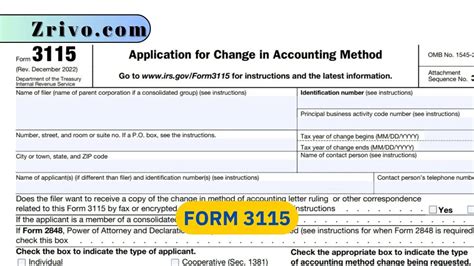

The world of tax accounting can be complex and overwhelming, especially when dealing with intricate forms like the Turbotax Form 3115. Also known as the Application for Change in Accounting Method, this form is a crucial document for businesses and individuals seeking to modify their accounting methods. Mastering the Turbotax Form 3115 can be a daunting task, but with the right guidance, you can navigate its complexities with ease.

In this article, we will delve into the world of Turbotax Form 3115, exploring its significance, benefits, and challenges. We will also provide you with practical tips and strategies to help you master this form and ensure a seamless tax filing experience.

Understanding the Turbotax Form 3115

What is the Turbotax Form 3115?

The Turbotax Form 3115 is a document used by the Internal Revenue Service (IRS) to allow taxpayers to request a change in their accounting method. This form is typically used by businesses and individuals who want to switch from one accounting method to another, such as from cash to accrual or from accrual to cash.

Benefits of Mastering the Turbotax Form 3115

Why is it essential to master the Turbotax Form 3115?

Mastering the Turbotax Form 3115 can have numerous benefits for taxpayers. Some of the most significant advantages include:

- Improved accuracy: By understanding the intricacies of the form, you can ensure that your accounting method change is accurately reflected, reducing the risk of errors and potential penalties.

- Increased efficiency: Filing the Turbotax Form 3115 correctly can save you time and effort in the long run, as you will avoid the need for costly corrections or amendments.

- Enhanced compliance: Mastering the form helps you stay compliant with IRS regulations, reducing the risk of audits and penalties.

- Better financial planning: By understanding the implications of changing your accounting method, you can make informed decisions about your financial planning and tax strategy.

5 Ways to Master the Turbotax Form 3115

Strategies for mastering the Turbotax Form 3115

Now that we have explored the importance of mastering the Turbotax Form 3115, let's dive into five practical strategies to help you achieve this goal:

1. Understand the Form's Purpose and Requirements

Purpose and requirements of the Turbotax Form 3115

To master the Turbotax Form 3115, you need to understand its purpose and requirements. The form is used to request a change in accounting method, and it must be filed with the IRS. The form requires you to provide detailed information about your current and proposed accounting methods, including the reasons for the change.

2. Choose the Correct Accounting Method

Choosing the correct accounting method

Choosing the correct accounting method is crucial when filing the Turbotax Form 3115. You need to select an accounting method that accurately reflects your business or financial situation. The two most common accounting methods are cash and accrual. The cash method recognizes income and expenses when cash is received or paid, while the accrual method recognizes income and expenses when earned or incurred.

3. Gather Required Documents and Information

Gathering required documents and information

To complete the Turbotax Form 3115, you will need to gather various documents and information. This may include financial statements, tax returns, and other supporting documentation. Ensure that you have all the necessary documents and information before starting the filing process.

4. Seek Professional Help When Needed

Seeking professional help when needed

Mastering the Turbotax Form 3115 can be challenging, especially if you are not familiar with tax accounting. If you are unsure about any aspect of the form, consider seeking professional help from a tax expert or accountant. They can provide guidance and support to ensure that your form is completed accurately and correctly.

5. Stay Up-to-Date with IRS Regulations and Changes

Staying up-to-date with IRS regulations and changes

The IRS regularly updates its regulations and forms, including the Turbotax Form 3115. To master the form, you need to stay up-to-date with these changes. Check the IRS website regularly for updates and changes, and ensure that you are using the most current version of the form.

Conclusion

Mastering the Turbotax Form 3115 requires a deep understanding of its purpose, requirements, and complexities. By following the five strategies outlined in this article, you can navigate the form's intricacies with ease and ensure a seamless tax filing experience. Remember to stay up-to-date with IRS regulations and changes, and don't hesitate to seek professional help when needed.

Call to Action

We hope this article has provided you with valuable insights and strategies for mastering the Turbotax Form 3115. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with others who may benefit from this information.

FAQ Section

What is the purpose of the Turbotax Form 3115?

+The Turbotax Form 3115 is used to request a change in accounting method. It is typically used by businesses and individuals who want to switch from one accounting method to another.

What are the most common accounting methods?

+The two most common accounting methods are cash and accrual. The cash method recognizes income and expenses when cash is received or paid, while the accrual method recognizes income and expenses when earned or incurred.

What documents and information are required to complete the Turbotax Form 3115?

+To complete the Turbotax Form 3115, you will need to gather various documents and information, including financial statements, tax returns, and other supporting documentation.