Are you a company or organization that provides stock compensation to your employees? If so, you're likely aware of the importance of filing Form 3921 with the IRS. This form is used to report the exercise of incentive stock options (ISOs) and the transfer of stock purchased under an employee stock purchase plan (ESPP). In this article, we'll take a closer look at Form 3921, its requirements, and how to file it with TurboTax.

Understanding Form 3921

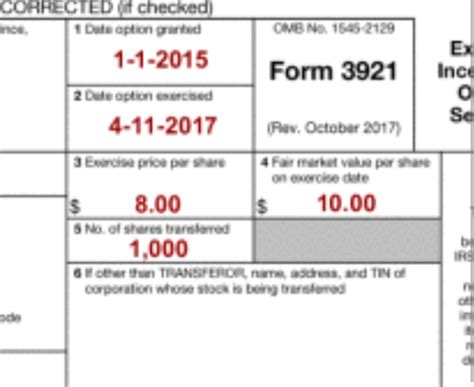

Form 3921 is a crucial document for companies that offer stock compensation to their employees. It's used to report the exercise of ISOs and the transfer of stock purchased under an ESPP. The form provides the IRS with information about the stock transactions, including the date of the transaction, the number of shares involved, and the fair market value of the stock.

Who Needs to File Form 3921?

Any corporation that issues stock under an ISO or ESPP must file Form 3921 with the IRS. This includes:

- Companies that issue stock options to employees

- Companies that offer employee stock purchase plans

- Companies that transfer stock to employees under an ESPP

Filing Form 3921 with TurboTax

Filing Form 3921 with TurboTax is a straightforward process. Here's a step-by-step guide to help you get started:

- Gather Required Information: Before you start filing Form 3921, make sure you have all the required information. This includes the employee's name, address, and Social Security number, as well as the details of the stock transaction, such as the date of the transaction, the number of shares involved, and the fair market value of the stock.

- Create a TurboTax Account: If you don't already have a TurboTax account, create one by visiting the TurboTax website. You'll need to provide some basic information, such as your name and email address.

- Select the Correct Form: Once you've logged in to your TurboTax account, select Form 3921 from the list of available forms. You can find Form 3921 under the "Employment" or "Stock" section.

- Enter Required Information: Enter the required information into the form, including the employee's name, address, and Social Security number, as well as the details of the stock transaction.

- Review and Submit: Review your form carefully to ensure accuracy. Once you're satisfied, submit the form to the IRS through TurboTax.

Tips for Filing Form 3921 with TurboTax

- Use the Correct Form: Make sure you're using the correct form (Form 3921) for the type of stock transaction you're reporting.

- Enter Accurate Information: Enter accurate information to avoid delays or penalties.

- Keep Records: Keep records of your Form 3921 filings, including the date of the transaction, the number of shares involved, and the fair market value of the stock.

Benefits of Filing Form 3921 with TurboTax

Filing Form 3921 with TurboTax offers several benefits, including:

- Convenience: Filing Form 3921 with TurboTax is a convenient and easy process. You can file the form from the comfort of your own home, 24/7.

- Accuracy: TurboTax ensures accuracy by guiding you through the filing process and checking for errors.

- Security: TurboTax provides a secure platform for filing Form 3921, protecting your sensitive information.

- Support: TurboTax offers support and guidance throughout the filing process, including phone, email, and live chat support.

Common Errors to Avoid

- Inaccurate Information: Entering inaccurate information can lead to delays or penalties. Make sure to double-check your information before submitting the form.

- Late Filing: Filing Form 3921 late can result in penalties. Make sure to file the form on time to avoid any issues.

- Incorrect Form: Using the incorrect form can lead to delays or penalties. Make sure to use Form 3921 for the type of stock transaction you're reporting.

FAQs About Filing Form 3921 with TurboTax

Here are some frequently asked questions about filing Form 3921 with TurboTax:

- Q: What is the deadline for filing Form 3921? A: The deadline for filing Form 3921 is January 31st of each year.

- Q: Can I file Form 3921 electronically? A: Yes, you can file Form 3921 electronically through TurboTax.

- Q: What information do I need to file Form 3921? A: You'll need to provide the employee's name, address, and Social Security number, as well as the details of the stock transaction.

What is the penalty for late filing of Form 3921?

+The penalty for late filing of Form 3921 is $10 per statement, with a maximum penalty of $500,000 per year.

Can I amend a previously filed Form 3921?

+Yes, you can amend a previously filed Form 3921 by filing a corrected form with the IRS.

How do I get help with filing Form 3921?

+You can get help with filing Form 3921 by contacting the IRS or TurboTax support.

In conclusion, filing Form 3921 with TurboTax is a straightforward process that can help you stay compliant with IRS regulations. By following the steps outlined in this article and avoiding common errors, you can ensure a smooth and accurate filing process. Don't hesitate to reach out to TurboTax support if you need help along the way.