As a business owner in the alcohol industry, understanding the complexities of tax compliance is crucial to avoid penalties and ensure smooth operations. One of the most critical forms to master is the TTB Form 5000.24, also known as the Excise Tax Return. In this article, we will delve into the world of TTB Form 5000.24 filing, providing you with expert tips to help you navigate the process with ease.

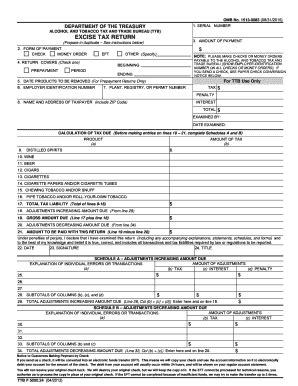

Mastering the TTB Form 5000.24 is essential for businesses involved in the production, importation, and sale of alcoholic beverages. This form is used to report and pay federal excise taxes on a quarterly basis. Failure to comply with the filing requirements can result in severe penalties, fines, and even loss of business licenses.

Tip 1: Understand the Filing Requirements

To master the TTB Form 5000.24, it's essential to understand the filing requirements. The form is typically filed on a quarterly basis, with the following due dates:

- January 14th for the fourth quarter (October 1st - December 31st)

- April 14th for the first quarter (January 1st - March 31st)

- July 14th for the second quarter (April 1st - June 30th)

- October 14th for the third quarter (July 1st - September 30th)

Businesses with a tax liability of $2,500 or less can file the form annually, rather than quarterly.

Tip 2: Gather Required Information

Before starting the filing process, ensure you have all the necessary information at hand. This includes:

- Business name and address

- Employer Identification Number (EIN)

- Tax period and due date

- Gross receipts from sales

- Taxable gallons of beer, wine, and spirits

- Excise tax liability

Having this information readily available will save you time and reduce the risk of errors.

Tip 3: Calculate Excise Tax Liability

Calculating the excise tax liability is a critical step in the TTB Form 5000.24 filing process. The tax rate varies depending on the type of beverage and the quantity sold. The current tax rates are:

- Beer: $0.58 per gallon ( domestic) and $0.61 per gallon (imported)

- Wine: $0.17 per gallon (still wine) and $0.66 per gallon (sparkling wine)

- Spirits: $2.14 per gallon ( domestic) and $2.70 per gallon (imported)

Use the correct tax rates to calculate your excise tax liability, and ensure you're taking advantage of any available credits or deductions.

Tip 4: Use the Correct Filing Method

The TTB offers two filing methods for the Form 5000.24: paper filing and e-filing. E-filing is the recommended method, as it reduces the risk of errors and provides faster processing times. The TTB's online filing system, Tax and Trade Bureau's (TTB) Permits Online, allows you to file the form electronically and pay the tax liability online.

Tip 5: Keep Accurate Records

Maintaining accurate records is crucial for successful TTB Form 5000.24 filing. Keep records of:

- Gross receipts from sales

- Taxable gallons of beer, wine, and spirits

- Excise tax liability

- Payments made

Accurate records will help you identify any discrepancies or errors, ensuring you're in compliance with TTB regulations.

By following these expert tips, you'll be well on your way to mastering the TTB Form 5000.24 filing process. Remember to stay up-to-date with the latest regulations and filing requirements to avoid penalties and ensure smooth operations.

Additional Tips:

- Ensure you're using the latest version of the TTB Form 5000.24, as the form is subject to change.

- Take advantage of the TTB's online resources, including the TTB's Permits Online system and the TTB's website.

- Consider consulting with a tax professional or attorney specializing in TTB regulations to ensure compliance.

Common Mistakes to Avoid:

- Failing to file the form on time or making late payments

- Underreporting or overreporting tax liability

- Using incorrect tax rates or failing to account for credits or deductions

- Failing to maintain accurate records

By avoiding these common mistakes and following the expert tips outlined in this article, you'll be able to master the TTB Form 5000.24 filing process and ensure compliance with TTB regulations.

What is the due date for the TTB Form 5000.24?

+The due date for the TTB Form 5000.24 is the 14th day of the month following the end of the quarter. For example, the due date for the first quarter is April 14th.

Can I file the TTB Form 5000.24 annually?

+Yes, businesses with a tax liability of $2,500 or less can file the form annually, rather than quarterly.

What is the current tax rate for beer?

+The current tax rate for beer is $0.58 per gallon (domestic) and $0.61 per gallon (imported).