Understanding the UCLA 1098-T Form: A Student's Guide

As a student at the University of California, Los Angeles (UCLA), you may have received a 1098-T form from the university's financial aid office. This form is a crucial document that reports the tuition payments you made during the tax year, and it's essential to understand its purpose and how to use it to claim tax credits and deductions.

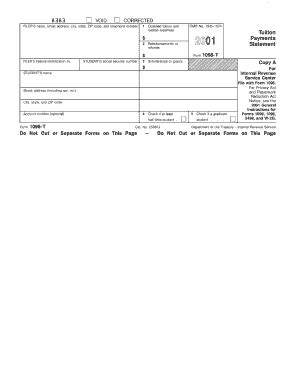

What is the 1098-T Form?

The 1098-T form is an official document provided by UCLA to report the tuition payments made by students or their families during the tax year. The form is typically mailed to students in January or February of each year, and it's used to report qualified tuition and related expenses (QTRE) paid during the previous tax year.

Why Do I Need the 1098-T Form?

The 1098-T form is necessary for several reasons:

- It provides proof of tuition payments made during the tax year, which can help you claim tax credits and deductions.

- It helps the university report the tuition payments to the Internal Revenue Service (IRS).

- It's used to determine eligibility for tax credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

How to Read the 1098-T Form

The 1098-T form typically includes the following information:

- Your name and student ID number

- The university's name, address, and employer identification number (EIN)

- The academic year and tax year reported

- The qualified tuition and related expenses (QTRE) paid during the tax year

- Any scholarships or grants received during the tax year

- Any adjustments made to the reported QTRE

It's essential to review the form carefully to ensure the information is accurate and complete.

How to Claim Tax Credits and Deductions

To claim tax credits and deductions using the 1098-T form, follow these steps:

- Gather all necessary documents, including the 1098-T form, your tax return, and any other relevant documents.

- Review the form to ensure the information is accurate and complete.

- Claim the tax credits and deductions on your tax return, using the information reported on the 1098-T form.

- Keep a copy of the 1098-T form and your tax return for your records.

Common Mistakes to Avoid

When claiming tax credits and deductions using the 1098-T form, avoid the following common mistakes:

- Failing to report all qualified tuition and related expenses (QTRE)

- Claiming credits or deductions for ineligible expenses

- Failing to keep accurate records of tuition payments and receipts

- Missing the deadline for filing your tax return

Tax Credits and Deductions: What's the Difference?

Tax credits and deductions are two types of tax benefits that can help reduce your tax liability. The main difference between the two is:

- Tax credits directly reduce your tax liability, dollar for dollar.

- Tax deductions reduce your taxable income, which in turn reduces your tax liability.

American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit (AOTC) is a tax credit of up to $2,500 per eligible student. To qualify, you must:

- Be pursuing a degree at an eligible educational institution

- Be enrolled at least half-time for at least one academic period

- Not have completed four years of post-secondary education before the beginning of the tax year

- Not have claimed the AOTC or the former Hope credit for more than four tax years

- Not have a felony conviction

Lifetime Learning Credit (LLC)

The Lifetime Learning Credit (LLC) is a tax credit of up to $2,000 per tax return. To qualify, you must:

- Be taking courses at an eligible educational institution to acquire or improve job skills

- Be enrolled in a course or program that leads to a degree or certificate

- Not have claimed the LLC for more than 20 tax years

- Not have a felony conviction

Tuition and Fees Deduction

The Tuition and Fees Deduction is a tax deduction of up to $4,000 per tax return. To qualify, you must:

- Pay qualified tuition and related expenses (QTRE) for yourself, your spouse, or your dependents

- Not claim the AOTC or LLC for the same student in the same tax year

- Not have a felony conviction

How to Get Help with the 1098-T Form

If you need help with the 1098-T form or have questions about claiming tax credits and deductions, you can:

- Contact the UCLA financial aid office

- Visit the IRS website for more information on tax credits and deductions

- Consult with a tax professional or financial advisor

Additional Resources

For more information on the 1098-T form and tax credits and deductions, you can:

- Visit the UCLA financial aid website

- Contact the IRS directly

- Consult with a tax professional or financial advisor

We hope this comprehensive guide has helped you understand the UCLA 1098-T form and how to claim tax credits and deductions. Don't hesitate to reach out for help if you need it.

Take the Next Step: Share Your Thoughts!

We'd love to hear from you! Share your thoughts on the UCLA 1098-T form and tax credits and deductions in the comments below. Have any questions or need further clarification? Let us know, and we'll do our best to help.

Share This Article:

Help your fellow students understand the UCLA 1098-T form and tax credits and deductions. Share this article on social media, and let's get the conversation started!

What is the 1098-T form?

+The 1098-T form is an official document provided by UCLA to report the tuition payments made by students or their families during the tax year.

Why do I need the 1098-T form?

+The 1098-T form is necessary to report qualified tuition and related expenses (QTRE) paid during the tax year, which can help you claim tax credits and deductions.

How do I claim tax credits and deductions using the 1098-T form?

+To claim tax credits and deductions, gather all necessary documents, review the 1098-T form to ensure accuracy, and claim the credits and deductions on your tax return using the information reported on the 1098-T form.