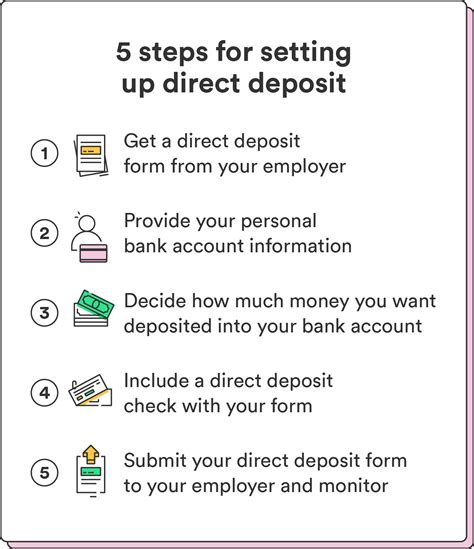

Managing finances efficiently is crucial in today's fast-paced world. One effective way to streamline your financial transactions is by using direct deposit. For members of the Air Force Federal Credit Union (AFCU), setting up a direct deposit can significantly simplify the process of receiving payments, such as paychecks, social security benefits, or tax refunds. In this article, we'll guide you through the 5 easy steps to complete an AFCU direct deposit form, ensuring you can enjoy the convenience and security that comes with direct deposit.

Understanding the Benefits of Direct Deposit

Before diving into the steps, it's essential to understand why direct deposit is a preferred method for many. The benefits are numerous:

- Convenience: Direct deposit allows funds to be transferred electronically, eliminating the need for physical checks and reducing the risk of lost or stolen checks.

- Speed: Deposits are typically made on the pay date, ensuring that you have access to your money as soon as possible.

- Security: Electronic transactions are more secure than traditional checks, significantly reducing the risk of fraud.

- Flexibility: You can choose to have your funds deposited into a checking or savings account, or even split your deposit between accounts.

Step 1: Gather Required Information

To start the process, you'll need several pieces of information readily available:

- AFCU Account Number: You can find this on your AFCU account statement or by logging into your online banking account.

- AFCU Routing Number: This is the unique identifier for AFCU (313386247). Ensure you use the correct routing number for your specific account type (checking or savings).

- Type of Deposit: Specify if the deposit is for payroll, social security, or another type of payment.

- Amount of Deposit: If applicable, indicate the amount you wish to deposit directly.

Step 2: Obtain the Direct Deposit Form

You can obtain the AFCU direct deposit form in several ways:

- Download from AFCU’s Website: Visit the official AFCU website, navigate to the forms section, and download the direct deposit form.

- Request by Mail: Call AFCU’s customer service number to request that a form be mailed to you.

- Visit a Branch: Stop by any AFCU branch to pick up a form in person.

Step 3: Complete the Direct Deposit Form

Carefully fill out the form with the information gathered in Step 1. Ensure all details are accurate to avoid delays or rejections:

- Fill in your AFCU account number and routing number.

- Specify the type of deposit and the amount if required.

- Sign and date the form.

Step 4: Submit the Form

After completing the form, you need to submit it to the relevant party:

- Employer or Payor: If setting up payroll direct deposit, submit the form to your HR department or payroll office.

- Social Security Administration: For social security benefits, you may need to contact the SSA directly.

- AFCU: If you’re unsure, you can always submit the form to AFCU for guidance.

Step 5: Verify Your Direct Deposit

To ensure your direct deposit is set up correctly:

- Wait for a confirmation from your employer, the Social Security Administration, or AFCU.

- Check your AFCU account statement or online banking to verify that your deposits are being made as expected.

Conclusion: Simplifying Your Finances with AFCU Direct Deposit

Setting up an AFCU direct deposit form is a straightforward process that can significantly simplify your financial management. By following these 5 easy steps, you can enjoy the benefits of direct deposit, including convenience, speed, security, and flexibility. Take the first step today towards a more streamlined financial experience.

What is the AFCU routing number for direct deposits?

+The AFCU routing number for direct deposits is 313386247. Ensure you use the correct routing number for your specific account type.