit for qualified education expenses

- Tuition and Fees Deduction: Up to $4,000 deduction for qualified tuition and fees

Tax Obligations for Employees

As a UCSB employee, you'll need to report your income and taxes withheld on your tax return. You might also be eligible for tax deductions, such as:

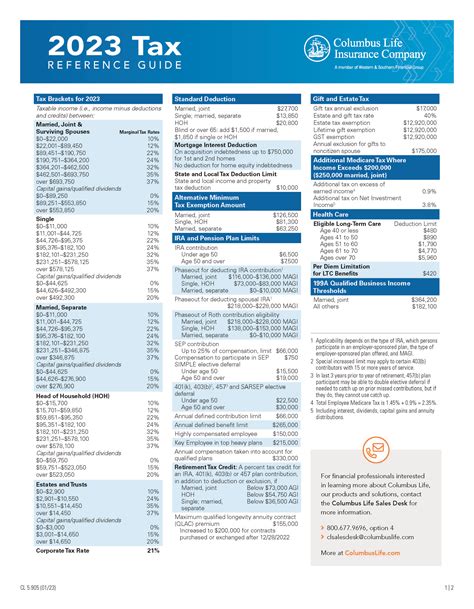

- Standard Deduction: A fixed amount that you can deduct from your taxable income

- Itemized Deductions: Expenses that you can deduct from your taxable income, such as mortgage interest or charitable donations

Conclusion

Navigating UCSB tax forms can seem daunting, but understanding their purpose and content can help you make informed decisions about your taxes. Remember to review your forms carefully, report the information accurately on your tax return, and explore tax credits and deductions that might be available to you.

We hope this guide has provided you with a comprehensive understanding of UCSB tax forms. If you have any further questions or concerns, don't hesitate to reach out to the UCSB Payroll or Student Affairs office.

Call to Action

Now that you've learned about UCSB tax forms, take the next step and review your own forms carefully. If you have any questions or concerns, share them with us in the comments below. Don't forget to share this article with your fellow students and employees to help them navigate the world of UCSB tax forms.

What is the purpose of a UCSB tax form?

+A UCSB tax form is used to report financial information to the IRS, ensuring compliance with tax laws and regulations.

What types of UCSB tax forms are there?

+Common UCSB tax forms include Form 1098-T, Form W-2, and Form 1042-S.

How do I read and understand my UCSB tax form?

+Review your form carefully, and refer to the relevant sections in this article for guidance.